Summary:

The result of the EU referendum was a considerable shock - not just to the UK, but to the EU and indeed to the whole world. Just how big a shock it was is evident from the fact that the OECD has suspended its forecasts until September. It usually only does this for "significant unforeseen or unexpected events", such as a major earthquake or a tsunami. Brexit is a shock to the global economy of a similar order. And it has permanently changed the world. Whatever the future holds, we can be pretty sure that it will be very different from the dominant paradigm of the last forty years. The vote was highly disruptive. It created chaos in the UK, anger and confusion in the EU, and puzzlement and concern further afield. But as the fog clears, markets return to some kind of normality and a new UK government takes the reins, we can perhaps begin to discern what the future might hold. To everyone's relief, the UK's banking sector appears resilient: bank share prices have fallen, but there have been no bank runs, market freezes or liquidity crises, and banks are continuing to lend. If only the same could be said of the European banks. The Brexit shock highlighted the weakness of Italian banks in particular, but the truth is that the entire European banking sector is under-capitalised, highly risky and stuffed with bad assets.

Topics:

Frances Coppola considers the following as important: Brexit, Economics, recession, recovery, UK

This could be interesting, too:

The result of the EU referendum was a considerable shock - not just to the UK, but to the EU and indeed to the whole world. Just how big a shock it was is evident from the fact that the OECD has suspended its forecasts until September. It usually only does this for "significant unforeseen or unexpected events", such as a major earthquake or a tsunami. Brexit is a shock to the global economy of a similar order. And it has permanently changed the world. Whatever the future holds, we can be pretty sure that it will be very different from the dominant paradigm of the last forty years.The result of the EU referendum was a considerable shock - not just to the UK, but to the EU and indeed to the whole world. Just how big a shock it was is evident from the fact that the OECD has suspended its forecasts until September. It usually only does this for "significant unforeseen or unexpected events", such as a major earthquake or a tsunami. Brexit is a shock to the global economy of a similar order. And it has permanently changed the world. Whatever the future holds, we can be pretty sure that it will be very different from the dominant paradigm of the last forty years. The vote was highly disruptive. It created chaos in the UK, anger and confusion in the EU, and puzzlement and concern further afield. But as the fog clears, markets return to some kind of normality and a new UK government takes the reins, we can perhaps begin to discern what the future might hold. To everyone's relief, the UK's banking sector appears resilient: bank share prices have fallen, but there have been no bank runs, market freezes or liquidity crises, and banks are continuing to lend. If only the same could be said of the European banks. The Brexit shock highlighted the weakness of Italian banks in particular, but the truth is that the entire European banking sector is under-capitalised, highly risky and stuffed with bad assets.

Topics:

Frances Coppola considers the following as important: Brexit, Economics, recession, recovery, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

The vote was highly disruptive. It created chaos in the UK, anger and confusion in the EU, and puzzlement and concern further afield. But as the fog clears, markets return to some kind of normality and a new UK government takes the reins, we can perhaps begin to discern what the future might hold.

To everyone's relief, the UK's banking sector appears resilient: bank share prices have fallen, but there have been no bank runs, market freezes or liquidity crises, and banks are continuing to lend. If only the same could be said of the European banks. The Brexit shock highlighted the weakness of Italian banks in particular, but the truth is that the entire European banking sector is under-capitalised, highly risky and stuffed with bad assets. On the day of the EU referendum, Deutsche Bank failed the Federal Reserve's stress tests for a second time, and the Spanish bank Santander for the third time. The EU's abject failure to deal adequately with its banks was brought into sharp focus. By comparison, the UK's banks looked - and still look - rather good.

However, the UK's property market does not look so good. Open-ended property funds suffered severe liquidity crises and were forced to cease redemptions: additionally, both open-ended and closed property funds slashed their valuations. Construction has already suffered a sharp downturn and it seems likely there will be more pain to come. We should expect a price correction in commercial real estate and high-end residential property, especially in London: it is possible that price falls may trickle down to ordinary residential property too. Falling property prices nearly always presage a recession.

There is also growing evidence of a significant hit to the real economy. Businesses are delaying or cancelling investment decisions, cutting production and in some cases considering moving headquarters and/or operations elsewhere. Of course, this might be a response to the chaos of the last couple of weeks. But if these effects are sustained, we should expect there to be negative consequences for wages and employment.

