I will probably add a topic of my own choice. you do bot have to follow it.

Read More »Real retail sales back to negative YoY

– by New Deal democrat The Bonddad Blog Here is today’s update on one of my favorite indicators: retail sales. In April they were unchanged on a nominal basis. Adjusted for inflation they declined -0.3% for the month. They are also down -6.2% from their 2021 peak and -2.9% since January 2023: On a YoY basis, they have also returned to the negative side, down -0.3% (note two graphs below adds 0.3% to show at the zero line): Here is...

Read More »April consumer prices: still an interplay of gas and house prices, with a side helping of motor vehicle insurance

– by New Deal democrat First, a programming note: I’ll post about retail sales later today. Consumer inflation in April continued essentially to be an interplay between shelter and gas prices, with a side helping of auto insurance and repairs. During late 2022 and early 2023, shelter was still accelerating or steady at a high rate of inflation, while gas prices were falling. Beginning in late 2023, the dynamic reversed, as shelter inflation...

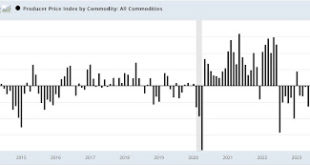

Read More »April producer prices reflect some building pressure from a strong economy with full employment

– by New Deal democrat Tomorrow and Thursday a plethora of data will be released, on consumer inflation and spending, production, housing, and jobless claims. In the meantime today we got a chance to look at upstream pressures on inflation. And those upstream pressures do seem to be building slightly, reflecting a strong economy with full employment. Commodity prices increased 0.9%. These are very volatile, so this was not particularly out...

Read More »The Old Man and the E.R.

The old man knew what it was. At first, he hoped to wait until tomorrow. That wasn’t meant to be. He had to go now, and his regular Doctor was too far away; especially at the time of day. The nearest Emergency Room (E.R.) it was. By this time, he could barely walk, but felt that he was alright to drive. The walk from the parking garage to the hospital front entry took all he had. There, the security guy told him that he couldn’t go through to the...

Read More »Weekly Indicators May 6 – 10 by New Deal democrat

Weekly Indicators for May 6 – 10 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. The majority of short leading and coincident indicators continue to show strength rather than weakness. This week it was commodity prices’ turn to show that the global economy is getting stronger. As usual, clicking over and reading will bring you up to the virtual moment as to the economic data, and reward me with...

Read More »The Household Survey isn’t the only data series sending up caution flares

– by New Deal democrat I’ve written two posts earlier this week delving into the big divergence between the Establishment Survey portion of the Employment Report, which shows moderate growth, and the Household Survey, which is most consistent with a recession already having started. At any given time, some data will be positive and some will be negative. That’s why I follow a whole series of reports with longer term proven reliability. Most of...

Read More »Is China eating our EV lunch?

We are not the typical American car buyers. In 40 years, my wife and I have owned exactly five cars, two of which we still drive: one is 21 years old and just ticked over 100K miles, while the other is 10 years old and will soon hit 50K. But who knows how much longer the 21 year-old Pontiac Vibe will last? When it dies, we’ll consider an EV or hybrid. There are certainly a lot of Teslas on the road, and there are other EVs that are cheaper than...

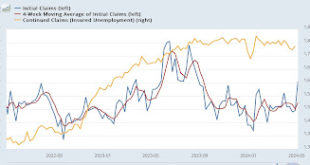

Read More »Initial claims jolted awake from snooze-fest by highest number in almost nine months

– by New Deal democrat After several months of snoozing at almost identical weekly levels, initial jobless claims awoke with a bit of a jolt this week, increasing by 22,000 to 231,000, the highest weekly number since last August. The four week average unsurprisingly also rose, by 4,750, to 215,000. With the usual one week delay, continuing claims rose 17,000 to 1.785 million, still one of the lowest readings since last August: As usual, the...

Read More »Microsoft is investing $3.3 billion dollars to build a new data center in Racine Wisconsin

by Prof. Heather Cox-Richardson Letters from an American Pres. Joe Biden, Dem Governor Tony Evers, and Microsoft are bailing out Wisconsin from trump’s “eighth wonder of the world” lie in Racine WI with Taiwan’s Foxconn. When this was occurring, Repub. Gov. Scott Walker with Repub legislators committed to a $3.3 billion subsidy and tax incentive package in support of the pirates. Racine did get upgraded upgrading roads, sewer system,...

Read More » Heterodox

Heterodox