from Lars Syll A democratic polity is supposed to be based on egalitarian distribution of political power. In a system where virtually all resources are available for a price, economic power can be translated into political power by channels too obvious for mention. In a capitalist society, economic power is very unequally distributed, and hence democratic government is inevitably something of a sham. In a sense, the maintained ideal of democracy makes matters worse, for it adds the...

Read More »Tony Blair, who brought us the war in Iraq, lectures on the evils of populism

from Dean Baker Tony Blair, the former Prime Minister of the United Kingdom, who is best known for lying his country into participating in the Iraq War, lectured NYT readers on the evils of populism. Once again he gets many key points wrong. He criticizes the left for abandoning centrist politicians: “One element has aligned with the right in revolt against globalization, but with business taking the place of migrants as the chief evil. They agree with the right-wing populists about...

Read More »New geography, old inequality

from David Ruccio It’s true (as I have argued many times on this blog), the number of U.S. manufacturing jobs has been declining for decades now—and they’re not coming back. Instead, they’ve been replaced (as is clear in the chart above) by service-sector jobs. source And, not surprisingly, most new jobs (during the past year, as in recent decades) have appeared in urban centers. But the idea that service-sector job growth in some urban centers—or “brain hubs,” as The Geography of...

Read More »Some methodological perspectives on statistical inference in economics

from Lars Syll Causal modeling attempts to maintain this deductive focus within imperfect research by deriving models for observed associations from more elaborate causal (‘structural’) models with randomized inputs … But in the world of risk assessment … the causal-inference process cannot rely solely on deductions from models or other purely algorithmic approaches. Instead, when randomization is doubtful or simply false (as in typical applications), an honest analysis must consider...

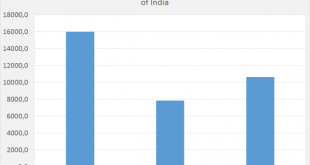

Read More »India: cash comes back

What’s happening in India? The people are clearly rolling back the recent move of the Indian government to basically abolish the cash economy: the amount of cash is, at the moment of writing this, increasing at a hyperinflation rate of 8,5% per fortnight (according to the Reservebank of India data). But the amount of cash is still way below last years’level. Bank deposits are 12% higher than last year but have been flat since December. The question is why cash was abolished. Read here,...

Read More »Hammer time

from David Ruccio Millions of workers have been displaced by robots. Or, if they have managed to keep their jobs, they’re being deskilled and transformed into appendages of automated machines. We also know that millions more workers and their jobs are threatened by much-anticipated future waves of robotics and other forms of automation. But mainstream economists don’t want us to touch those robots. Just ask Larry Summers. Summers is particularly incensed by Bill Gates’s suggestion that...

Read More »Economics — confusing mathematical masturbation with intercourse between research and reality

from Lars Syll There’s no question that mainstream academic macroeconomics failed pretty spectacularly in 2008 … Many among the heterodox would have us believe that their paradigm worked perfectly well in 2008 and after … This is dramatically overselling the product. First, heterodox models didn’t “predict” the crisis in the sense of an actual quantitative forecast. This is because much of heterodox theory is non-quantitative. Basically, people write down English words explaining their...

Read More »The new trade agenda: deals that promote equality rather than inequality

from Dean Baker With the Trans-Pacific Partnership now definitely dead and Donald Trump pushing for a renegotiation of NAFTA, many progressives are looking for a fundamental re-examination of trade deals. As supporters of international cooperation rather than narrow nationalists, progressives have often felt uncomfortable opposing trade deals. While there is no reason to be defensive about opposing trade deals that favored business interests at the expense of workers, consumers, and the...

Read More »RyanCare! Or is it TrumpCare?

from Peter Radford Well, the wait is over. We now know what the Republican health care plan looks like. It’s early days and the inevitable compromises will have to be made, but the Republican seven year crusade is reaching its climax. Or not. The problem is this: as we have discussed many times, any credible health care plan needs a number of key features. Three stand out: You need to ensure the biggest insurance pool you can. In an ideal world this pool would be the entire population of...

Read More »Trumponomist

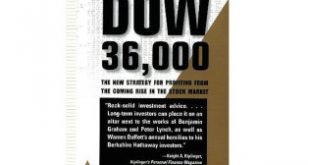

from David Ruccio According to recent news reports, Kevin Hassett, the State Farm James Q. Wilson Chair in American Politics and Culture at the American Enterprise Institute (no, I didn’t make that up), will soon be named the head of Donald Trump’s Council of Economic Advisers. Yes, that Kevin Hassett, the one who in 1999 predicted the Down Jones Industrial Average would rise to 36,000 within a few years. Except, of course, it didn’t. Not by a long shot. The average did reach a record...

Read More » Real-World Economics Review

Real-World Economics Review