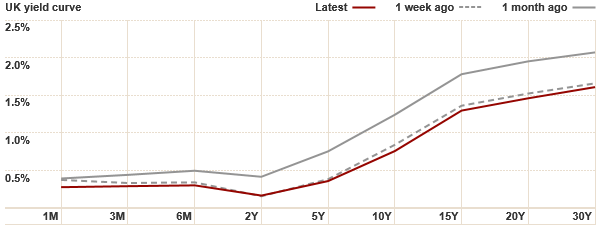

Currently, the indications are that the UK will suffer possibly quite a nasty downturn. The gilt yield curve is inverted at the 2-year point, which suggests that markets are expecting a recession within the next two years:

Because of this, the Bank of England has already relieved banks of the requirement to build up countercyclical buffers, and is widely expected to cut interest rates and perhaps do more QE to support the economy. But as this is primarily a supply-side shock, monetary policy won't be enough. Indeed, in the absence of fiscal support, the unfortunate distributional consequences of unconventional monetary policy could even make matters worse. In the aftermath of a vote driven to a considerable extent by anger against what is perceived as a rich metropolitan elite, the last thing the UK needs is a policy response that increases inequality.

I am relieved that key government figures have already indicated that tough fiscal targets will no longer apply. Trying to close the deficit now would be folly. Quite apart from the fact that tax revenues are likely to disappoint and benefits bills to rise, the economy will need fiscal support. A cut in VAT would be sensible to support demand, coupled with a substantial programme of investment spending. There is no reason to be shy about this. The new Chancellor, whoever it is, will no longer have the European Commission breathing down his or her neck. Gilt yields are low and falling. And the Bank of England can be relied upon to support gilt prices. This is a heaven-sent opportunity to invest in infrastructure, R&D, innovation, education and housing.

Once the path and timetable for Brexit are clear, changes are likely to intensify in the run-up to leaving the EU. Those who no longer see their future in the UK will leave: but we may see others arriving, perhaps attracted by the UK's global outlook. It depends how we play it, of course: if we make life very hard for immigrants or foreign businesses, new ventures may be slow to appear. The new government will need to think about what businesses it wishes to attract for the future, and how to attract them.

To me, the present situation looks a lot like the preparation for the handover of Hong Kong to China in 1997. In 1996, while working for a major global bank, I was involved in a project to transfer trading books from Hong Kong to London. Like many international businesses, we feared that Hong Kong would lose access to international markets once it returned to China, so we wanted to get our business out of there. We were by no means the only business planning to leave. Many people, too, did their best to leave: those with British passports came to the UK, while others went to Singapore. There was a general atmosphere of worry during the five years between the terms of the handover being agreed and the actual return of Hong Kong to China. And it had a dampening effect on Hong Kong's economy.

But we were wrong. Leaving the UK did not end Hong Kong's access to international markets. Nor did it result in the imposition of a repressive Chinese regime, as many feared. In fact, Hong Kong has become both the gateway to the largest market in the world and one of the world's great financial centres in its own right. It remains a lively, cosmopolitan, multi-cultural place. And many of those who left out of fear before 1997 have returned, attracted by Hong Kong's vibrant economy and its key role in the South East Asian marketplace.

Of course, the UK is very different from Hong Kong, and it is leaving rather than joining a major trading bloc. It all could go horribly wrong: the UK could lose large parts of its financial services industry and be unable to develop other industries to compensate. Rather than a vibrant future, it could face years of stagnation and decline. There are no guarantees. But it is entirely possible that, like Hong Kong, once the UK has completely cut the ties, investment could return and the economy start to grow again.

Whatever happens, though, the UK will change fundamentally. I do not know what the UK will look like in thirty years' time. But I am certain it will be little like today. Those who voted for Brexit in the hope of preserving their idea of Britain, preventing "their" culture from being diluted by foreign influences, are in my view doomed to be disappointed. When the UK leaves the EU and faces the world, it will place itself at the mercy of the world, and the world will make of it whatever it chooses. Short of imposing North Korea-style autarky, UK will have little control over this process. "Take back control" is in fact relinquishing control and stepping into the unknown.

Not for a long time has the future been so uncertain. In the short-term, there will be pain. But in the longer-term, the future could be exciting. I did not vote for this, but this is what my compatriots chose, and I accept their decision. So this is what we - collectively - have chosen. Now we must embrace it, fully. For only by committing to our post-Brexit world can we have any hope of making it work. While we hanker after the past, and try to find ways of hanging on to it, we remain condemned to a stagnant future. Risk is life. Let's take some risk.

Related reading: