Share the post "The Great Myths of Investing" This is a guest post from the always awesome Bob Seawright (mostly awesome because he’s from San Diego) As the great Mark Twain (may have) said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” That’s particularly true in the investment world because we know, to a mathematical certainty, that avoiding errors provides more bang for the buck than making correct calls and generating...

Read More »Was Raising Rates a Yuge Mistake?*

Share the post "Was Raising Rates a Yuge Mistake?*" The recent market jitters have a lot of people saying that the Fed might have made a yuge mistake by raising rates. I’ve been a vocal proponent against raising rates, but I am not convinced that this was a policy error (just yet). The risk/reward doesn’t look great in a world where the US economy is fairly weak and global growth is clearly slowing. Here’s my thinking: The risk with rate hikes is creating an extreme divergence in global...

Read More »The Bear Market Playbook

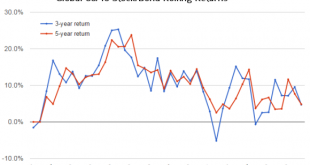

Share the post "The Bear Market Playbook" As many markets enter bear market territory around the globe investors are inevitably getting skittish. Bear markets are a regular part of the financial markets, but that doesn’t make them easy to handle. Here are some keys to handling a bear market: 1. Don’t lose your perspective. In the last 45 years a globally allocated 60/40 stock/bond portfolio has never had a negative rolling 5 year return. Of course, it’s not easy to maintain a 5 year...

Read More »AAII Roundtable Discussion This Saturday in Los Angeles

Share the post "AAII Roundtable Discussion This Saturday in Los Angeles" I’ll be part of a round-table discussion in Los Angeles this Saturday, 9AM at the AAII Los Angeles annual meeting. The awesome Tom Petruno from the LA Times will be joining me to discuss the financial markets and the maroeconomic environment. If you’re in the LA area you should come out and join us. The event will be mostly a Q&A session so come with questions prepared. It should be informative and a lot of fun...

Read More »QE: “Printing Money” To Tax Your Own Citizens

Share the post "QE: “Printing Money” To Tax Your Own Citizens" The Federal Reserve reported a massive $97.7B in net income for the year 2015 thanks primarily to the income the Fed earned on its asset holdings via QE. And while the media will likely report this as a windfall profit the reality is that this is a huge drag on the aggregate economy. You see, the Fed doesn’t retain these profits and spend them back into the real economy like most corporations do. Instead, the US Treasury...

Read More »Powerball Fever!

Share the post "Powerball Fever!" Tonight’s Powerball is expected to total $900MM. But you won’t really get $900MM. Most winners choose the lump sum payout option which, in this case, will amount to $558MM. This is probably the smart move for a savvy saver in a low interest rate environment who will wisely allocate the cash in a diversified portfolio expecting to beat the rate of return that the winner would otherwise earn with the 30 year annuity option. But since most winners aren’t...

Read More »Three Things I Think I Think – Lose Money With Friends Edition

Share the post "Three Things I Think I Think – Lose Money With Friends Edition" Here are some things I think I am thinking about: 1) MARKETS IN TURMOIL! You just have to love the financial media. Every time there is a small hiccup in the global economy they latch onto it to drive up viewership. Fear is, by far, the most powerful emotion and the media has mastered the art of selling it. I suspect this is one reason why markets have become more volatile over the last 20 years. The 24 hour...

Read More »China, China, China….

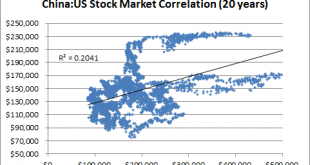

Share the post "China, China, China…." The year of China appears to have started. At least that’s what the headlines would have us all think. I feel like I can’t read anything in the financial news in 2016 without stumbling on how awful the Chinese stock market is. But let’s pan way out here and put things in perspective again because we’ve been through this movie already….just 6 months ago! Three things I am tired of: 1) China 2) China 3) China — Cullen Roche (@cullenroche) January 7,...

Read More »Why Hedge Funds Are Sucking Wind

Share the post "Why Hedge Funds Are Sucking Wind" The basic arithmetic of the financial markets is very simple. At the aggregate level there is just one portfolio of all outstanding financial assets. These financial assets generate “the market” return. This means that the holders of these financial assets must, by definition, generate the post-tax and post-fee return. That is, the aggregate of investors will generate the top line return from all outstanding financial assets MINUS any taxes...

Read More »10 Useless Predictions for 2016

Share the post "10 Useless Predictions for 2016" I’ve discussed in detail why annual predictions are relatively useless. In short, a 12 month period is too brief to establish a reliable data set for market predictions. There is simply too much noise inside of this time frame for us to establish high probability predictions. But hey, let’s not rain on the parade here. And yes, there will be a parade of these predictions….I am not going to disappoint you by not contributing to this slew...

Read More » Heterodox

Heterodox