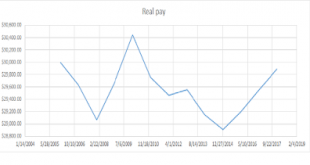

Real Military Pay Donald Trump lies about everything including military pay: Trump Brags To Troops About A Fictional Giant Pay Raise He Got Them – The president told military personnel in Iraq that they’ll get a raise of over 10 percent, their first in a decade. But it’s 2.6 percent, and they get a hike every year. Dave Jamieson even notes that Bill Kristol has called out Trump on this whopper. But to me this is not the story. The real story is that...

Read More »Taxes Up 30%!

Taxes Up 30%! A couple of months ago yours truly complained a bit about some fiscal dishonesty coming from Team Trump: He was basically lying to us hoping the public would be too stupid to realize that when the price level rose by 2.5% during the same period, we are talking about a 2% real decrease in tax revenues. But if we look at customs duties we do see an increase in a category that represents a very modest part of Federal tax collections. Back in...

Read More »Paul Ryan wouldn’t recognize a free market if one bit him

(Dan here…lifted from Robert’s Stochastic Thoughts) Paul Ryan wouldn’t recognize a free market if one bit him Robert Costa and Mike DeBonis wrote an excellent retrospective on the career of Paul Ryan‘He was the future of the party’: Ryan’s farewell triggers debate about his legacy They are quite harsh, but not, I think, quite harsh enough. My comment: This is an excellent article. Tough but fair with no sugar coating but also no discourtesy. However,...

Read More »Neoliberalism as Structure and Ideology

Neoliberalism as Structure and Ideology As someone who has looked at the world through a political economic lense for decades, I am restless with the “cultural turn”. Once upon a time, it is said, the bad old vulgarians of the left believed that economic structure—the ownership of capital, the rules under which economies operate and the incentives these things generate—were everything and agency, meaning culture and consciousness, were nothing. The...

Read More »Rah Rah Economics

Rah Rah Economics Greg Mankiw read Trumponics by Art Laffer and Stephen Moore so we don’t have to: When economists write, they can decide among three possible voices to convey their message. The choice is crucial, because it affects how readers receive their work. The first voice might be called the textbook authority. Here, economists act as ambassadors for their profession. They faithfully present the wide range of views professional economists hold,...

Read More »Real retail sales very positive; industrial production decent

Real retail sales very positive; industrial production decent Real retail sales for November, together with the revisions for October, were very positive. While November sales, both nominally and adjusted for inflation, increased +0.2%, October sales were revised upward to a nominal +1.1%. On an inflation adjusted basis, that translates to +0.8%. As a result, as of November both real retail sales and real retail sales per capita set new records:...

Read More »Real wage growth: November 2018 update

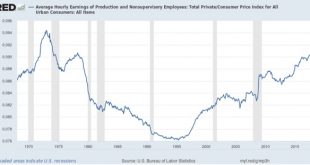

Real wage growth: November 2018 update Now that November inflation has been reported (as unchanged), let’s update what that means for real wages. Nominally, wages for nonsupervisory workers grew +0.3% in November. With inflation flat, that means real wages also grew +0.3%: Even so, although they are at a new 40 year high, real hourly wages are nevertheless below their peak level set in the early1970s! On a YoY basis, real wages have risen 1%:...

Read More »Employment by community size

Brookings Institute points us to: Big, techy metros like San Francisco, Boston, and New York with populations over 1 million have flourished, accounting for 72 percent of the nation’s employment growth since the financial crisis. By contrast, many of the nation’s smaller cities, small towns, and rural areas have languished. Smaller metropolitan areas (those with populations between 50,000 and 250,000) have contributed less than 6 percent of the nation’s...

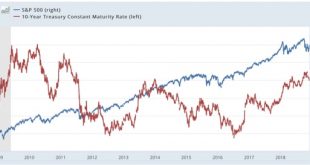

Read More »A note about the financial markets

A note about the financial markets The markets are closed today in observation of former President George H.W. Bush’s funeral. In the meantime, let me offer a brief few observations (pontifications?) about my sense of the immediate and longer term trend. First off, here is a broad look at the last 10 years for the S&P 500 (blue, right scale) and 10 year Treasury bond (red, left scale): The moves in the bond market look exaggerated, because the...

Read More »Is the “Green New Deal” a Marxist Plot?

At the CEPR blog, Beat the Press, Dean Baker and Jason Hickel are debating degrowth. Dean makes the excellent point that “claims about growth” from oil companies and politicians who oppose policies to restrict greenhouse gas emissions, “are just window dressing.” I also agree, however, with the first comment in response to Dean’s post that his point about window dressing could be taken much further. I would add that economic growth is window dressing for...

Read More » Heterodox

Heterodox