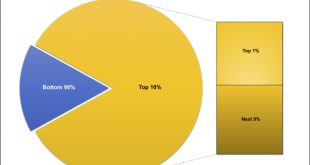

David Ruccio Ed Wolff is right: For the vast majority of Americans, fluctuations in the stock market have relatively little effect on their wealth, or well-being, for that matter. That’s because, as his research shows (and as I illustrate in the chart above), the bottom 90 percent of Americans own (either directly or indirectly) a tiny share—16 percent—of total stock value in the United States.* The rest is owned by the top 10 percent: 40.3 percent by just the top one percent (with a...

Read More »The debate continues in the same absurd, polarized and simplified form.

from Neva Goodwin One of the outstanding features of the time in which we live is the terrifying prospect of global climate change, regarding which it has been said that contemporary humankind is suffering from “Pre-Traumatic Stress Disorder”. Whether we squarely face what this will likely mean for the coming years, or whether we simply can’t bear to look at the facts, it is getting ever harder to avoid the gut-knowledge that the world is rapidly becoming markedly less beautiful, rich...

Read More »The future — something we know very little about

from Lars Syll All these pretty, polite techniques, made for a well-panelled Board Room and a nicely regulated market, are liable to collapse. At all times the vague panic fears and equally vague and unreasoned hopes are not really lulled, and lie but a little way below the surface. Perhaps the reader feels that this general, philosophical disquisition on the behavior of mankind is somewhat remote from the economic theory under discussion. But I think not. Tho this is how we behave in the...

Read More »Real-World Economics Review Blog 2018-02-19 00:43:47

from James Galbraith and the Journal of Behavioral and Experimental Economics Paul Davidson, Who’s Afraid of John Maynard Keynes? Challenging Economic Governance in an Age of Growing Inequality, 2017, Palgrave-MacMillan Paul Davidson, in his ninth decade, has produced a crisp and clear exegesis of essential Keynesian ideas and the critical failures of so-called mainstream economic thought. The most critical flaw lies in the treatment of time. Rooted in ancient ideas of equilibrium,...

Read More »Economics education — teaching cohorts after cohorts of students useless theories

from Lars Syll Nowadays there is almost no place whatsoever in economics education for courses in the history of economic thought and economic methodology. This is deeply worrying. A science that doesn’t self-reflect and asks important methodological and science-theoretical questions about the own activity, is a science in dire straits. How did we end up in this sad state? Philip Mirowski gives the following answer: After a brief flirtation in the 1960s and 1970s, the grandees of the...

Read More »The third axiom of neoclassical economics: methodological equilibration

from Christian Arnsperger and Yanis Varoufakis The third feature of neoclassical economics is, on our account, the axiomatic imposition of equilibrium. The point here is that, even after methodological individualism turned into methodological instrumentalism, prediction at the macro (or social) level was seldom forthcoming. Determinacy required something more: it required that agents’ instrumental behaviour is coordinated in a manner that aggregate behaviour becomes sufficiently regular...

Read More »The problem of extrapolation

from Lars Syll There are two basic challenges that confront any account of extrapolation that seeks to resolve the shortcomings of simple induction. One challenge, which I call extrapolator’s circle, arises from the fact that extrapolation is worthwhile only when there are important limitations on what one can learn about the target by studying it directly. The challenge, then, is to explain how the suitability of the model as a basis for extrapolation can be established given only...

Read More »Polanyi’s six points

from Asad Zaman The analysis of Polanyi’s Great Transformation can be summarized in the six points listed below. 1: All societies face the economic task of producing and providing for all members of society. Modern market societies are unique in assigning this responsibility to the marketplace, thereby creating entitlements to production for those with wealth, and depriving the poor of entitlement to food. All traditional societies have used non-market mechanisms based on cooperation and...

Read More »The second axiom of neoclassical economics: methodological instrumentalism

from Christian Arnsperger and Yanis Varoufakis We label the second feature of neoclassical economics methodological instrumentalism: all behaviour is preference-driven or, more precisely, it is to be understood as a means for maximising preference-satisfaction.[1] Preference is given, current, fully determining, and strictly separate from both belief (which simply helps the agent predict uncertain future outcomes) and from the means employed. Everything we do and say is instrumental to...

Read More »Modern macro-economists: money is not ‘neutral’. Bordo, Meissner, Sufi and Mian do a good job.

Hardcore neoclassical economist John Taylor has edited a new handbook of macro-economics. The good news: the sands are shifting. After 2008, more attention has been paid to the obvious fact that we’re living in a monetary world. Guess what: it turns out that money is non-neutral after all. Two examples (summaries below): (A) Bordo and Meissner claim that whenever a country has a large banking sector it has a choice, during a financial crisis. It can bail out the banks or it can try to...

Read More » Real-World Economics Review

Real-World Economics Review