Otmar Issing can look back on a long and consequential central banking career. Even in his retirement he is still living the part, evaluating whether his successors at the European Central Bank are pursuing stability-oriented monetary policies to his liking. His most recent critique (“‘Living in a fantasy’: euro’s founding father rebukes ECB over inflation response” https://www.ft.com/content/145b6795-2d21-48c6-984b-4b05d121ba16) shows him on the wrong side of events and debates about...

Read More »Otmar Issing Is Still Living in His Monetary Fantasy World

Otmar Issing can look back on a long and consequential central banking career. Even in his retirement he is still living the part, evaluating whether his successors at the European Central Bank are pursuing stability-oriented monetary policies to his liking. His most recent critique (“‘Living in a fantasy’: euro’s founding father rebukes ECB over inflation response” https://www.ft.com/content/145b6795-2d21-48c6-984b-4b05d121ba16) shows him on the wrong side of events and debates about...

Read More »Ein Euro-Ausstieg darf kein Tabu sein

Walter Tobergte ist Sozialwissenschaftler und war in verschiedenenBereichen der Erwachsenenbildung sowie als Unternehmer tätig. Er hatüber internationale Wirtschaftsbeziehungen mit dem SchwerpunktDirektinvestitonen gearbeitet. Die Corona-Pandemie hat zu einer schweren Wirtschaftskrise in ganz Europa geführt. Ein wirtschaftspolitischer Paradigmenwechsel ist dennoch wenig wahrscheinlich. Eher früher als später wird sich daher die Frage nach einem Euro-Ausstieg wieder...

Read More »Dissecting the Eurozone’s (lack of) inflation

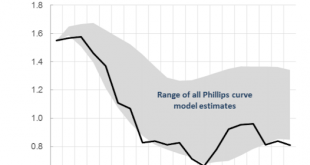

Eurozone inflation is in the doldrums again. After perking up to 1.7% in April, it slumped back to 1.2% in May. According to Bloomberg, this was "lower than expected". But I wonder who, apart from the ECB, really expected anything else. Core inflation has been well below target for the last five years: (chart from Bloomberg)And although the headine HICP measure increased in 2016-18, this was mostly due to the oil price bouncing back from its 2014-15 slump: (chart from Macrotrends)The...

Read More »The Eurozone’s Long Depression

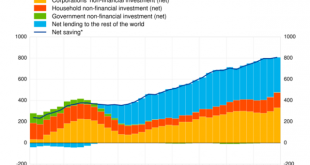

Sectoral balances can tell us so much about what is going on in an economy. Especially when they are expressed as a time series, as in this remarkable chart from the ECB: Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly. What do we mean...

Read More »ECB forecasting is a joke

Over at Bruegel, Zsolt Darvas takes the ECB to task for systematic forecasting errors in the last five years. He shows that the ECB has persistently overestimated inflation and unemployment, and on this basis he questions the ECB's decision to end QE in December 2018. I share his concern that the ECB has tightened too soon, though as the ECB's QE program is seriously flawed and very damaging, I am not sorry to see the back of it.But I think that in focusing on the last five years, he has...

Read More »Vítor unbound

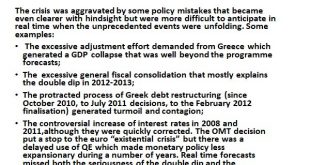

I always find the views of former policymakers fascinating, not least because of their tendency to become much more outspoken once they are out of office. Some express much more radical views than they did while in office: Larry Summers springs to mind, and Adair Turner. Others become critical of the institutions that they ran: Mervyn King, for example. The latest former policymaker to reveal what he really thinks is Vítor Constâncio, Vice President of the ECB from 2010 to 2018. In a...

Read More »L’Italia distruggerà l’Eurozona?

Mia intervista a New Europe. Mi dicono che la rivista con l'intervista sarà diffusa in forma stampata a Bruxelles negli hotels, lobbisti, ambasciate ecc. Speriamo che faccia innervosire qualcuno! Published 08:37 September 28, 2018 Updated 12:54 September 28, 2018 Will Italy destroy the Eurozone? By NEOnline | IRIlia Roubanis Euro-critical discourse is mainstream in Italy. The current government is a coalition that encompasses...

Read More »The New York Times Editorial Board’s Incoherence on Italian Austerity and the Euro

William K. Black June 2, 2018 Bloomington, MN (Third in a series of articles on Italy, Austerity, and the euro) The New York Times’ editorial board published a May 29, 2018 editorial about Italy’s ongoing political and financial issues that praised austerity in Italy. The board cheered the anti-democratic appointment of “Carlo Cottarelli, a solidly pro-Europe and pro-austerity economist and former official of the International Monetary Fund, to form a nonelected government.” In...

Read More »IMF Provides Cover for Europe’s Dysfunctional Currency Union

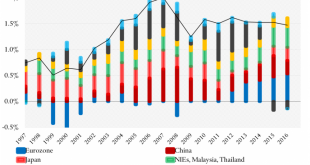

The Council on Foreign Relations’ Brad W. Setser has produced a couple of interesting blogposts on Germany’s fiscal policies of late. The first one, titled “Germany Cannot Quit Fiscal Consolidation,” was published at the end of August. On September 18th, the second one appeared, titled “The Global Cost of the Eurozone’s 2012 Fiscal Coordination Failure.” The latter is more limited in scope and draws heavily on a recent report by the Banque de France. Setser elaborates on the rather...

Read More » Heterodox

Heterodox