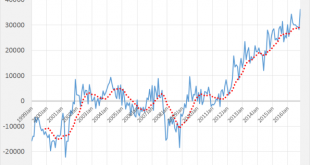

Update: after writing this post I discovered that today Matthew Klein wrote a much longer and much more in depth article about the same subject here. Same conclusion. Should we start a trade war? Let’s, before doing this, take a closer look at current accounts: higher current account surpluses or smaller deficits are not necessarily associated with higher employment. To the contrary. Two examples: between 2009 and 2016 the monthly Eurozone Current Account changed from about minus 10...

Read More »Truthiness on trade

from Dean Baker With the official death of the Trans-Pacific Partnership (TPP) and the likely renegotiation of the North American Free Trade Agreement (NAFTA), the proponents of these deals are doubling down in their defense of the current course of US trade policy. While there are serious arguments that can be made in defense of these policies, advocates are instead seeking to deny basic reality. These trade policy proponents are trying to deny that these policies have hurt large...

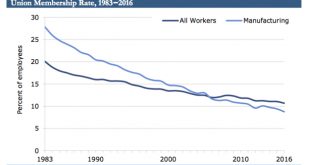

Read More »Union membership rates in the US 1983-2016 – 3 graphs

from David Ruccio source (pdf) The share of American workers in unions fell to 10.7 percent in 2016 (down from 11.1 percent in 2015), the lowest level on record, according to the Bureau of Labor Statistics (pdf). What we’re seeing is a return to the downward trend for organized labor after membership figures had stabilized in recent years—and this is before the new Republican administration even took office. source (pdf) Union membership in the private sector fell by 119 thousand and...

Read More »Protectionist trends

from Maria Alejandra Madi Throughout 2016, many countries around the world keep on competing for market share in high-wage, innovation-based industries. Indeed, these countries have turned to “innovation mercantilism” by imposing protectionist policies to expand domestic production and exports of high-tech goods and services. In this setting, innovation mercantilist policies are being oriented to high-value tech sectors such as life sciences, renewable energy, computers and electronics,...

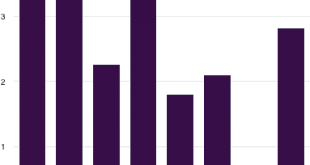

Read More »Economy Base Level

from Peter Radford We are, no doubt, about to be barraged by a torrent of alternative facts concerning the economy and economic growth under our new leader. So let’s get a few facts on the table in order to set a base level for future reference. Let’s start with growth during the past six presidencies: So, no, Obama was not the disaster Trump and the Republicans are trying to paint him as. The economy during Obama’s term outperformed that of his predecessor. This includes the enormous...

Read More »Beyond Trump and free trade

from David Ruccio Now that President Trump has begun carrying out his campaign pledges to undo America’s trade ties, formally withdrawing the United States from the Trans-Pacific Partnership and announcing he will start to renegotiate the North American Free Trade Agreement, it’s time to analyze what this means. As it turns out, I’d already started to do this before the election, with a series of posts (e.g., here, here, here, and here) on Trump and the mounting criticism of the trade...

Read More »The Trump cabinet: strangest show on Earth

from Dean Baker As we start the Trump presidency, events just keep getting more bizarre. At his first and last press conference as president-elect, Donald Trump boasted about his divestment plan in which he was “sort of, kind of” turning over the management of his business enterprises to his two adult sons. He displayed a table full of documents that were supposed to indicate the extent of his divestment, but the documents were not made available for the press to examine. Furthermore, in...

Read More »The Fed and the Crisis on the Eurozone

Yes, he said it. One of the gems found by Erwan Mahé in the minutes of the FOMC meetings. Ben Bernanke: “Here we potentially have a comparison to Keynes’ The Economic Consequences of the Peace and the Versailles treaty, where he pointed out that forcing Germany into extreme austerity, although it might satisfy certain moral, ethical, or political urges, had macroeconomic consequences that might force Germany eventually to rebel. By the same token, if there’s not growth for the South,...

Read More »A $500 bn pot of gold: How Boston Consulting and Google pushed Modi to end the era of cash

from Norbert Häring Boston Consulting Group (BCG), the omnipresent US-consulting company, and Google, the global data miner, issued a joint report in July 2016 on the “$500 bn Pot of Gold”, which is the Indian digital payment market. Even though the authors deny it, the report gives much reason to suspect that the authors knew that something radical was imminent from the Indian government. The report is remarkably honest about the aims of the whole exercise. There is no statement in the...

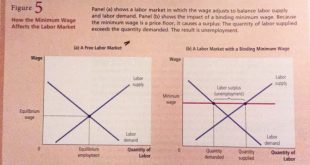

Read More »Economism—or vulgar economics

from David Ruccio In discussing the textbook treatment of the minimum wage, James Kwak provides a perfect example of how contemporary mainstream economics “can be more misleading than it is helpful.” Kwak refers to the problem as “economism.”* For me, borrowing from a different tradition, it is a case of “vulgar economics.” The argument against increasing the minimum wage often relies on what I call “economism”—the misleading application of basic lessons from Economics 101 to...

Read More » Real-World Economics Review

Real-World Economics Review