I will probably have New Deal democrats’ commentary up on Angry Bear shortly. This arrived in my mailbox this morning. It would have been up much sooner for readers; except I am about three hours behind many of you. So, this is timely for me. I agree with Robert Reich and have said what he is claiming as far as corporate control of price increases blaming supply chain is also economic manipulation. It is no surprise to me. Corporations did similar...

Read More »Flying the Friendly Skies Became More Expensive

Flying became more expensive. The last time we flew and whether I was American Advantage or not, there still was a fee to check bags. So we checked our bags outside of the terminal as it was easier and less expensive. There was never a fee outside of the terminal. Now there was. Once American put it into play, they started to charge. It was not a big deal to us. Overall, the airlines have a monopoly. And can get away with egregious actions. If one...

Read More »About the April JOLTS report: hiring and quitting remain very, very good

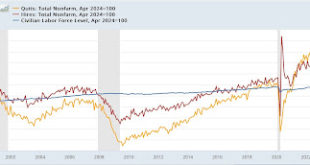

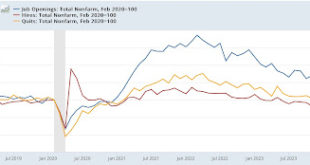

– by New Deal democrat I’ll write about today’s ISM non-manufacturing report later, but first I wanted to follow up with several more graphs based on yesterday’s JOLTS labor report for April. Basically, I didn’t want to leave the impression that the labor market was in any way sub-par based on those numbers. With that in mind, below are two graphs. Both show the entire history of hires (red) and quits (gold) normed to 100 as of the yesterday’s...

Read More »April JOLTS report: firming in hires, quits, and a (good) decline in layoffs, while “fictitious” job openings continue their slide

– by New Deal democrat The JOLTS report for April showed most metrics rebounding slightly from March lows, with the exception of the “soft data” job openings. The overall picture is that hiring is weak relative to the past five years, but so are layoffs, and voluntary quits are equally relatively strong, balancing them out. To wit: job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling...

Read More »Is 3D printing the answer to the housing crisis?

In a rebuke to the standard economic model that demand drives supply, housing prices in the US these days continue to rise. How much of this is due to local regulation vs cost of new home construction is above my pay grade. But the claim is that 3D printed homes can mitigate shortages in affordable new home construction:“Dozens of 3D-printed homes have been built across the world – to house a family in the US state of Virginia or members of an...

Read More »May new manufacturing orders slide, truck sales rise, construction spending close to unchanged

– by New Deal democrat As usual, the month starts out with important data on manufacturing and construction. The news was mixed this month and weighted more to the downside in my opinion. First, the ISM report on manufacturing declined again slightly to 48.7. This is the second month in a row that this index has been under the equipoise point of 50. More importantly, the more leading new orders subindex declined sharply to 45.4, the lowest...

Read More »An update on USPS service performance in Georgia

Steve Hutkins of Save the Post Office giving an update on Louis Dejoy’s Delivering for America Plan. The expectation has been to cut costs through minimizing operations by moving mail between regional centers and delivering to fewer Post Offices. So far in Georgia and in particular Atlanta, the plan has not been working as well as Louis expected. Instead of increasing efficiency, 1st Class Mail is late by days. Instead of decreasing costs, First...

Read More »Hype, or the future of hybrids?

Our first car was a Mazda GLC. We bought it new in 1981, after living without a car for four years. It was a stick shift, front wheel drive ICE car. It got about 32 mpg in town and about 38 mpg on the highway, driving at 55 mph. Since then, we’ve owned four other cars (two that we still have); all were ICE cars and none topped that GLC for mileage. “Great Little Car” indeed.With my wife’s 21 y.o. Pontiac Vibe ticking over 100,000 miles, we’ll probably...

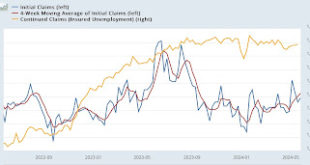

Read More »Slight increasing trend in initial jobless claims, but continuing claims continue slightly lower

– by New Deal democrat Initial jobless claims rose 3,000 last week to 219,000. More importantly, the 4 week moving average rose another 2,500 to 222,500, the highest level in 9 months. With the usual one week lag, continuing claims rose 4,000 to 1.791 million: On the one hand, it does appear that claims have been in a small uptrend for the last four weeks. But on the other hand, recall that there was a similar increase last May into summer,...

Read More »Southern Border or Ukraine Issues?

I believe the decision has already be made. The US is in for both issues be it the Southern Border or Ukraine.. This is something I played with in February 2024. It was long then and it is not shorter today. I did add two graphs which help make my point. The US and Mexican borders are not open. And with the aid of Mexico, the border crossing have become more difficult. Keep in mind one other factor. The Fertility Rate is about 1.62. To...

Read More » Heterodox

Heterodox