This article was first published on the Prospect magazine website on 15th October 2017“Strong and stable” seems of a world so far, far away. The recent Daily Mail headline “PM slaps treacherous Chancellor down” portrays a government in political chaos. Thanks to open, unresolved intra-Brexiteer warfare, ministers are unable to agree the basics of how to exit the European Union. This state of uncertainty intensifies just as the risks to British jobs and living standards are...

Read More »Pedro Nicolaci da Costa — Inequality is getting so bad it’s threatening the very foundation of economic growth

Income inequality has been rising so rapidly in the United States and around the world that it threatens to make economic growth less durable, according to research from the International Monetary Fund. "While strong economic growth is necessary for economic development, it is not always sufficient," four IMF economists write in a new blog. "Inequality has risen in several advanced economies and remains stubbornly high in many that are still developing," they added. "This worries...

Read More »Steve Roth — “If you tax investment income what will people do? Stuff their money in the mattress?”

A lot of pseudo-problems arise from confusion about use of terms, especially when key terms are ambiguous. For example, "capital" can be either financial or non-finanacial ("real" or actual). "Investment" has two different meanings. Financial "investment" is portfolio wealth held as financial instruments a form of savings in contrast to real goods like real estate, physical precious metals, and collectibles like art. "Savings" denotes a stock, and "saving" denotes a flow....

Read More »Lars P. Syll — Abba Lerner and functional finance

Must-read for anyone interested in MMT.Lars P. Syll’s BlogAbba Lerner and functional financeLars P. Syll | Professor, Malmo University

Read More »OECD ignores deficit hawks, backs higher public investment in infrastructure & people

The Financial Times’ economics editor, Chris Giles, has had a busy few days. He has written several interesting articles, covering the absence of “the deficit” as a big election issue (as a hawk he’s really not happy about that), the OECD’s new forecast for the UK economy, and the marked similarities between the economies of...

Read More »Raising interest rates is not that simple, Lord Hague

The present period of very low interest rates is widely assumed to be temporary, a consequence of the 2008 financial crisis and subsequent central bank action. Because of this, as the financial crisis fades into the mists of time, there is growing political pressure for "normalisation" of interest rates. Here, for example, is William Hague warning that central banks must start to raise rates or face losing their independence: The only way out is for the US Fed to summon the courage to lead...

Read More »If only we could return to the glorious 1990s…..

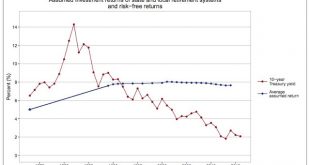

The chart below comes from Silver Watch on Twitter. I haven't been able to identify the original source, but it illustrates perfectly the point I have been trying to make for quite some time now. Pension funds are not taking on more risky investments because the risk premium has fallen, but because the risk-free rate has fallen: In fact, as the chart shows, the risk-free rate has been falling steadily for over thirty years. This is not a post-crisis blip. It is a secular trend. Yet pension...

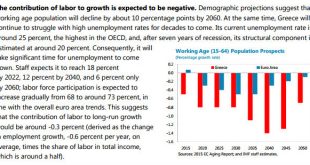

Read More »Where on earth is growth in Greece going to come from?

It's not going to come from people working more. Excerpt from the IMF's latest Debt Sustainability Analysis for Greece, just released: Oh dear. Quite apart from the negative contribution to growth, the prospect of unemployment taking 44 years to return to something approaching normality is simply appalling for Greece's population. I've looked in more detail at this here (Forbes).Well, if labour isn't going to drive growth, there's always investment, yes?Er, not really. The outlook for...

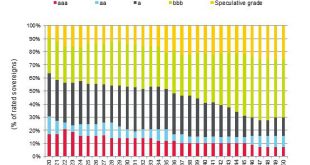

Read More »The safe asset scarcity problem, 2050 edition

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

Read More »Germany’s negative-rates trap

Germany's Finance Minister Wolfgang Schaueble has long been critical of ECB monetary policy,. But now, as Reuters says, the gloves are off. In a speech at a prizegiving for an ordoliberal economics foundation last Friday, Dr. Schaeuble demanded that the ECB raise interest rates.The justification? Very low interest rates hurt Germany's savers, which are the bedrock of its economy.There is a political dimension to this. Dr. Schaueble's party, the CDU, is losing popularity and desperate for...

Read More » Heterodox

Heterodox