Scenes from the May employment report: leading indicators and the big picture – by New Deal democrat As I wrote Friday, the May employment report was deeply bifurcated, with a strong Establishment survey, but a weak Household survey. Let’s take a look at some of that bifurcation, focusing on the leading indicators. There are 4 leading indicators in the Establishment portion of the report: manufacturing, residential construction, and...

Read More »New Deal democrats Weekly Indicators for May 29 – June 2

Weekly Indicators for May 29 – June 2 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. Much like yesterday’s employment report, which showed a deep bifurcation between the Establishment and Household Surveys, the economy as a whole is also showing a deep bifurcation between elements well into recessionary territory, and elements showing strong growth. Together they net out to drifting sideways at a...

Read More »Dueling May jobs reports: establishment report strong, household report pre-recessionary.

Dueling May jobs reports: establishment report strong, household report pre-recessionary – by New Deal democrat My focus for this report continued to be whether the leading sectors and other indicators continued to decline, and whether the pace of growth continued to decelerate. The establishment side of the report was strong, with most leading indicators improving. But the household side was not just weak, it was negative, with an...

Read More »New and improved initial claims! Now including comparison to Sahm Rule

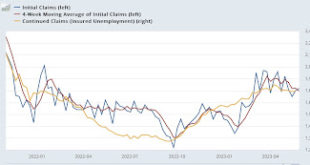

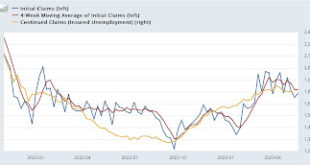

New and improved initial claims! Now including comparison to Sahm Rule – by New Deal democrat I’m making an important addition to my weekly blurb on jobless claims this week: I’m showing how it compares with and leads the Sahm Rule. Just in case you’re not familiar with the Sahm Rule, it is a rule of thumb started by economist Claudia Sahm, stating that the economy is in a recession when the 3 month average of the unemployment rate rises...

Read More »House prices may have bottomed, YoY price increases (leading inflation) have declined

House prices may have bottomed, while YoY price increases (leading inflation) have declined to lower than their 25-year average – by New Deal democrat Seasonally adjusted house prices through March as measured by both the FHFA (light blue in the graphs below) and Case Shiller (dark blue) Indexes rose, the former by 0.7% and the latter by 0.2%. This is the second straight increase in a row, and suggests that house prices may have bottomed:...

Read More »New Deal democrats Weekly Indicators for May 22 – 26

Weekly Indicators for May 22 – 26 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Several of the indicators that popped higher one week ago sank back lower this week. The overall picture remains very slight positivity in the coincident numbers. Meanwhile stock prices continued to make several new 3 month+ highs, but several long leading indicators, including corporate profits as reported in revised...

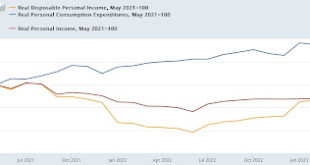

Read More »April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January

April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January – by New Deal democrat As I’ve repeated for the past several months, at present the report on personal income and spending is co-equal to the employment report as the most important monthly data. And for the second month in a row, the results were very mixed. And also, like yesterday, revisions played a big role,...

Read More »Initial claims: revisions rear their ugly head again

Initial claims: revisions rear their ugly head again – by New Deal democrat Revisions are a permanent hazard in reporting on economic data. That was very much in evidence in this week’s jobless claims report. Not only was last week’s number revised down by -17,000, but the initial report of 264,000 two weeks ago is now all the way down to 231,000! Big difference. Anyway, the current report indicates a weekly uptick of 4,000 to 229,000....

Read More »Financial markets in past fiscal crises; the “gold standard” of employment reports . . . big deceleration in Q4 of last year

Financial markets in past fiscal crises; the “gold standard” of employment reports shows big deceleration in Q4 of last year – by New Deal democrat I have a post up at Seeking Alpha on how stocks, bonds, and consumers behaved during the 3 fiscal crises of the last decade. Hint: recessions are always disinflationary. Also of interest: the “gold standard” of employment data is the Quarterly County Employment and Wages report, which is not a...

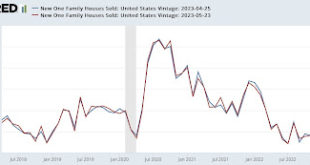

Read More »New home sales and prices: yet another confirmation of a bottom in sales, while prices continue to decline YoY

New home sales and prices: yet another confirmation of a bottom in sales, while prices continue to decline YoY – by New Deal democrat The last of the monthly updates for new home construction, new home sales, was reported this morning. And it continued the theme from the other data (permits, starts, existing home sales); namely, the bottom in sales appears to be in, while prices are still declining. First, on sales: new home sales...

Read More » Heterodox

Heterodox