I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to go through another 2008, but also want to generate a decent return above the rate of inflation. This means I end up managing a lot of fixed income because being a long only equity manager would expose investors to too much 2008 risk and owning cash guarantees a negative inflation adjusted return....

Read More »Make Investing Simple Again

Back in 2013 I wrote about how dangerous many of the new products on Wall Street are. I said this about XIV, an inverse volatility fund: But you have to be very careful about the latest fads and trends. Some of the funds that have been created in the last 5 years since the crisis have been downright dangerous if misunderstood. Funds like these VIX funds, many of the commodity funds with futures roll issues, the 3X funds, etc. The moment where it struck me as a bit overboard was when I...

Read More »Why the Stock Market Falls (Sometimes)

Whenever the stock market falls people always try to explain why. The honest answer is “no one knows”. We don’t really know why the stock market rises and falls on any given day. There can be any multitude of unknown factors that lead to stock price increases and decreases. Maybe it snowed in NY? Maybe Donald Trump tweeted a lot from the toilet? Maybe a Credit Suisse VIX ETF blew up. Who knows? The needle can move in one direction for lots of reasons. The one thing we know for certain is...

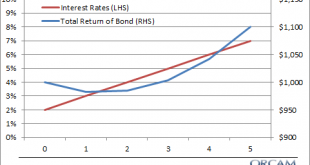

Read More »What Will Happen to Bonds if Interest Rates “Normalize”?

There’s a lot of chatter out there about rising interest rates and “normalizing” rates. As I’ve written about before, I think most of these fears are a case of short-termism being way overblown.¹ But I want to put things in some perspective and show you a scenario analysis of how things might look if bond yields do jump a bit and “normalize”.² To run this scenario analysis I want to look back at the period from 1956 to 1970 when rates jumped from 2.9% to 7.78%. With the 10 year t-note...

Read More »An “Oh Sh$T” Chart of the Day

One of the consistent themes on this blog over the last few years has been a Trump stock bubble. It’s pure speculation, but it makes a lot of sense when you think about it – big talking business friendly capitalist wins Presidency, implements all sorts of business friendly policies and then talks about how great those policies all are. Stocks boom because, in part they should and also in part because this big talker keeps talking about them. Then stocks boom so much that they outpace the...

Read More »Do Bond Prices Have Momentum?

Here’s a strange thought from Jeff Gundlach, one of the world’s largest bond managers: “If you get above 3%, then it’s truly, truly game over for the ancient bond rally.” And here’s Bill Gross from earlier this month: Gross: Bond bear market confirmed today. 25 year long-term trendlines broken in 5yr and 10yr maturity Treasuries. — Janus Henderson U.S. (@JHIAdvisorsUS) January 9, 2018 This is super interesting. In essence, two of the world’s most famous bond managers are making massive...

Read More »3 Things I Think I Think – Wrong!

This is definitely my favorite Donald Trump GIF: via GIPHY In keeping with that spirit, here are some things I think I am thinking about: 1. “The US economy is booming” – WRONG Here’s Donald Trump talking about the “booming” state of the US economy: Will soon be heading to Davos, Switzerland, to tell the world how great America is and is doing. Our economy is now booming and with all I am doing, will only get better…Our country is finally WINNING again! — Donald J. Trump...

Read More »Why Does Momentum Investing Work?

When you’re choosing an equity market allocation I generally prefer to keep things simple – just buy a low fee global market cap weighted portfolio and call it a day. If you build your hedges (bonds or whatever) around that slice correctly then your asset allocation will match your risk profile and you’ll have a reasonably good probability of having constructed a plan that you’ll stick with and will work just fine for you over long periods of time. One of the reasons why I like a market...

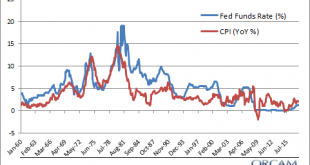

Read More »2 Annoying Myths About Low Rates

* – This is an updated post from 2015 that remains relevant. There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. These myths have scared people away from stocks and bonds and left them frozen in cash or worse, chasing commodities and gold. So let’s take a look at each of these ideas because some clarity might help put things in a more...

Read More »Will Centralized Entities Ruin the Decentralized Party?

One of the key aspects of the crypto boom that keeps bothering me is the inherent conflict between centralized entities and decentralized entities.¹ For instance, let’s think about Bitcoin. Bitcoin is a supposedly useful form of money because it’s decentralized and no one can manipulate it. Then again, I’ve argued that Bitcoin’s biggest weakness is its decentralized nature because: It cannot act as a stable form of money (because money that settles at par does so because a trustworthy...

Read More » Heterodox

Heterodox