from Lars Syll In his book Why Minsky Matters L. Randall Wray tries to explain in what way Hyman Minsky’s thoughts offer a radical challenge to mainstream economic theory. Although there were a handful of economists who had warned as early as 2000 about the possibility of a crisis, Minsky’s warnings actually began a half century earlier—with publications in 1957 that set out his vision of financial instability. Over the next forty years, he refined and continually updated the theory. It...

Read More »Indian ministers and CEOs flock to the US to report to the digital colonizers

from Norbert Häring To “prepare the next generation of world leaders”, the Massachusetts Institute of Technology (MIT) will hold its 2017 MIT India Conference, this time on “Digital India”. Members of the Indian government and CEOs are travelling to Cambridge to report on the “success” of the US inspired crackdown on the use of cash. As usual, the plight of the cash-using poor and the data-security and privacy nightmare resulting from mandatory biometric identification are unlikely to be...

Read More »Look, Ma, no competition

from David Ruccio It comes as no surprise, at least to most of us, that corporations are getting larger and increasing their share in many different industries. We see it everyday—when we buy plane tickets or try to take out a loan or just make a purchase at a retail store. We know it. And now, it seems, economists and the business press have finally taken notice. According to recent research by Gustavo Grullon, Yelena Larkin, and Roni Michaely, More than 75% of US industries have...

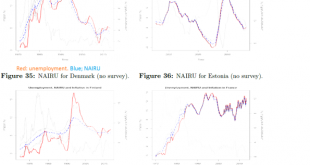

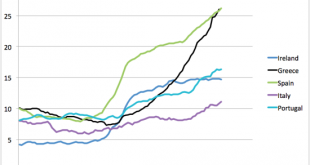

Read More »More ‘NAIRU’ bashing or: does Spain really needs 26,6% unemployment to keep prices stable?

Below, three sets of graphs from three ‘structural’ seconomic tudies which show that the celebrated concept of NAIRU, as defined in these general equilibrium models is little more than a complicated running average of the level of estimated unemployment (though, quite unscientific, economics does not even seem to have an agreed upon algorithm to calculate this average). This a consequence of the assumption of these models that unemployment is a voluntary state of existence. Yesterday,...

Read More »Simon Wren-Lewis — flimflam defender of economic orthodoxy

from Lars Syll Again and again, Oxford professor Simon Wren-Lewis rides out to defend orthodox macroeconomic theory against attacks from ‘heterodox’ critics like yours truly. A couple of years ago, it was the rational expectations hypothesis (REH) he wanted to save: It is not a debate about rational expectations in the abstract, but about a choice between different ways of modelling expectations, none of which will be ideal. This choice has to involve feasible alternatives, by which I...

Read More »Populism and mainstream economics

from David Ruccio There doesn’t seem to be anything remarkable about mainstream economists’ rejection of the new populism. Lest we forget, mainstream economists in the United States and Europe (and, of course, around the world) mostly celebrated current economic arrangements. As far as they were concerned, everyone benefits from contemporary globalization (the more trade the better) and from the distribution of income created by market forces (since everyone gets what they deserve). To be...

Read More »Robert Lucas — an example of macroeconomic quackery

from Lars Syll In an interview a couple of years ago, Robert Lucas said he now believes that “the evidence on postwar recessions … overwhelmingly supports the dominant importance of real shocks.” So, according to Lucas, changes in tastes and technologies should be able to explain, e.g., the main fluctuations in unemployment that we have seen during the last seven decades. Let’s look at the facts and see if there is any strong evidence for this allegation. Just to take an example, let’s...

Read More »Looking for work in all the wrong places

from David Ruccio Donald Trump promised to bring back “good” manufacturing jobs to American workers. So did Hillary Clinton. Both, as I argued back in December, were wrong. What neither candidate was willing to acknowledge is that, while manufacturing output was already on the rebound after the Great Recession, the jobs weren’t going to come back. They were also wrong, as I argued in November, about there being anything necessarily good about factory jobs. But perhaps even more...

Read More »Healthcare continued …

from Peter Radford Nothing could possibly give us more insight into the ineptitude and unpreparedness of Trump for high office than his comment yesterday: “It’s an unbelievably complex subject. Nobody knew health care could be so complicated.” Really? Everyone knew. Everyone. Except for Trump who has blithely been assuming that his bully-boy attitude could translate easily from his real estate business into the White House. He, like a lot of others in recent years, reacted to the gridlock...

Read More »Why human capital is not capital

from David Ruccio Noah Smith is right about one thing: mainstream economists tend to use the word “capital” pretty loosely. It just means “anything you can spend resources to build, which lasts a long time, and which also can be used to produce value.” That’s really broad. For example, it could include society itself. It also typically includes “human capital,” which refers to people’s skills, talents, and knowledge. But then Smith proceeds, like the neoclassical equivalent of Humpty...

Read More » Real-World Economics Review

Real-World Economics Review