from Lars Syll One may perhaps, distinguish between obscure writers and obscurantist writers. The former aim at truth, but do not respect the norms for arriving at truth, such as focusing on causality, acting as the Devil’s Advocate, and generating falsifiable hypotheses. The latter do not aim at truth, and often scorn the very idea that there is such a thing as the truth … The authors I have singled out are far from marginal, and in fact are at the core of the profession. Their numerous...

Read More »Janet Yellen and Barack Obama’s economy is looking good

from Dean Baker As Congress debates plans to give even more money to the country’s richest people, it is worth briefly recounting where the economy is now, before we feel the effects of any tax plan. Basically, it is a pretty good story. The overall unemployment rate for October was 4.1 percent. This is the lowest unemployment rate since 2000. And that was an extraordinarily good year for the labor market. We would have to go back to 1970 to find the last time the unemployment rate had...

Read More »Chicago economics delirium VSOP

from Lars Syll Macroeconomics was born as a distinct field in the 1940s (sic!), as a part of the intellectual response to the Great Depression. The term then referred to the body of knowledge and expertise that we hoped would prevent the recurrence of that economic disaster. My thesis in this lecture is that macroeconomics in this original sense has succeeded: Its central problem of depression-prevention has been solved, for all practical purposes, and has in fact been solved for many...

Read More »Why Latin American nations fail

from Matias Vernengo and Esteban Pérez Caldenteyand WEA Commentaries [Editor’s note: Here the authors summarise the main themes of their recently published book, Why Latin American Nations Fail(Matias Vernengo and Esteban Pérez Caldentey, 2017, University of California Press)] Institutions are central to explaining the way in which, nations grow and develop. Traditionally the study of institutional economics focused on a very broad range of interests and made contributions in several...

Read More »Chicago economics delirium

from Lars Syll I believe there is no other proposition in economics which has more solid empirical evidence supporting it than the Efficient Market Hypothesis. That hypothesis has been tested and, with very few exceptions, found consistent with the data in a wide variety of markets … Michael Jensen I am skeptical about the argument that the subprime mortgage problem will contaminate the whole mortgage market, that housing construction will come to a halt, and that the economy will slip...

Read More »The poor and unequal die younger

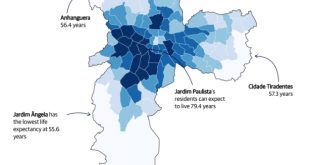

from David Ruccio source According to a new report on inequality in the Brazilian city of São Paulo, compiled by Rede Nossa São Paulo (pdf, in Portuguese), the gap in the average age of death between the poorest and richest districts of the city is almost 24 years. Thus, for example, the average age of death in Jardim Paulista is 79.4 years while that of residents of Jardim Ângela is only 55.7 years. This should come as no surprise since Brazil is one of the most unequal countries on the...

Read More »Taking Issue with Dani Rodrik: Trade deficits are different with secular stagnation (see Addendum)

from Dean Baker I am a big fan of Dani Rodrik’s writings on trade, and I agree with most of what he says in his NYT column today, but I do have one major disagreement. However, before going there let me emphasize some of the key points he makes in the piece. First, Rodrik is very much on the mark in arguing that recent trade deals, like the Trans-Pacific Partnership, have very little to do with free trade. As he says, these deals are about imposing a corporate-friendly structure of...

Read More »Blanchard and Summers: Back to the future

from Maria Alejandra Madi Olivier Blanchard and Lawrence Summers have recently called for a reflection about the macroeconomic tools required to manage the outcomes of the 2008 global crisis in their paper Rethinking Stabilization Policy. Back to the Future. The relevant question they address is: Should the crisis lead to a rethinking of both macroeconomics and macroeconomic policy similar to what we saw in the 1930s or in the 1970s? In other words, should the crisis lead to a Keynesian...

Read More »Swedish housing bubble soon to burst

from Lars Syll High and rising household indebtedness poses the greatest risk to the Swedish economy. Household indebtedness has been increasing in Sweden since the mid- 1990s. Home ownership financed by high levels of mortgage debt with variable interest rates makes households vulnerable to falling house prices and increasing interest rates … In the present Economic Commentary, we extend the earlier analysis by using updated data covering the period up to September 2017 … Our main...

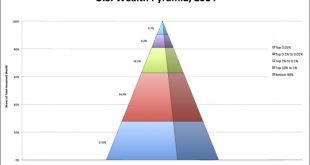

Read More »The arc of (pre)history bends towards greater inequality

from David Ruccio The United States, as I have shown over the past week (e.g., here, here, and here), has an obscenely unequal distribution of wealth. How do we put that grotesque level of inequality into perspective? One way is by taking a historical perspective; the other is by looking across the world today. As it turns out, Nature (unfortunately behind a paywall) has just published a study in which the authors attempt to estimate the degree of wealth inequality in ancient societies...

Read More » Real-World Economics Review

Real-World Economics Review