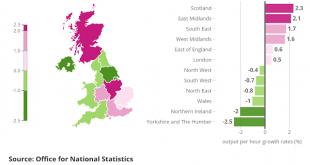

When the banks fell over, they knocked the stuffing out of the British economy. The UK’s productivity has been dismal ever since. Unemployment has fallen to historic lows and wages are rising, but productivity growth remains near zero. This “productivity puzzle,” as it is known, has had economists scratching their heads for best part of a decade.But UK productivity is a tale of two halves. Experimental statistics recently released by the Office for National Statistics (ONS) reveal widely...

Read More »A tale of two halves

When the banks fell over, they knocked the stuffing out of the British economy. The UK’s productivity has been dismal ever since. Unemployment has fallen to historic lows and wages are rising, but productivity growth remains near zero. This “productivity puzzle,” as it is known, has had economists scratching their heads for best part of a decade.But UK productivity is a tale of two halves. Experimental statistics recently released by the Office for National Statistics (ONS) reveal widely...

Read More »Trump’s trickle dries up — Michael Roberts

Well, Trump’s boast turned to dust in 2019. US GDP grew by 2.3% in 2019, well below President Trump’s promise of 3%+ growth. The most recent GDP number proved that the tax cuts championed by Trump had no sustained impact on US growth. Indeed , even the most optimistic forecasts see growth to stay well below 3% for the next few years. Of course, that won’t stop Trump in his State of the Union speech today in Congress proclaiming a huge rise in the living standards of working people under...

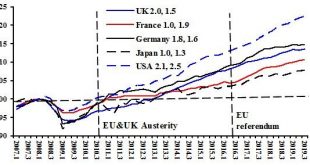

Read More »EU and UK economic prospects post-Brexit – the impact of investment

Analytical Considerations As Brexit is finalized we find considerable speculation about the likely consequences for the UK and EU economies after the end of January. Because this event has no clear precedent, much of the speculation derives from political predilections and opinion without an analytical anchor. Since private investment plays a major role in both growth and diversification of economies, beginning with the motivation to invest might provide that anchor. As...

Read More »Trudeau’s proposed speculation tax

I’ve written a blog post about the Trudeau Liberals’ recently-proposed speculation tax on residential real estate owned by non-resident, non-Canadians. The full blog post can be accessed here. Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and is Section Editor of the Canadian Review of Social Policy/Revue canadienne de politique sociale. You can...

Read More »Trudeau’s proposed speculation tax

Posted by Nick Falvo under BC, bubble, cities, economic thought, foreign investment/ownership, globalization, housing, inequality, interest rates, investment, Liberal Party policy, monetary policy, municipalities, Ontario, party politics, prices, private equity, regulation, Role of government, taxation, Toronto, wealth. September 25th, 2019Comments: none I’ve written a blog post about the Trudeau Liberals’ recently-proposed speculation tax on residential real estate owned...

Read More »Michael Roberts — A profits recession?

Falling aggregate profit rate? As James Montier, the post-Keynesian economist at GMO, the large asset fund manager, points out, real earnings growth in the corporate sector has been below the rate of real GDP growth even after the significant boost from the financial engineering from share buybacks. According to Montier, when you dig down into the market you find that a staggering 25-30 per cent of firms are actually making a loss. In Montier’s view, “the US is witnessing the rise of the...

Read More »Why targeting productivity is a bad idea

Last week I attended a workshop entitled "Enhancing the Bank of England Toolkit," hosted by the Progressive Economy Forum. Presented at the workshop, and underpinning most of the debate, was this report from GFC Economics and Clearpoint Advisers, which was written for the Labour Party and first issued last June. The report was widely criticised at the time, as one of its authors ruefully observed in the introduction to the presentation. Nonetheless, the authors presented it unamended.The...

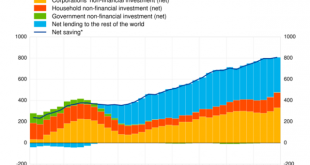

Read More »The Eurozone’s Long Depression

Sectoral balances can tell us so much about what is going on in an economy. Especially when they are expressed as a time series, as in this remarkable chart from the ECB: Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly. What do we mean...

Read More »Lars P. Syll’s Blog Krugman vs Kelton on the fiscal-monetary tradeoff

The battle of the titans. Or maybe better, David and Goliath. We have to free ourselves from the loanable funds theory — and scholastic gibbering about ZLB — and start using good old Keynesian fiscal policies. Keynes — as did Lerner, Kaldor, Kalecki, and Robinson — showed that it was possible to promote economic growth with an “appropriate size of the budget deficit.” The stimulus a well-functioning fiscal policy aimed at full employment may have on investment and productivity does not...

Read More » Heterodox

Heterodox