Share the post "Say it With me now: Interest on Reserves isn’t Sterilization!" Here’s a very excellent Ben Bernanke blog post on interest on reserves. In one section he trolls Joe Stiglitz a bit who stated that banks might be sitting on reserves due to interest on reserves (something I also criticized in this post): “This claim, made even by some good economists, is puzzling. Before December, the Fed paid banks one-quarter of one percent on their reserves. If the Fed had not paid...

Read More »What Have We NOT Learned Since 2008?

Share the post "What Have We NOT Learned Since 2008?" Paul Krugman has a post up highlighting some of the lessons we’ve learned since 2008. He’s using a Liquidity Trap model, which, regular readers know I’ve been very critical of (see here and here for some exciting reading on this).* But I wanted to highlight a different point – what have we NOT learned since 2008 which is still holding us back: The money multiplier myth is still rampant. Unfortunately, Paul Krugman’s Liquidity Trap...

Read More »Why Would Anyone Buy a Negative Interest Bearing Bond?

Share the post "Why Would Anyone Buy a Negative Interest Bearing Bond?" Good question here from the Q&A section about negative yielding bonds: Hi Cullen. The Economist had a good article explaining why people buy negative yielding bonds. http://www.economist.com/blogs/economist-explains/2016/02/economist-explains-6 Do you agree with their explanation? The Economist’s explanation is a bit odd as it leaves out the main reason that someone might want to buy a negative yielding bond –...

Read More »Central Banks Didn’t Eat Your Lunch

Share the post "Central Banks Didn’t Eat Your Lunch" One of the consistent trends you’ll find in my econ and finance work is that I don’t think much about Central Banks. In other words, I think mainstream macro puts far too much emphasis on the efficacy of things that Central Bankers do. This is why I said QE wouldn’t do much back in 2009 and it’s also why I’ve consistently argued that the Federal Reserve wasn’t the primary cause of the stock bull market of recent years. Of course, none...

Read More »We’re in Uncharted Waters

Share the post "We’re in Uncharted Waters" Last year I expressed the concern that the global economy of the future might be excessively influenced by a black box economy – China. But as 2016 has picked up the turmoil that 2015 started, it’s become clear that this is not the global economy of the future. It is the global economy we are dealing with now. And the fears over China have created a market environment of uncertainty – the market’s worst enemy. A lot of people keep asking me...

Read More »Fiscal Policy Has Failed the US Economy

Share the post "Fiscal Policy Has Failed the US Economy" The story of the post-crisis economic period is simple: The housing boom left the household sector mired in a deep debt hole. This was further exacerbated by the leverage Wall Street added on top of the household sector’s debt. This left the banks and household sector needing a great deal of support. Since 2008 we’ve seen huge amounts of stimulus from the Federal Reserve and global Central Banks, but we’ve had trouble transitioning...

Read More »The Best Asset Price to Know Twenty Years Out

Share the post "The Best Asset Price to Know Twenty Years Out" Tyler Cowen asks a fun question here: “You are an investor with $10 million planning to cash out in 20 years. A genie appears and offers to send you the price of one but only one asset 20 years from now to inform your investment decisions (a stock, currency pair, commodity, equity index, etc.). What do you want to know? The genie also gives you 20 year cumulative inflation (or exchange rate change for non USD assets) so you...

Read More »Why Do Corporations Pay Dividends?

Share the post "Why Do Corporations Pay Dividends?" There is increasing chatter in recent years about share repurchases, dividends, corporate investment and the ideal way for firms to use capital. But one question that economists can’t really agree on the answer to is why companies pay dividends at all? As noted in an excellent Twitter conversation initiated by Matthew Yglesias, even great thinkers like Richard Thaler and Tyler Cowen don’t have good answers. And even the legends in...

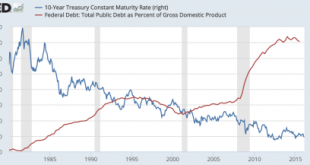

Read More »Let’s Talk About the US Government’s Interest Burden

Share the post "Let’s Talk About the US Government’s Interest Burden" Greg Ip had a piece in the Wall Street Journal yesterday discussing the debt burden in the USA and how low interest rates have “moved back” the “hands on the doomsday debt clock”. The article touches on the important topic of entitlement spending and whether it’s sustainable, but does so in a manner that misleads readers about why this might be a problem. For instance, Ip says that “higher federal borrowing puts upward...

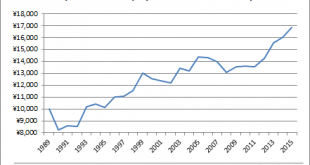

Read More »The Importance of Global Asset Allocation – Japan Edition

Share the post "The Importance of Global Asset Allocation – Japan Edition" I’m a big fan of owning a global equity market portfolio consistent with something resembling the Global Financial Asset Portfolio (though, I would also add that this portfolio isn’t necessarily ideal).¹ If you’re a US investor this has looked like a pretty silly idea in the last few years as foreign stocks have been poor performers in relative terms. Despite this short-term performance there is widespread...

Read More » Heterodox

Heterodox