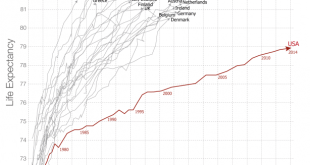

from David Ruccio It is likely, if some version of Trump/Ryancare is approved in the United States, millions more people will not be able to purchase the insurance necessary to receive adequate healthcare. The problem is, the United States is already an outlier when it comes to the relationship between health expenditures and health outcomes—measured in this case by life expectancy. As Esteban Ortiz-Ospina and Max Roser explain, all countries in this graph have followed an upward...

Read More »Budget Topline

from Peter Radford We all ought calm down about the Trump budget. Presidential budgets never, ever, get put into practice. They are simply exercises in politics. They simply give us insight into presidential goals. In Trump’s case there is nothing that we didn’t already know. He wants to slash domestic programs, especially those niggling ones that offend his far right fans, and pile on the offensive weaponry for the Pentagon. As I said: no big surprise. Here’s a very short synopsis of the...

Read More »Solving the fundamental problem of decision theory (wonkish)

from Lars Syll Currently the dominant formalism for treating the [general gamble] problem is utility theory. Utility theory was born out of the failure of the following behavioral null model: individuals were assumed to optimize changes in the expectation values of their wealth. We argue that this null model is a priori a bad starting point because the expectation value of wealth does not generally reflect what happens over time. We propose a different null model of human behavior that...

Read More »The Wrongest Profession

from Dean Baker Over the past two decades, the economics profession has compiled an impressive track record of getting almost all the big calls wrong. In the mid-1990s, all the great minds in the field agreed that the unemployment rate could not fall much below 6 percent without triggering spiraling inflation. It turns out that the unemployment rate could fall to 4 percent as a year-round average in 2000, with no visible uptick in the inflation rate. As the stock bubble that drove the...

Read More »Understanding economic development and demolishing neoliberal development myths

from Erik Reinert, Jayati Ghosh and Rainer Kattel and WEA Commentaries We have recently co-edited a book (The Handbook of Alternative Theories of Economic Development, Edward Elgar 2016, also available as an e-book on http://www.ebooks.com/95628740/handbook-of-alternative-theories-of-economic-development/reinert-erik-s-ghosh-jayati-kattel-rainer/) that seeks to bring back the richness of development economics through many different theories that have contributed over the ages to an...

Read More »Tale of two depressions

from David Ruccio One of the courses I’m offering this semester is A Tale of Two Depressions, cotaught with one of my colleagues, Ben Giamo, from American Studies. It’s a comparison of the conditions and consequences of the two major crises of capitalism during the past hundred years, the 1930s and the period after the crash of 2007-08.* It just so happens the Guardian is also right now revisiting the 1930s. Readers will find lots of interesting material, from some evocative street...

Read More »Has economics really become an empirical science?

from Lars Syll As I see it, a rational predictor should use a combination of theory and empirics. But theory should also be informed by data – there are lots of theories, and in general they can’t all apply to the same situation, so you need evidence to tell you which one(s) to use. So a rational predictor’s predictions should always be tied as closely as possible to empirical evidence. Discounting empirical evidence … seems inevitably to lead to the use of casual intuition (or to even...

Read More »The scorekeeper speaks

from Peter Radford The Congressional Budget Office is the latest victim of the intensity of Washington politics. The CBO is the organization we rely on to “score” legislation so that Congress and the White House know roughly what impact their policies will have on the country. As you can imagine being the CBO during times such as these when alternative facts have become the primary way of explaining things is perilous. Worse: being the CBO when one party wants to cram through some...

Read More »Behavioral vs Neoclassical Economics

from Asad Zaman In my paper entitled “Empirical Evidence Against Neoclassical Utility Theory: A Survey of the Literature,” I have argued that neoclassical utility theory acts as a blindfold, which prevents economists from understanding simple realities of human behavior. The paper provides many examples of this phenomenon, which I will illustrate briefly with one simple example in this post. Consider the two player Ultimatum Game. The Proposer (P) has ten dollars in single dollar bills....

Read More »Changing the story to hide the problem

from David Ruccio It’s obvious to anyone who looks at the numbers that the wage share of national income is historically low. And it’s been falling for decades now, since 1970. Before that, during the short Golden Age of U.S. capitalism, the presumption was that the share of national income going to labor was and would remain relatively stable, hovering around 50 percent. But then it started to fall, and now (as of 2015) stands at 43 percent. That’s a precipitous drop for a supposedly...

Read More » Real-World Economics Review

Real-World Economics Review