I joined Taylor Schulte from Define Financial to discuss the potential impact of COVID-19. We covered: The recent research paper I published. Two potential scenarios for COVID-19. Why this recession is more like a natural disaster than a standard business cycle recession. The temporal dislocation between the economy and financial markets that makes this environment difficult to navigate. What makes the government unique in times of crisis and how it creates money. I hope you enjoy it! ...

Read More »What Do you Do When the Shit Hits the Fan?

Full blown panic has set in. And no one knows when it will end. The uncertainty is like a daily replay of the worst moments of the financial crisis. Except on warp speed. A global pandemic is the type of event that you expect to see in movies, not in reality. And there’s no precedent for how to navigate such an acute and fast economic/market downturn. So, we’re in uncharted territory. What can we do now? Match Your Liabilities Good asset management is about asset liability mismatch. What I...

Read More »It’s Time to Declare War on COVID-19

We’re going to see an economic contraction due to COVID-19. No one knows how deep it will be, but there are going to be sectors of the economy that experience depression-like pain. Restaurants, bars, travel, etc are very likely to see 50%+ year over year declines in revenue. I don’t know how long this will last, but based on past experience with Coronaviruses we should assume that it won’t be brief. We should assume this will last 6, 9, 12 or more months. Now, all recessions are painful....

Read More »Three Things I Think I Think – Corona Edition

Here are some things I think I am thinking about: 1) Is it different this time? I wrote in my book that it’s always different this time. No two economic environments will ever be the same, but we can learn a bit from history and better prepare ourselves for what might be coming. I wrote a short Twitter thread about my general thoughts on the Coronavirus. No one really knows what to expect. So be careful putting too much faith in anyone’s forecasts and narratives. The one thing we know for...

Read More »A Crisis is the Worst Time to Learn Your Risk Tolerance

When I talk to new clients I always tell them “a crisis is the worst time to learn your risk tolerance”. Unfortunately, far too many people do exactly that. They chase returns during a bull market when investing looks easy and then when times get tough they learn that, while they thought they were chasing higher returns, they were only chasing higher risks. Then they rebalance and sell low to align their portfolio closer to their actual profile except usually too far in the other...

Read More »Three Things I Think I Think – Bubbles, Bernie & the Recliners

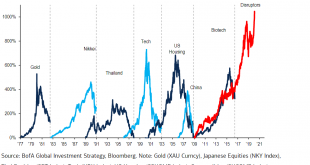

Here are some things I think I am thinking about: 1) Is there another stock market bubble? Over the course of the last 6 or 7 years I have consistently shot down the idea that there is a stock market bubble (see here and here for example). My view of a bubble is pretty simple. It is when the price of an instrument becomes unsustainably detached from its fundamentals creating the risk of a very significant price decline (50%+). So, I was pretty interested in this chart going around Twitter...

Read More »American Living Standards Have Never Been Better

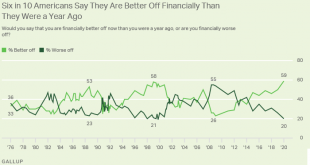

Gallup released a series of polls in the last few weeks that contradict the narrative that the US economy is performing poorly and that Capitalism isn’t working for everyone. This is a narrative that I have been trying to convince people of for much of the last 5 years. I’ve called this period of US economic growth the Era of Irrational Apathy because living standards have continued to increase, but the Financial Crisis and a handful of misconstrued media narratives have created the...

Read More »Why is Shorting Stocks so Difficult?

Did you hear about Tesla? Yeah, it’s up a lot. A lot. A lot. Like, hundreds of percent a lot. Or, 400% from its recent lows. Now, that might not matter much except that that rally now makes Tesla an extraordinarily large business by market cap. At 160B market cap they’re now the 44th largest firm in the world. That’s roughly the same size as McDonalds and larger than Nike. It’s FOUR times the size of Ford and GM. TWO times as large as Ford and GM COMBINED. Whoa. Much of this growth seems...

Read More »Sorry, but Your ESG Funds Probably Suck

I’ve previously discussed ESG investing and how investing in what you view as subjective morality is actually nothing more than old school stock picking. I get it – we want to do what’s right and make money. That’s all well and good, but as it pertains to secondary markets and stock picking this is mostly a fools errand and the investment management industry is taking advantage of this timely topic to sell what is nothing more than high fee active management sold as a do-gooder strategy...

Read More »Do Recessions Need to Happen?

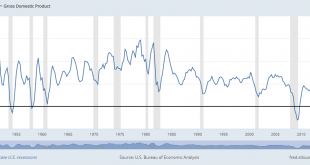

There was an interesting Twitter spat that, aside from personal nonsense, raised a pretty interesting question – do recessions need to happen? There tend to be two views on the subject with one side claiming that recessions are a healthy sort of “cleansing” part of the business cycle and the other side tends to argue that policymakers could smooth the business cycle so that recessions become a thing of the past.¹ First, it’s helpful to understand the terms we’re using here because they’re...

Read More » Heterodox

Heterodox