Share the post "Ten Attributes of Great Fundamental Investors"Fantastic note here by Michael Mauboussin of Credit Suisse. Mauboussin is the rare fundamental analyst who is both a good analyst and a good communicator. That is, he can break big complex matters down in such a way that they don’t just sound like a bunch of numbers thrown at a wall.In his latest research piece he breaks down the key aspects of great fundamental investors. Of course, a fundamental analyst like myself loves this...

Read More »Do Savers Deserve a Risk Free Return?

Share the post "Do Savers Deserve a Risk Free Return?"Low interest rates have led many people to conclude that savers are being unjustly punished by a lack of interest bearing savings. In this case, we’re referring specifically to people who are trying to generate a reasonable return in a risk free or nearly risk free instrument like a Treasury Bill, CD or money market fund.¹ But this raises a more interesting question – do savers deserve a risk free rate of return?Before we can answer this...

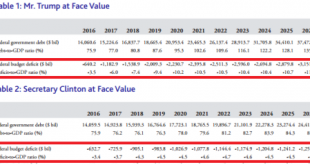

Read More »Donald Trump is a Keynesian on Steroids

Share the post "Donald Trump is a Keynesian on Steroids"Moody’s is out with a new analysis on the Clinton and Trump economic plans.¹ The short story is, Moody’s says the Clinton plan is superior to the Trump plan generating 2.6% RGDP for Clinton vs 0.6% RGPD for Trump in their first terms. But there’s a potential flaw in the Moody’s report in which they assume that a larger budget deficit hurts growth and causes rates to rise due to the crowding out myth. Of course, this is a common myth in...

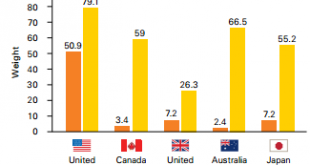

Read More »Everyone Has a Home Bias & No One Should

Share the post "Everyone Has a Home Bias & No One Should"Here’s an awesome chart from a recent Vanguard research piece:What this chart is showing is that every country has a home bias. So, if you’re an American investor you tend to hold mostly domestic stocks. If you’re a Japanese investor you tend to hold mostly Japanese stocks. So on and so forth. And what’s crazy to think here is that you’re literally just buying stocks from one country because you were born there and for whatever...

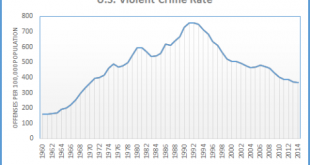

Read More »Yeah, The Fed Didn’t Cause That….

Share the post "Yeah, The Fed Didn’t Cause That…."There are all sorts of crazy myths surrounding central banks. Which is strange because once you understand the operational realities of the monetary system you realize that Central Banks are actually pretty boring entities who mostly serve as bank clearinghouses with far less control over the economy than some think. But that doesn’t stop people from constantly blaming the Fed for all of our problems or expecting them to be able to solve...

Read More »NGDP Futures Targeting – Still Doesn’t Work….

Share the post "NGDP Futures Targeting – Still Doesn’t Work…."This post is pretty nerdy. If you’re a normal person you might consider skipping it….It’s been a while since I talked about monetary policy, but the old debate about NGDP Futures Targeting kicked up again last week with a number of very smart people criticizing the mechanics of the idea. Here’s economist Noah Smith on the subject, quant trader Zachary David and bond trader Brian Romanchuk. And here’s structured product wizard Mike...

Read More »The Good Side of Pessimism

Share the post "The Good Side of Pessimism"“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.” – Winston ChurchillWe seem to live in an environment of perpetual fear. I see it almost every day in the financial markets and this seems to have filtered into the broader sense of well-being across the country. I suspect that this fear is largely overblown. As this story over at Econompic argued, it’s not that the world is becoming more...

Read More »Revisiting My “Useless” 2016 Predictions

Share the post "Revisiting My “Useless” 2016 Predictions"Well, 2016 is over half way in the books. And since I am a big fan of personal accountability I am going to hold myself personally accountable for my “useless” predictions for 2016. I must say, however, since they’re “useless” and forecasting is out of fashion these days (not sure how anyone can make decisions about the future without making implicit forecasts, but whatever) then hopefully none of you will hold me too accountable here....

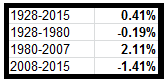

Read More »There Are No “Bond Kings” in This Bond Market

Share the post "There Are No “Bond Kings” in This Bond Market"I’ve called the 30 year bull market in bonds the greatest risk adjusted bull market ever because the figures are truly amazing. For instance, anyone who bought a 30 year T-Bond in 1985 generated about a 9% annualized return with just a 12% standard deviation. That’s 90% of the stock market’s return over the same period with just 68% of the risk. The investor who bought nothing but short-term Treasury Bills generated an average...

Read More »Revisiting Price Compression – Long Bond Edition

Share the post "Revisiting Price Compression – Long Bond Edition"If you’ve read my paper Understanding Modern Portfolio Construction you know that I like to think of all financial instruments as if they’re bonds. This is helpful for multiple reasons:It helps provide a realistic timeframe for holding certain instruments.It helps put the various risks of those instruments in the right perspective.The thing about bonds is that they pay a specific coupon. So, a 10 year T-Bond paying 2.5% will...

Read More » Heterodox

Heterodox