from Peter Radford What? Surely not! How dare he suggest such a thing. What, you are correct in asking, am I talking about? The recent speech by a Department of Justice official who dared suggest that it is getting quite difficult to find a truly neutral technocratic expert to give testimony in court. Imagine the cheek. How dare he question ‘expertise’. Especially economic expertise, which is, surely, the gold standard. Why did he say what he said? Because academics are apparently so...

Read More »What is heterodox economics?

from Lars Syll Based on our interviews, heterodox economics appears to be a positive project, inevitably defined somewhat in terms of the mainstream but not exhaustively so. It is also efficacious, with policy and real-world impact. It is a complex object, not amenable to definition by a single criterion. Its dimensions are partly intellectual, in terms of what it believes. It holds a realist position. It is concerned with asymmetric power relations, in the economy and in the economics...

Read More »Rizzo goes for the guild

from Peter Radford Is it a cult? Is it a guild? Both perhaps? I remember reading sometime not long ago that Steve Levitt was leaving Chicago. Two things stood out in the article bringing that news: first, Levitt said he was concerned that economics was becoming irrelevant; second, someone had told him he was not doing ‘proper economics’. Here’s a clue who that someone was: Heckman. Then, more recently, the Financial Times editorial page accused the economics discipline of becoming a...

Read More »Windows in the past. Some words on glass, the importance of repairing broken windows and GDP.

This post was written because of a tweet by David Andalfatto, who wondered why medieval and early modern Europe, a society that built cathedrals, did not show any per capita growth. Per capita growth is an average, and when the rich get richer, it can increase even when the number of poor and destitute increases. The question is: was something like this the case in the time of the cathedrals? I won’t give a definite answer. But I will go beyond ´real´ GDP per capita (ultimately a...

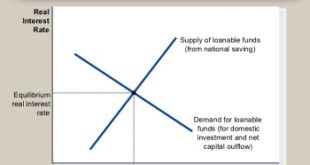

Read More »Rethinking public debt

from Lars Syll Few issues in politics and economics are nowadays more discussed — and less understood — than public debt. Many raise their voices to urge for reducing the debt, but few explain why and in what way reducing the debt would be conducive to a better economy or a fairer society. And there are no limits to all the — especially macroeconomic — calamities and evils a large public debt is supposed to result in — unemployment, inflation, higher interest rates, lower productivity...

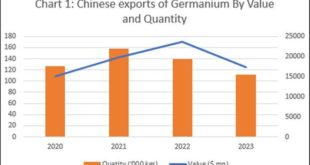

Read More »The Chinese threat in critical minerals

from C. P. Chandrasekhar and Jayati Ghosh It is more than a year since China, reportedly in retaliation to US-driven restrictions on exports of advanced semiconductors and related manufacturing equipment, imposed export controls on two crucial materials—germanium and gallium—that enter into the production of semiconductors and military and communications equipment (advanced microprocessors, fibre-optic products and night-vision goggles). Imposed in the name of safeguarding “national...

Read More »Diverting class warfare into generational warfare

from Dean Baker In the last-half century, productivity has outpaced the growth of real compensation for the median worker by more than 40 percent. This means that if workers’ pay had kept pace with productivity, as it did in the three decades after World War II, it would be roughly 40 percent higher than it is today. This would mean that instead of a typical worker earning $34 an hour, they would be earning close to $48 an hour. That implies an annual wage of $96,000 a year for a worker...

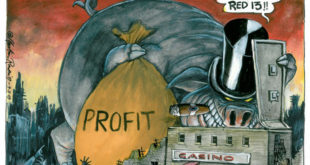

Read More »Casino capitalism

from Lars Syll According to Keynes, financial crises are a recurring feature of our economy and are linked to its fundamental financial instability: It is of the nature of organised investment markets, under the influence of purchasers largely ignorant of what they are buying and of speculators who are more concerned with forecasting the next shift of market sentiment than with a reasonable estimate of the future yield of capital-assets, that, when disillusion falls upon an...

Read More »Price Gouging Part Two

from Peter Radford When you are only concerned with one thing and have only one tool things can go awry quite easily. So it is with our price theory friends. They bask in the rigor of their thinking and look askance at the inability of regular folks to grasp the point of the logic of their so-called price mechanism — note the mechanical nature of it all. The recent spate of snooty commentary aimed at Kamala Harris and her ideas about price gouging are a case in point. I talked about...

Read More »How empirical is ’empirical’ macroeconomics?

from Lars Syll At a first glance, DSGE models seem to imply total ignorance because representative agents (or representative groups of agents with limited heterogeneity) featuring objective utility functions populate the literature. At a second glance, however, it becomes obvious that “methodological individualism” prevails and even dominates. To understand this dominance one only has to once again note that the representative agent has fixed properties only within any given model, or...

Read More » Real-World Economics Review

Real-World Economics Review