Here are some things I think I am thinking about. 1) The Mask Controversy. I manage risk for a living. It’s something I obsess about every minute of every day. Understanding risk helps you optimize risk and reward by understanding when things have an asymmetric payoff. We all want to do things that have a high payoff and low amount of risk. COVID is obviously a very high risk virus. We don’t know exactly how to stop the transmission of the virus, but it is becoming clear that mask wearing...

Read More »Three Things I Think I Think – Market Bonanza!

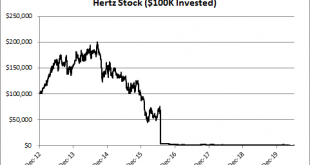

Here are some things I think I am thinking about. 1) Are the markets losing their minds? I’ve tried my best to caution people in recent months over the excessive pessimism of the permabears. There have been numerous comparisons from the usual suspects about how this was the next Great Depression and how the next financial crisis was right around the corner. As I noted in April and is now becoming clear this was very wrong. But there’s still a long road ahead and I somewhat sympathize with...

Read More »What if the Stock Market is Exactly Right?

(Sorry for the radio silence here. It’s been a crazy couple of weeks between this whole new dad thing, the global pandemic, running a business, STILL building my house and eating my way through the lockdown. Hopefully life starts to normalize a bit now and I can find more time for writing!) I always describe the stock market as a temporal conundrum. What I mean by that is that the stock market is basically a perpetual instrument whose future cash flows are unknown so its price movements...

Read More »I Did Some Podcasts. They Were Great.

I did some podcasts recently that I think you might enjoy. Or you might hate them. I guess it depends. But I figured you might want to give them a listen in any case. The Alpha Trader Podcast – I joined Aaron Task and Stephen Alpher to discuss the current state of the financial markets including: Why the recent rally makes more sense than some people seem to think. Why this isn’t the next Great Depression. Why value stocks might finally become more attractive. The risk of future...

Read More »What the Hell is the Stock Market Doing?

The stock market just had its best month since 1987. And the economy just had one of its worst months ever. How is this possible? What is going on? Is it all a conspiracy by the Fed? Are stock traders just insane? All of the above? What do we make of all this? Let’s talk about it. First, the stock market is forward looking. So, while we see everything for what it is, the stock market is looking for what it might become. This ebbs and flows across time. The stock market’s fluctuations are...

Read More »Letting States Default is Very Dangerous Thinking

There’s a growing narrative that states should be allowed to default if they can’t fund their spending needs during the pandemic. Let me be very clear about this: THIS IS AN INSANELY DANGEROUS PROPOSAL Get the message? Let me explain. During the Euro crisis I explained the important difference between the European Monetary Union (EMU) and the USA. The Euro had a series of rolling crises coming out of the financial crisis and they experienced depression-like growth in many countries....

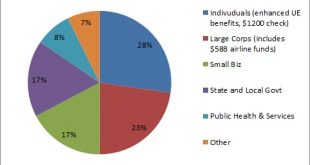

Read More »Understanding the COVID-19 Aid Package

I was watching CNN the other day when a commentator, discussing the government aid package, said that individuals were only getting $1,200 checks and the rest of the money was going to “big business”. This seems to be an increasingly popular narrative and the confusion over the aid package seems widespread. The new COVID programs are much more targeted towards Main Street than the media has been reporting. I was vehemently against the bank bailouts in 2008 and thought that they didn’t help...

Read More »Three Things I Think I Think – (Mo Ron)a

Here are some things I think I am thinking about: 1) What’s up with the stock market? There was widespread outrage that the stock market didn’t go all the way to zero in the last few weeks. This image from Mad Money seemed to symbolize the outrage well: The global stock market is down 20% over the last 5 weeks. It was down 35% at one point. But then things started to look a little better on the virus front. And so the stock market recovered a little, but is still pricing in a pretty bad...

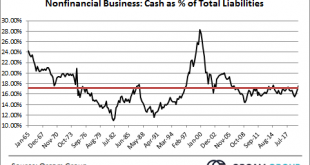

Read More »Fed Truthers Are Wrong (Again)

Fed Truthers spent much of the last 10 years screaming about hyperinflation. When that turned out to be wrong they pivoted and claimed the “inflation” was all in asset prices. That was also wildly misleading and based on the same underlying fundamental misunderstandings that led them to believe in the hyperinflation narrative. Unfortunately, now that a pandemic has hit the global economy they’re using the same set of misleading narratives to argue against any sort of Fed intervention in...

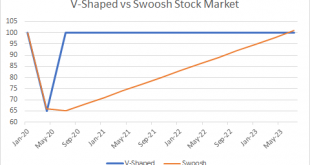

Read More »This Isn’t the Next Great Depression

In my recent research note on COVID I noted two potential scenarios: Short and painful. Basically, 6 months of lockdown with a modestly fast recovery (~15 months). Short-ish and painful. Basically, 12-18 months of lockdown with devastating economic pain and a much slower recovery (24+ months).¹ Case 1 happens if social distancing is working, herd immunity is building, treatments are improving, warm weather helps and we can stave off the virus long enough for a vaccine to be developed...

Read More » Heterodox

Heterodox