The latest polls showing Clinton would win the presidential election is more evidence to support my argument that trying to predict human behavior — whether it involves economic decision making or politics decision making — involves dealing with a nonergodic stochastic process. Pollsters believe that if you take a RANDOM SAMPLE OF THE VOTING POPULATION ON DAY X BEFORE THE ELECTION and calculate the probability distribution of voting for the various candidates, then this x day before...

Read More »Global warming: bet on it

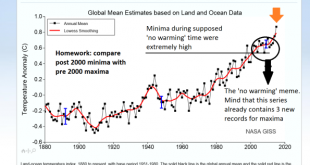

I guess it is time to publish this graph, from the USA NASA.gov site. My prediction: this series will soon be discontinued. I did add some text, as grading has tought me that even intelligent people often have difficulties with the interpretation of graphs. My interpretation: the ‘no warming’ meme, which has been quite influential in climate denial circles, is and Always has been bonkers and climate change is progressing faster than expected. But are these deniers really stupid, or bad at...

Read More »Economic Depression: A commentary on Paul Romer’s The Trouble With Macroeconomics

By David Orrell In a previous article for this newsletter, I wrote about the rather long and withdrawn grief process that the economics profession is working through, as it comes to terms with its role in what has become known as the Great Financial Crisis. Initial denial was followed by anger towards critics, which in turn was followed by a bargaining stage. The latter (I used Dani Rodrik’s book Economics Rules as an example) involved claims that there is nothing seriously wrong with...

Read More »There are two price levels in capitalism

One essential aspect of Minsky’s Financial Instability Hypothesis was the argument that there are two price levels in capitalism: consumer prices, which are largely set by a markup on the costs of production, and asset prices, which are determined by expectations and leverage. This argument originated with Keynes in Chapter 17 of the General Theory, when he noted that investment is motivated by the desire to produce “those assets of which the normal supply-price is less than the demand...

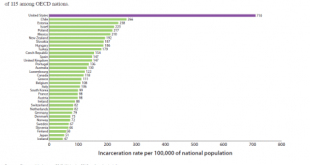

Read More »Crime, starvation and incarceration in America (2 charts)

Subject to an unregulated free market for labor, Polanyi believed that “workers would die as the victims of acute social dislocation through vice, perversion, crime, and starvation”. The US has the most “flexible” labor market of all OECD countries, meaning the freest market for labor, with the least intervention by government or social institutions, as defined by Polanyi. “Essentially, to get high ratings, a country must have low marginal tax rates, a low minimum wage, a high degree of...

Read More »The libertarian case against TrumpKKK – I’m waiting

Deirdere McCloskey should be freaking out. A man called Trump threatens her world. McCloskey is not just the most eloquent but also the most thorough defender of the idea that ‘the bourgeois ethic’ and bourgeois virtues were crucial to the unprecedented prosperity of modern men and women – and improved our ethical standards in the process: “Give masses of ordinary people equality before the law and equality of social dignity, and leave them alone, and it turns out that they become...

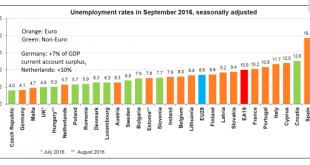

Read More »Euro economies: still out of kilter

According to Eurostat, unemployment differences in the EU are still large (graph). Especially the euro countries do bad. The Netherlands and Germany seem to buck this trend but this must be ascribed to whopping surpluses on their current accounts. As not all countries can, by definition, run current account surpluses at the same time (my surplus is your deficit) this means that total domestic demand in the Euro Area is way to low. Another option: people are working too much and have to...

Read More »Scary numbers

from David Ruccio Gabriel Zucman, in his article in the special issue of Pathways, “State of the Union: The Poverty and Inequality Report 2016” (pdf), reveals lots of scary numbers about wealth inequality in the United States.* The scariest is the percentage of wealth owned by the top 0.1 percent of households, which “has exploded in the U.S. over the past four decades.” The share of wealth held by the top 0.1 percent of households is now almost as high as in the...

Read More »Finance as warfare

To simple people it is indubitable that the nearest cause of the enslavement of one class of men by another is money. They know that it is possible to cause more trouble with a rouble than with a club; it is only political economy that does not want to know it. — Leo Tolstoy, What Shall We Do Then? (1886) The financial sector has the same objective as military conquest: to gain control of land and basic infrastructure, and collect tribute. To update von Clausewitz, finance has become war...

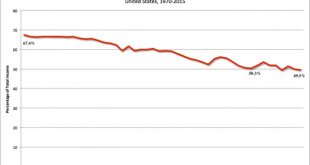

Read More »What shared prosperity?

from David Ruccio Eduardo Porter is right: the “long, painful slog out of the Great Recession” hasn’t been accompanied by any kind of shared prosperity. As the chart above reveals, the share of income going to the bottom 90 percent of U.S. households has actually fallen since 2007 (from 50.3 percent to 49.5 percent)—and, in recent years, remains far below what it was (67.4 percent) in 1970. In other words, the so-called recovery looks a lot like the unequalizing dynamic of...

Read More » Real-World Economics Review

Real-World Economics Review