from David Ruccio Readers know the old adage: in this world nothing can be said to be certain, except death and taxes. And, we should add, employers complaining they can’t find enough good workers. The fact is, if workers were really scarce, their wages would be rising dramatically. That’s how things works in a capitalist labor market: employers who want to hire workers offer higher wages. But, according to the latest report from the Bureau of Labor Statistics, average hourly earnings of...

Read More »Why economists don’t know what every baby knows about scientific methods

from Lars Syll Limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we “export” them to our “target systems”, we have to be able to show that they do not only hold under ceteris paribus conditions and a fortiori only are of limited value to our understanding, explanations or predictions of real...

Read More »Spirituality & Development – part 1

from Asad Zaman Friday, 26th Jan 2017: Lecture by Dr. Asad Zaman, VC PIDE to students at University of Cambridge, Center of Development Studies for Religion & Development paper. 40 minute video recording of lecture on you-tube. Part 1: “What Is Spirituality?”: Modern Secular thought takes spirituality and religion to be diseases which affect weak minds not properly trained in the scientific method. Part I of this lecture explains why this view, which is based on positivist ideas, is...

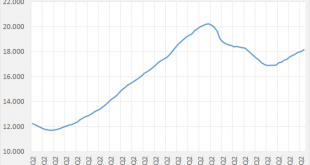

Read More »Spain: fast employment growth (but….)

According to the European Commission, Spain does well. And it does: after 6 years of decline employment has increased with 1,2 million. This is, when it comes to EU job creation, a decisive development! But… well, look at graph 1. Employment is nowhere where it has to be. And double digit increases in the number of tourists won’t last forever – Spain will need a new growth sector (or a more equitable division of labor). When it comes to this: half of the employment increase took place...

Read More »Greece: it did not have to be this way

Ashoka Mody on Bloomberg Then came the cardinal error: At the IMF’s Board, over the fierce opposition of several executive directors, the Europeans and Americans pushed through a bailout program that, contrary to the fund’s rules, did not impose losses on Greece’s private creditors. The decision was based on a spurious claim that “restructuring” private debt would trigger a global financial meltdown. Thus, European governments and the IMF lent Greece a vast sum to repay its existing...

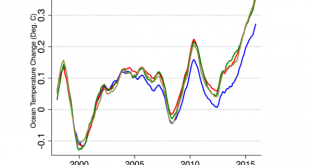

Read More »Global warming: an update

In an article in today’s Mail on Sunday, David Rose makes the extraordinary claim that “world leaders were duped into investing billions over manipulated global warming data, accusing the US National Oceanic and Atmospheric Administration (NOAA) of manipulating the data to show more warming in a 2015 study by Tom Karl and coauthors. What he fails to mention is that the new NOAA results have been validated by independent data from satellites, buoys and Argo floats and that many other...

Read More »End patent and copyright requirements in NAFTA

from Dean Baker The trade deals negotiated in the last quarter century are becoming less focused on traditional trade barriers like tariffs and quotas. Instead, they are imposing a regulation structure on the parties, which tend to be very business oriented. In many cases, the rules being required under the trade deals would never be accepted if they went through the normal political process. The renegotiation of the North American Free Trade Agreement allows the United States, Canada and...

Read More »Lies, damn lies, and statistics

from David Ruccio Regular readers know I take statistics quite seriously. So, as it turns out, did Stephen Jay Gould who, in the most poignant story about statistics of which I am aware, explained how important it is to go beyond the abstractions of central tendencies and understand the distribution of variation within the numbers. And right now, when the numbers are under attack—when, for example, the new Trump administration is threatening to purge the inconvenient numbers about climate...

Read More »On the non-applicability of statistical theory

from Lars Syll Eminent statistician David Salsburg is rightfully very critical of the way social scientists — including economists and econometricians — uncritically and without arguments have come to simply assume that one can apply probability distributions from statistical theory on their own area of research: We assume there is an abstract space of elementary things called ‘events’ … If a measure on the abstract space of events fulfills certain axioms, then it is a probability. To use...

Read More »Risk Adjusted Work

from Peter Radford One of the greatest shifts in our economy over the past few decades has been the steady rise of what we call contingent workers. These are people who make their livings on a part-time or contractual basis and have no full-time job. In the US the increase in contingent workers accounted for all the increase in jobs between 2005 and 2015. Whilst there was an increase in full-time jobs during that period that increase was more than offset by a simultaneous elimination of...

Read More » Real-World Economics Review

Real-World Economics Review