Thomas Kuhn once famously described textbooks as the vehicle by which students learn how to do “normal science” in an academic discipline. Economic textbooks clearly fulfil this function, but the pity is that what passes for “normal” in economics barely deserves the appellation “science”. Most introductory economics textbooks present a sanitised, uncritical rendition of conventional economic theory, and the courses in which these textbooks are used do little to counter this mendacious...

Read More »The old debt and entitlement charade

from Dean Baker The establishment is trying to pull a big one over on the public yet again. One of the designated topics for the last presidential debate goes under the heading, “debt and entitlements.” This should have people upset for several reasons. The first is simply the use of the term “entitlements.” While this has a clear meaning to policy wonks, it is likely that most viewers won’t immediately know that “entitlements” means the Social Security and Medicare their parents receive....

Read More »Economic growth is not “natural”: re-thinking current economic challenges

from Maria Alejandra Madi Since the late 1980s, the World Bank has been defending a policy agenda that reinforces the free market model of endogenous economic growth where human capital plays an outstanding role since the acquisition of abilities would increase the productivity levels, and as a result, the income levels. In the model of endogenous growth, the evolution of the level of product per worker depends on the increase of productivity. Regarding the human capital model, the long...

Read More »Links. EU (not?).

The latest UK (un)employment data (August) show at worst some stalling of the relatively high pace of the growth of employment. But there is no sign of any kind of Brexit cliff. The latest UK retail sales data show a 4,1% increase in volume (September). Obviously, people care more about earnings growth (2% higher wages and 1,6% more employment compared with one year ago) than about Brexit. This surprised me: average store prices were 1,1% lower than one year before. The latest UK data on...

Read More »Denying globalization’s downside won’t stop right-wing populism

from Jim Stanford I was somewhat surprised to see Stephen Poloz recently urging economists to do more work identifying and disseminating research on the supposed benefits of free trade. That’s slightly beyond his job description (perhaps more fitting with his last position as head of Export Development Canada). But like economic leaders elsewhere in the world, Mr. Poloz is obviously concerned with the disintegration of popular support for neoliberal free trade deals. That...

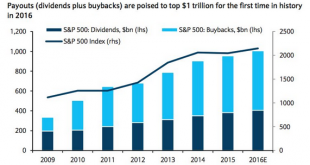

Read More »Sharing in the booty

from David Ruccio We’ve just learned that the corporate payouts—dividends and stock buybacks—of large U.S. firms are expected to hit another record this year. At the same time, John Fernald writes for the Federal Reserve Bank of San Francisco that the “new normal” for U.S. GDP growth has dropped to between 1½ and 1¾ percent, noticeably slower than the typical postwar pace. What’s the connection? Fernald, as is typical of many others who have concluded the United States has entered a...

Read More »Can we move on?

from Peter Radford Really. I am hardly alone in ranting on about economics, but it never changes. How can it? The intellectual honesty required to make the sort of shift needed to recapture the discipline’s honor simply doesn’t exist. Its practitioners are too deeply embedded and ingrained. Its students are too intimidated by the burden of its closed social pressures. Nowhere is there a leader willing to take on the mantle of righting the ship. So it continues to wallow low in the water,...

Read More »In the EU, house prices are increasing too fast.

In the EU, house prices are Increasing too fast (graph 1). Yes, I do know that the general price level is rising, too. And I do know that wages are increasing even somewhat faster than the general price level – which mitigates problems. While, a problem in its own right, in Italy and Greece house prices have been declining for years and are still declining. And almost nowhere the record levels of 2007 have been reached (graph 2). But that does not matter. House prices are increasing too...

Read More »Market myths and realities

from Asad Zaman One of the core and central properties of markets is that they lead to increasing concentration of wealth at the top. This is because market allocations of goods and services respond to money, automatically conferring great power to those with wealth. For instance, market incentives lead to the production of luxury handbags and briefcases for plutocrats priced at $40,000+. According to the World Health Organisation (WHO), the price of one such bag can save more than 300...

Read More »Blind leading the blind

from Peter Radford A few days ago David Ruccio posted an article titled “Crash and Learn” on the state of economics education. I want to elaborate a little further, although my usual skepticism on this subject does bridle a tad at the concept of economics education. Is that the same as “military intelligence”? Anyway, in that article is this quote: In Manchester, Diane Coyle also defends the basic methodology of economics. She says there is confusion among critics between microeconomics,...

Read More » Real-World Economics Review

Real-World Economics Review