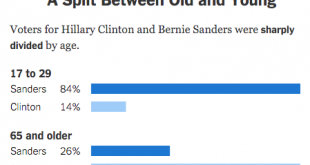

Share the post "Three Things I Think I Think – In the Dark Edition" Here are some things I think I am thinking about: 1 – Young People Don’t Like Hillary. The craziest thing about last night’s Iowa Caucus was the disparity on the Democratic side. Hillary Clinton is getting very little support from young voters. Even young females are voting for Bernie Sanders. Here’s the breakdown by age: This is very different from the Democratic party that Barack Obama won under where young voters...

Read More »What Financial News Sources Should You Read?

Share the post "What Financial News Sources Should You Read?" The Wall Street Journal recently noted that they will be closing the backdoor search loophole to their content thereby forcing readers to subscribe. For those who aren’t aware of this trick – you can access most pay-for financial news sites by searching for the headline on Google. Clicking on that link takes you to the full article even if the site is behind a paywall. Now, some people call this “theft”, but it’s really just...

Read More »Why are Treasury Bonds the Ultimate Safe Haven?

Share the post "Why are Treasury Bonds the Ultimate Safe Haven?" The last 10 years have exposed a very important reality for any global asset allocator – US Treasury Bonds are the ultimate safe haven investment. For decades we have heard stories about how gold, silver, real assets or other types of financial instruments would serve as the “safe haven” investment during times of crisis. Many of these stories were based on mythical ideas about the coming collapse of fiat money or the...

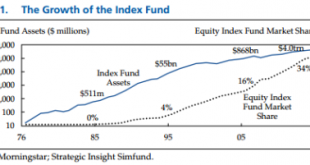

Read More »Dear Hedge Funds: Index Funds Didn’t Eat Your Returns

Share the post "Dear Hedge Funds: Index Funds Didn’t Eat Your Returns" Indexing strategies have been the fastest growing segment of the asset management world in the last 15 years due to low fees, tax efficiency, diviersification and the failure of higher fee active managers to justify their higher fees. As this trend plays out we’re hearing more and more stories about how this trend is bad for investors and how we need these old high fee active managers to better manage the asset space....

Read More »Three Things I Think I Think – Scary Stories Edition

Share the post "Three Things I Think I Think – Scary Stories Edition" Here are some things I think I am thinking about: 1 – Scary Stories Sell Well. Morgan Housel has a great piece over at Motley Fool about why scary stories sound so smart in finance. Morgan rings off a bunch of reasons why scary stories usually sound smarter than bullish stories. This is particularly important to keep in mind when we’re going through rocky times like right now. Scary stories always sell well. And for...

Read More »Revisiting Max Pain

Share the post "Revisiting Max Pain" This is a timely repost from last year. Sharp downturns are always a good reminder that our financial theories might not always align with our financial reality. As I like to say, if you don’t get your risk profile right at the start, the market will teach it to you at some point. Knowing your max pain point is a crucial part of good portfolio management. My biggest gripe with Modern Portfolio Theory is that it tends to lead investors into very...

Read More »5 Big Macro Myths

Share the post "5 Big Macro Myths" James Montier of GMO wrote a wonderful piece earlier this week that I am just getting around to posting. Pragcap readers will really enjoy it as it covers a lot of ground that I’ve been harping on for years now. James discusses 5 big macro myths that just won’t die including: Myth 1: Governments are like households Myth 2: Printing money to finance budget deficits is inflationary Myth 3: Budget deficits/high debt lead to high interest rates Myth 4:...

Read More »What a Time to Build Something!

Share the post "What a Time to Build Something!" While all the doom and gloomers are running into their bunkers to snuggle with their bars of gold the real visionaries of the future are licking their lips in the current environment. With interest rates close to 0% and commodities plummeting to 20 year lows the current environment is presenting itself as one of the truly incredible periods to be a builder. It’s almost as if the financial markets and non-financial asset markets are...

Read More »This Tech Cycle is/was Amazing

Share the post "This Tech Cycle is/was Amazing" Lots of people are declaring the end of the current tech cycle. And others are expressing their disappointment with the way it contributed to society. But I think these views are too near-sighted and unfairly malign technology’s incredible contributions in the last 10 years. Every time I read something about the evils of new technology I think about this Louis CK clip talking about how the world has become so amazing and how everyone is...

Read More »On the Probability of Another 2008

Share the post "On the Probability of Another 2008" I spoke at the AAII investor conference in Los Angeles this past weekend and one of the more common questions I got was whether we’re on the precipice of another 2008. I probably don’t know much better than anyone else, but I’ve stated in the last few quarters that I don’t see it. Here’s my thinking in a nutshell: US and European banks are much healthier today than they were in 2007. There hasn’t been a big credit boom in the US and...

Read More » Heterodox

Heterodox