Weekly Indicators for July 3 – 7 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. A real-time daily update of inflation (based on millions of prices posted at internet sales sites among other things) has become available, and has been added to the array of coincident indicators. The complete array remains consistent with very slow growth that has not tipped over into contraction. But despite the...

Read More »June jobs report: deceleration continues, with weakest private jobs sector growth since 2020

June jobs report: deceleration continues, with weakest private jobs sector growth since 2020 – by New Deal democrat My focus remains on whether jobs growth continues to decelerate, and whether the leading indicators, particularly manufacturing and construction jobs, as well as the unemployment rate (which leads going into recessions) have meaningfully deteriorated. In May the headlines on employment were decent if slightly weak, but hid...

Read More »MIdyear update: the state of the big monthly coincident indicators

MIdyear update: the state of the big monthly coincident indicators – by New Deal democrat Let’s take a look at the important monthly coincident indicators that the NBER has indicated they weight most heavily, along with quarterly real GDP, in gauging whether the economy is expanding or contracting. Remember, a recession isn’t actually defined by 2 quarters of negative GDP, but rather by a significant decline in jobs, income, sales, and...

Read More »May JOLTS report: continued decelerating trend, but still extremely positive

May JOLTS report: continued decelerating trend, but still extremely positive – by New Deal democrat Let me start out with the statement that has been my touchstone for the JOLTS report for the last year or more: for the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase their wage and/or...

Read More »Initial jobless claims: moving closer to a red flag warning

Initial jobless claims: moving closer to a red flag warning – by New Deal democrat Initial claims for jobless benefits rose 12,000 last week to 248,000. The 4 week average declined -3,500 to 253,250. With a one week lag, continued claims declined -13,000 to 1.20 million: More importantly for forecasting purposes, initial claims are up 17.1% YoY. The more important 4 week average is up 18.1%, and continuing claims are up 27.0%: This is...

Read More »Manufacturing and construction sectors continue downward pull on economy

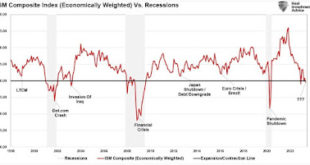

Manufacturing and construction sectors continue downward pull on economy – by New Deal democrat As usual, we start the month with new manufacturing and construction data. The ISM manufacturing index goes all the way back to the 1940s, and has been a very good short leading indicator of recession throughout that time (although nothing’s perfect!). However, since the “China shock” started 20 years ago, with so much offshoring of...

Read More »New Deal democrats Weekly Indicators June 26-30

SUNDAY, JULY 2, 2023 Weekly Indicators for June 26 – 30 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. Movement among the indicators continues to be slow as molasses, but an important bifurcation stands out: indicators focusing on services continue to show good growth, while indicators focusing on goods are either stalled or outright contracting. As usual, clicking over and reading will...

Read More »Real income continues to set records, while real spending and real total sales falter

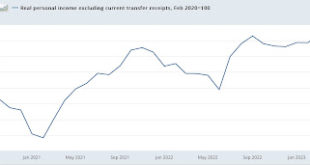

Real income continues to set records, while real spending and real total sales falter – by New Deal democrat Real personal spending faltered in May, and real total sales continued to falter in April, as of this morning’s report; while real personal income continued to be aided by the big decline in gas prices that started a year ago. Let me start with the good news. Real personal income less government transfer receipts is one of the...

Read More »Pent-up demand and sales: an Update

Pent-up demand and sales: an update – by New Deal democrat There’s no big economic news today. So while we wait to see if initial jobless claims continue to worsen tomorrow, and what happens with real personal spending and income, as well as real business sales on Friday, let me point you to an updated detailed discussion of why the Fed’s rate hikes haven’t yet caused the economy to turn down (hint: gas prices plus pent-up demand in several...

Read More »House prices increase for third straight month . . .

House prices increase for third straight month, but Case Shiller index now negative YoY – by New Deal democrat Seasonally adjusted house prices through April as measured by both the FHFA (red in the graph below) and Case Shiller (blue) Indexes rose, the former by 0.7% and the latter by 0.5%. This is the third straight increase in a row. Thus house prices have probably bottomed. But on a YoY basis, prices have continued to decelerate sharply,...

Read More » Heterodox

Heterodox