Positive production print points to continued economic expansion in May The usual suspects are out, claiming that a recession has either already started or is imminent. Well, the big reason I call industrial production the King of Coincident Indicators is because empirically is the one whose peaks and troughs coincide most definitively with NBER recession dates. And unless there is a significant downward revision, in May the King of Coincident...

Read More »Downturn in housing permits and starts in May

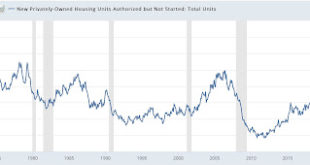

An across the board downturn for housing permits and starts in May Housing permits and starts declined across the board in May. In the past year there has been a unique divergence between permits and starts due to construction supply shortages. This has been reflected in the number of housing units authorized but not started increasing to a near-50 year records of 298.4 in March. In May that number increased from April by 1.5 million...

Read More »Consumer prices rise 1% in May alone; owners’ equivalent rent at 30 year high

Consumer prices rise 1% in May alone; owners’ equivalent rent at 30 year high; expect the Fed to keep stomping on the brakes Today is a travel day for me, so I’ll keep this relatively brief. People who were hoping inflation would abate did not get the news they wanted from the May CPI. Consumer prices rose 1.0% in that month alone. Inflation less energy rose 0.7%, and “core” inflation less food and energy rose 0.6%. On a YoY basis, prices are...

Read More »Weekly Indicators for May 16 – 20

– by New Deal democrat Weekly Indicators for May 16 – 20 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The yield curve tightened some more this week (but did not invert). Meanwhile, I am seeing a fair amount of commentary suggesting that a recession is imminent. This is jumping the gun, and is mainly relying on the downturn in the stock market as well as the increase in gas prices. These are short leading indicators,...

Read More »Weekly Indicators for May 9 – 13 at Seeking Alpha

Weekly Indicators for May 9 – 13 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. One measure of how the Russia-Ukraine war has been “normalized” globally, is that industrial commodity prices have declined sharply – on the order of 25% – in the past two weeks, taking back their entire sharp increase at the start of hostilities. Meanwhile, the Treasury yield curve has “normalized” somewhat more in...

Read More »Omicron has Peaked, Now What?

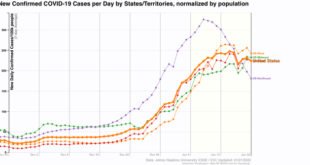

Coronavirus dashboard: Omicron has peaked; now what?, New Deal Democrat – by New Deal democratLet’s start out with the good, or at least less catastrophic news: it’s almost certain that the Omicron wave has peaked in the US. In fact, the only Census region it is still up week over week is in the Midwest: In almost all of the areas hit hard early – Puerto Rico, and the NYC and DC metro areas – cases are down sharply since peaking....

Read More »Weekly Indicators for January 10 – 14 at Seeking Alpha

Weekly Indicators for January 10 – 14 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. In addition to Omicron, commodity prices and interest rates are having an impact across the board on the long and short term forecasts and the nowcast. (Just for spite, two weeks ago some RW nut jobs had a fit about my including a meteor as the image for the article, so this week I including an even more graphic...

Read More »Real Retail Sales tank; Industrial Production declines; Consumer slowdown?

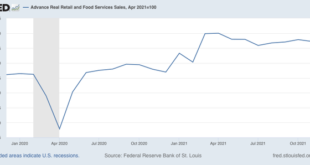

December real retail sales tank; industrial production also declines; consumer slowdown seems nearly certain – by New Deal democrat Two days ago, in connection with consumer inflation, I reiterated that: “we certainly are at a point where a sharp deceleration beginning with the consumer sector of the economy is more likely than not.” I didn’t expect to have it show up so soon! Retail sales, one of my favorite “real” economic indicators,...

Read More »Continuing Unemployment Claims Make New 45+ Year Low

Continuing unemployment claims make new 45+ year low – by New Deal democrat New claims increased 23,000 last week to 230,000. The 4 week average of new claims increased 6,250 to 210,750: The big increase is likely affected by seasonality. It’ll be another week or two before we can tell if there is any real change in trend. If there is, it is likely to be a flattening in new claims rather than any significant increase. Continuing claims...

Read More »An Urgent Warning about Omicron’s Exponential Spread

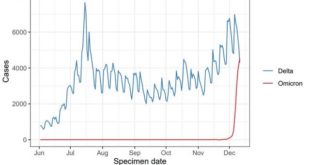

A brief introduction, not to New Deal democrat, but to the subject matter. An extremely contagious new Covid virus is emerging globally and in the US. Those who have resisted inoculations and other preventative measures may find themselves particularly vulnerable. Reviewing the graphs presented, this virus will rapidly infect the US. This Covid Virus will test the ability of people’s resistance. Coronavirus dashboard: An Urgent Warning about...

Read More » Heterodox

Heterodox