Well, it looks like it’s going to be another year of Zoom calls so what better way to start it off than a podcast recorded on a Zoom call. I joined Stig and Preston on The Investor’s Podcast again and we covered a lot of ground including: – Why money supply expansion is not equal to inflation– Understanding the new rules of bond investing in today’s inflation and interest rate environment– How to protect your portfolio against inflation– Whether there is a rational argument for stocks to...

Read More »Is All of Finance Just a Big Network Effect?

In college I was a registered Republican. After I graduated I registered as a Democrat. And a few years ago I registered as an Independent. I guess I just couldn’t ever figure out which tribe I belonged to – which network I wanted to associate with. The last 8 years have been interesting to me mainly because I feel like I’ve watched two competing network effects trying to convince one another that their network is better and the more they can demean, retain and recruit others the more...

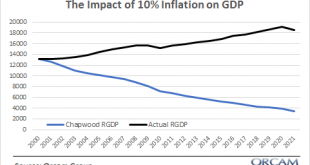

Read More »Is Inflation Really 10%?

One of the long running themes on this website is low inflation and debunking narratives about how very high inflation might be around the corner. I like to work from a first principles understanding, looking at things for what they are and trying to be as objective as possible. Overall, my predictions about low inflation and low interest rates over the last 10 years have been mostly spot-on. Sure, in the last year I’ve been predicting rising inflation due to the huge stimulus measures,...

Read More »Three Things I Think I Think – Happy New Year!

Here are some things I think I am thinking about. 1) Happy new year! 2020 – what a strange year. Awful in many ways and weirdly good in others. For asset prices it was a nightmare of a year, turned into a great year: Global Stocks: + 16.3% US Stocks: +18.3% US Bonds: +7.5% 1-3 year T-Notes/Bills: +3% 20+ Year T-Bonds: +18.1% Gold: +24.8% On a more personal level this was a year of enormous struggle for many. From the pandemic and its health problems to the constant economic concerns. I...

Read More »This Man Lost Everything Betting on Stocks

The headline of this article is something you’ll very rarely, if ever, see in the financial press. You’re much more likely to hear something along the lines of: “Joe Schmo made $1,000,000 buying Tesla stock” “Jane Doe retired early buying Bitcoin” “If you’d invested $1,000 in Microsoft in 1990….”tual I will not parse words here. THESE ARE ALL HORRIBLE ARTICLES. Most of this is survivorship bias that promotes an imprudent gambler’s mentality. Let me explain. Back in 2015 there was a great...

Read More »The 2020 Podcast World Tour Continues!

We took a break from the 2020 podcast world tour due to some engine problems in the old RV, but we got things working again and we’re back. Just kidding of course, I have been mindlessly working from home and jumping on Zoom calls every few hours. This time I spoke with Jack Forehand and Justin Carbonneau from Validea Capital. Jack and Justin are great guys and super open-minded about how to navigate the financial markets. You should check out their website and follow them on Twitter if...

Read More »Revisiting S = I + (S – I)

Warning – this one could put you to sleep if you’re not an econ nerd. I will do my best to translate this into English for those who feel like it’s Chinese. About 10 years ago a huge war broke out in Post-Keynesian circles. Modern Monetary Theory (MMT) was becoming somewhat popular, but many people (including some rather prominent Post-Keynesians like Tom Palley and Marc Lavoie) thought they were being a bit loose with some of their descriptions. One of the big debates that raged had to...

Read More »The Other Side of the Trade

Joe Biden will be the next President of the USA. To many people this is happy news. To many others it’s sad news. Like 2016, it was a remarkably close race and our country is going to be divided as we head into 2021. This division could sow the seeds of further division and dysfunction. Or, if we choose to understand that division it can help us compromise and function better. One of the nice things about thinking of the world from a macro perspective is that you necessarily have to...

Read More »The Markets and the Economy Don’t Care About Your Politics

In 2017 I wrote a detailed post about how political biases consistently hurt people’s portfolios. In that post I provided some historical data showing that the President doesn’t determine market returns. But I want to be even more direct about this – there’s zero reliable data on this point and the data points that would impact the outcomes are so random that they will render the data meaningless. Let’s take two recent examples to emphasize this point. In the post 2009 era we heard a lot...

Read More »What the Heck Just Happened?

A post-election autopsy of what just happened and whether it matters…. 1) What Happened to the “Blue Wave”? As of this morning it looks like the Republicans will retain the Senate and the White House will likely go to Biden. The blue wave turned into more of a blue ripple. What’s going on here? I think the big takeaway from this election is that the country is much more moderate than most people assume. There’s no need to over-complicate this. While there are clearly two tribes the...

Read More » Heterodox

Heterodox