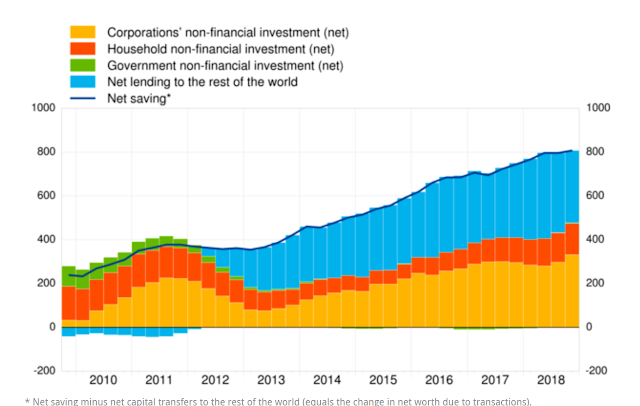

Sectoral balances can tell us so much about what is going on in an economy. Especially when they are expressed as a time series, as in this remarkable chart from the ECB: Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly. What do we mean by "net saving"? The legend appears to conflate saving with investment, and the brief explanation at the bottom of the chart doesn't really help. So here's some simple algebra to sort it out.In national accounting, "saving" is the excess of income over desired consumption. For the private sector, it

Topics:

Frances Coppola considers the following as important: depression, Eurozone, investment, trade

This could be interesting, too:

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

DT Cochrane writes What do Canadian corporations do with their profits?

Frances Coppola writes Trade lunacy is back

Angry Bear writes Policies Shifted Trade from China?

Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly.

What do we mean by "net saving"? The legend appears to conflate saving with investment, and the brief explanation at the bottom of the chart doesn't really help. So here's some simple algebra to sort it out.

In national accounting, "saving" is the excess of income over desired consumption. For the private sector, it looks like this:

Sp = Y - T - C

where Y is the net income of the private sector from all sources, T is tax payments, and C is all other consumption.

Thus, "net saving" is what is left over after the private sector has paid its taxes, met its other obligations such as rent and debt service, fed and clothed itself, and bought the latest Mulberry handbag. It is a residual. So when economists and politicians say "we need more saving in the economy," what they really mean is people and corporations should spend less.

The public sector can also "net save". It looks like this:

Sg = T - G

where T is tax revenue (the same T as in the private sector equation) and G is government spending. The OECD defines government net saving thus:

Net saving arises, and accrues over time, when revenues exceed expenditures without taking into account capital expenditures, such as public investment, transfers to publicly-owned enterprises or transfers to financial institutions (for instance, rescuing them during the financial crisis).Thus, a government that is running a persistent budget surplus is "net saving."

Putting private and public "net saving" together gives us this:

Sp+g = Y - G - C

which is also equal to total net investment:

S = I

This identity is crucial. The chart above breaks down total net saving, S, into its investment (not saving) components:

S = Ih+ Ic + Ig + Ix

where h is households, c is corporations, g is government and x is the rest of the world (positive sign here indicates outward investment, ie capital exports).

The chart shows us that since 2009, with the exception of the two worst years of the Eurozone crisis, the Eurozone as a whole has been investing like crazy. But as Adam Tooze observed on Twitter, the investment has not gone into the Eurozone:

It is clear from the chart that something fundamentally changed when the Eurozone crisis struck. As Adam points out, government net investment completely vanished and has never returned. But it was not exactly large prior to the crisis. The chart shows that collapsing corporate investment is the real story of the Eurozone crisis. European corporations all but stopped investing in the Eurozone in 2012-13. Even now, corporate investment in the Eurozone is barely higher than it was in 2011, in the wake of the Great Financial Crisis.This data on Eurozone net saving should be retweeted daily! Large foreign lending is the flip side of the current account balance. But it is the low level of domestic investment and the complete absence of net public investment since 2012 that is truly dramatic. @SoberLook pic.twitter.com/5qtbpGiny3— Adam Tooze (@adam_tooze) May 2, 2019

But European corporations didn't stop investing. They simply looked elsewhere. Net saving didn't dip much in the Eurozone crisis - but the associated investment no longer went into the Eurozone economy. It flowed out of the Eurozone to the rest of the world. Ever since the crisis, as net saving has increased in the Eurozone, the rest of the world has benefited from its rising exports of capital.

