Here are some things I think I am thinking about: 1 – Rich People Being Gross. Do you remember that episode of the Sopranos when Tony sends a boat over to a neighbor’s house and blasts Dean Martin music to annoy him? This is, you know, the kind of stuff you only see in TV shows. Oh, but this is 2020 and anything goes this year so it’s no surprise that this is actually happening. According to the LA Times, former “bond king” Bill Gross has been blasting the Gilligan’s Island theme song...

Read More »Three Things I Think I Think – Cycles, Hunting Biden and Hacking Life

Here are some things I think I am thinking about: 1) When the boom doesn’t cause the bust. The new Howard Marks missive is typically excellent. Howard cites something that I discussed in my April note about the markets and why this market recovery could end up being much faster than many expect. My working thesis for the last 6 months has been that this decline isn’t a “cycle” resulting from a boom. It’s just an exogenous shock. Said differently, the boom didn’t cause the bust. The bust...

Read More »Three Things I Think I Think – Muting Trump and Biden

Sorry for the recent radio silence. I’m trying to focus my energy on writing about the markets when it’s pertinent as opposed to just spewing a daily or weekly note for the purpose of generating eyeballs. 1) Hit the mute button. There is going to be a lot of noise in the coming months about who will win the Presidency and why that person is good or bad for the country. As I’ve noted on many occasions, politics is the absolute best way to wreck your portfolio. The objective fact is that...

Read More »The COVID Price Compression in Technology

If I had to summarize my view of the Efficient Market Hypothesis it would be this: Markets tend to be more inefficient in the short-term and more efficient in the long-term. One way of thinking about this is that the information we obtain in the short-term tends to be incomplete. So investors have to make informed guesses about market prices. This makes the short-term prices “wrong” at all times. In my book I talked about one of my favorite ways to think about the inefficiency of markets –...

Read More »Three Things I Think I Think – Lumbering Along

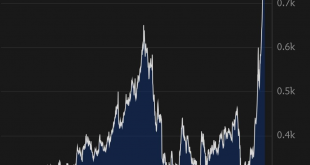

Here are some things I think I am thinking about: 1) Holy lumber, batman! Have you checked out lumber prices lately? Prices have TRIPLED since the March bottom. It’s one of the most interesting economic developments since the pandemic started. Basically, people started staying home and realizing they wanted to remodel the house. Other people started moving out of big cities driving demand for new construction. Young home buyers tried to pounce on the economic weakness. Lumber mills got...

Read More »Three Things I Think I Think – Moar Stuff

Here are some things I think I am thinking about: 1) Moar Home Owners? There was a funny (and serious) Tweet going around in recent days. This made me laugh.¹ Homeownership is massively overrated. I used to rent. I miss it all the time. Don’t get me wrong. I love my house. I bought this old beat up house near the beach and I basically drove a bulldozer through it (which was amazing) and then I spent much of the last 3 years building it myself. It’s been fun, educational and truly horrible...

Read More »The Investor’s Podcast Interview

You’re not gonna believe this, but I recorded a Podcast recently. But trust me, this one is really good. I joined Stig Brodersen and Preston Pysh on The Investor’s Podcast. They always ask the best questions and deep dive into topics in a very educational and informational way. In this one we covered the whole gamut of financial topics including: The main advantage of centralized currencies Why the risk of inflation is more likely to come from the Treasury than from the Federal Reserve...

Read More »Three Things I Think I Think – Bad Tweets Edition

Here are some things I think I am thinking about…there are a lot of bad tweets these days. Come to think of it, maybe all tweets are bad tweets. But on the scale from bad tweet to very bad tweets these were some that triggered me this week: 1) 401Ks are actually very good. There was this article in Bloomberg arguing that the 401K is no longer a good retirement vehicle. Seemed like click-bait, but then I started reading it and the numbers were somewhat compelling. The author had really put...

Read More »The 2020 Podcast World Tour Continues

I know. It’s getting to be a bit much. But I did another podcast. What the hell else am I gonna do on lockdown? Anyhow, I joined Dan Ferris on The Investor Hour to talk about the financial markets. Some of the topics included: The impact of the stimulus and the state of the markets. Why Fed Trutherism is dangerous. Why the stock market rally makes more sense than people think. How the Fed influences interest rates. Why future returns could be lower than many expect. Why patience is going...

Read More »40 Things I’ve Learned in 40 Years

I turn 40 years old today. Since I hate birthday presents I figured I’d pass along some of the presents people have taught me over the last 40 years. 1) Always try to be a good person. This is the most obvious one and also often the hardest one. Life is hard and everyone is fighting their own personal battles. Help them through it by being kind enough to try to understand their battle. 2) Never mistake money for wealth. The person who mistakes money for wealth will live a life...

Read More » Heterodox

Heterodox