Share the post "3 Big Flaws in “The Market” Portfolio"I get a lot of emails about the Global Financial Asset Portfolio, which is the only true “passive index” of the world’s outstanding financial assets (you can see a basic depiction of it here using 4 Vanguard funds). This is a fine portfolio, but I always like to emphasize that the thing I find most interesting about the GFAP is its flaws. As it turns out, “the market” portfolio isn’t necessarily the ideal portfolio which is a pretty...

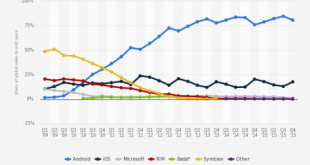

Read More »Samsung is Winning the Productivity and Security Battle

Share the post "Samsung is Winning the Productivity and Security Battle"Back in 2011 I switched from an iPhone to an Android device. I had owned an iPhone from its first version and I loved that phone like no other piece of technology I’ve ever owned. It was game changing in every way. I’ll never forget sitting in restaurants with my iPhone 1 (before everyone and their mother owned one) and having people walk up to me asking me what it was. Switching from an iPhone was not easy, but my basic...

Read More »Helicopter Money Policy Formulation

Share the post "Helicopter Money Policy Formulation"The following is a guest post from fellow Monetary Realism contributor JKHAn important aspect of helicopter money is just how a central bank would obtain the authority to undertake such a policy. Eric Lonergan is a leading proponent of HM. As he points out, the resolution of this issue could depend on the institutional regime for the central bank in question. For example, it may be quite different in the case of the ECB than for the Fed,...

Read More »The Alpha Paradox

Share the post "The Alpha Paradox"Here are a few things we know about the financial markets:Beating the market or obtaining “alpha” (excess return) is extremely difficult as evidenced by the annual SPIVA Scorecards.Alpha doesn’t exist in the aggregate because we all hold what sums to one portfolio wherein we earn the after tax and after fee return of the global financial asset portfolio (GFAP).In order to be properly diversified to reduce single entity risk we must hold a portfolio that...

Read More »Short-Termism and the Olympics – Why the Decathlon is Superior to the Sprint

Share the post "Short-Termism and the Olympics – Why the Decathlon is Superior to the Sprint"There is no question that the two biggest stars of the 2016 Summer Olympics were Michael Phelps and Usain Bolt. In a sea of events these two athletes have something in common – they specialize in relatively short events. Bolt is best known for his 100M and 200M sprints. Phelps is also best known for his 100M and 200M races. Bolt, living up to his name, rarely races for more than 30 seconds while...

Read More »Why You’re Probably a Libertarian Keynesian

Share the post "Why You’re Probably a Libertarian Keynesian"In a recent post I said that my political views are independent. But if I was forced to describe them more specifically I’d probably say they’re consistent with Libertarian Keynesianism. Yes, I know that’s a totally made-up thing, but it just describes someone who’s socially liberal and fiscally conservative within the boundaries of understanding the reality of the economy. But what the heck does that mean?In a recent interview...

Read More »Auto Loans Aren’t a Repeat of the 2008 Financial Crisis

Share the post "Auto Loans Aren’t a Repeat of the 2008 Financial Crisis"John Oliver had a provocative piece on last night’s show about US auto loans referring to it as the next 2008 subprime crisis. Specifically, he compares it to the “medium short” as opposed to the “big short” because the auto loan market is small relative to the total economy. But this comparison is still overstating the size of the risk here.We have to be really careful when comparing things to 2008 because the financial...

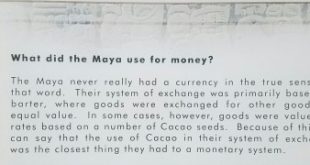

Read More »Money – The Window to Understanding the Economy

Share the post "Money – The Window to Understanding the Economy"We live in a monetary economy. That is, unlike a barter system we have created “money” which serves as the medium by which we exchange goods and services in our economy. Therefore, to understand the economy you must understand money. You must define it, understand where it comes from and understand how it impacts the economy. Money is the language of the economy. For instance, if you wanted to understand human interaction it...

Read More »How They’ll Sell you Higher Fees

Share the post "How They’ll Sell you Higher Fees"The paradox of lower expected returns is that investors get scared investing their own money so they turn to professionals. In doing so, they’re often hiring high fees advisors or portfolio managers who might actually manage these assets better than they can on their own, however, what the manager puts in one pocket with better behavior and performance they take from the other pocket with their high fees. We even see this in the recent data....

Read More »What Does it Mean to be a “Modern” Monetary System?

Share the post "What Does it Mean to be a “Modern” Monetary System?"When I wrote my popular paper on the monetary system (which is now, to my shock, ranked #7 all-time on SSRN) I specifically wrote it with the “modern” monetary system in mind. But what does it mean to be a “modern” monetary system? It’s a strange and interesting question that I always find myself pondering when I travel. Traveling to other spots in the world is so interesting because no two economies or monetary systems are...

Read More » Heterodox

Heterodox