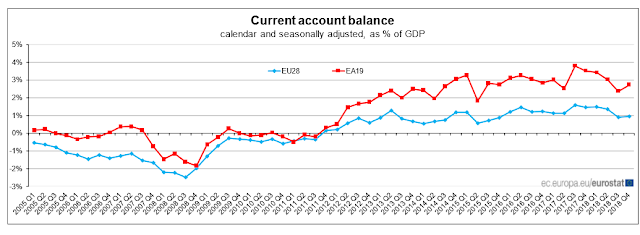

It wasn't only Eurozone corporations that stopped investing in the Eurozone. As Adam says, the growing external surplus is the flip side of the Eurozone's current account balance. The chart shows that in 2011, the Eurozone abruptly switched from net borrowing from the rest of the world to net lending to it. This is consistent with a "sudden stop", in which external investors abruptly pull their funds, causing severe economic damage. If so, then we would expect to see the current account switch from deficit to surplus at this time (net borrowing from the rest of the world indicates a current account deficit). And that is indeed what Eurostat shows:

The Eurozone's "sudden stop" in the last quarter of 2011 is hardly news. Many people have commented on it. But the point is that it is driven by the behaviour of external investors. It was not just domestic investment that collapsed in the Eurozone crisis. External investment fled too. And the persistently wide current account surplus since then tells us that it has never returned.

Economies don't always bounce back after a "sudden stop." If investment doesn't return, then the economy stays stuck in a slump. That is what has happened to the Eurozone. It needs much, much more investment. Investment by domestic corporations is slowly growing, but the ECB says that households are still deleveraging. And government investment is all but absent, as balanced-budget rules proliferate across the Eurozone and Brussels threatens to impose draconian sanctions on any country that dares run much of a deficit. Meanwhile, external investors stay away, put off by the Eurozone's poor growth prospects and rising political risks.

But the Eurozone authorities have very good reasons for pursuing policies that discourage external investment. The "sudden stop" in 2011 nearly destroyed the Euro. Those in charge in the Eurozone daren't risk another one. The current account surplus, and associated capital exports, are protective. After all, if you never borrow from the outside world, they can't hurt you. And if you are a net lender to the outside world, you have some leverage over them. Of course, they can still trash your currency, but as you don't need to service external debt, that doesn't cause you a major problem. It simply helps you to sell them more goods. Alternatively, they can refuse to buy your goods, in which case the loss of export income will make your population poorer. But hey, the people are already used to austerity, because that's how you maintain your current account surplus. They won't notice even more pain when the export income dries up.

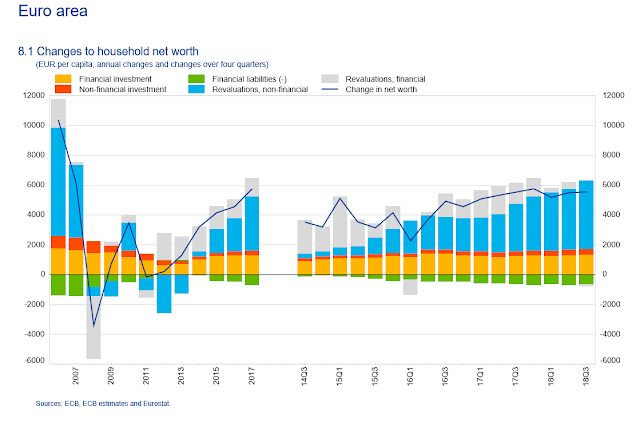

But the Eurozone is not a young developing country whose population is generally living on a low income. It is a mature Western economy with a population that is used to a relatively high standard of living and whose net worth took an absolute beating not only in the 2007-8 financial crisis, but also in the Eurozone crisis:

(chart from the ECB)Rising property prices seem to be the only means the people of the Eurozone have of restoring their lost wealth. But for the young, already suffering from high unemployment, rising house prices mean an even more impoverished future. For how much longer will they tolerate this Long Depression?

Related reading:

Lessons from the Long Depression

How do you say "dead cat" in Latvian? (I need to revisit this post in the light of what we now know about Latvia's banks and money laundering...!)