Let’s compare apples to apples here. Originally Published at Wealth Economics Uncle Joe has thrown out this 8.2% figure a couple of times, including in last night’s SOTU. Multiple folks have unpacked it; it’s not the standard “tax rate” measure. The usual “tax rate” is taxes divided by personal income, which doesn’t include accrued holding gains. The alternative that Joe’s using is based on Total “Haig-Simons” income, which does include...

Read More »Addressing Credit Card late fees and Supply Chain Pricing

My beef has been with the Supply Chain. Yep, you can be forced into manufacturing less product due to part shortages. Unless you are air freighting that stuff or running OT, costs do not necessarily increase due to producing less. Another situation? In 2008, the calls would come in about raising prices in a take it or leave it manner. This was in regard to semiconductors mostly. It was not due to increased costs as much as increased demand. A...

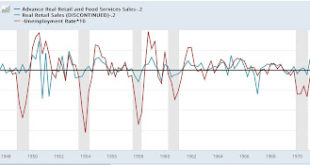

Read More »What real spending and the unemployment rate portend for the 2024 Presidential election (so far)

A bit behind here as other things have distracted me in AZ. Health being one of them. A double dose of excellent reviews of the economy today. If there is one commentary (if you are rushed) on Angry Bear you should read concerning the economy, it is NDd’s reporting. Spending and Unemployment are in the early commentary today. Not sure what NDd has in store for later. The economy and employment are in far better shape after the pandemic than what...

Read More »Representative DeFazio taking on Boeing

Taking on Boeing, A senior manager for Boeing’s 737 MAX program testimony about Boeing manufacturing issues and its supply chain. The fatal MAX 8 crashes occurred in 2018 and 2019. He decided to speak up publicly and was then called to testify before Congress on the problems he says he saw up close. The story is at Politico and is accessible. I wanted to read the Congressional Investigation hearing. Below is part of it and an easy read....

Read More »No Longer Right to Work

We were living in Michigan when Engler and the Republican Legislature passed Right to Work Laws. The effort was meant to undercut Unions and saving costs for the Big Three automakers. Supposedly cars would be lower in costs to with the reductions reflected in prices to consumers. Never happened. Michigan reversed Right to Work Laws just recently. Michigan becomes 1st state in decades to repeal ‘right-to-work’ law, PBS NewsHour, Paula Gardner...

Read More »Aggregate payrolls vs. total withholding taxes paid: which one has been telling the truer tale?

Aggregate payrolls vs. total withholding taxes paid: which one has been telling the truer tale? – by New Deal democrat The drought in new data continues for today. So I wanted to take a further look at the two measures of total payrolls I discussed on Friday, one of which has been of some concern. One is total aggregate payrolls, which is part of the Establishment survey portion of the jobs report each month, and the other is total tax...

Read More »State Supreme Court Issues A Devastating Rebuke of the U.S. Supreme Court

As you read this Slate article, this is something I was also thinking about. How did SCOTUS arrive at its decision and what was the basis or history supporting its decision? SCOTUS was interpreting what they thought it should be. Thomas was telling judges to study the history of gun control before they arrive at a decision. The discussion centers around militia and right of individuals to bear arms. Read on . . . A State Supreme Court Just Issued...

Read More »trump’s TCJA Made the Tax System, Tax Season More Burdensome

In Angry Bear’s commentary Looking at the Trump 2017 Tax Breaks, we examined exactly what the TCJA did for citizens. By the end of 2025, the TCJA would add to the deficit an ~$2.2 trillion. If extended, we can expect another $1.5 trillion. Special exempts were written into the bill so those (business interests) who benefited from the tax cuts would have the tax break into the 2030s. We beginning to or are exceeding the nations GDP. RI’s Emily...

Read More »Mark Cuban’s Cost Plus Drugs Plan

Mission of Mark Cuban Cost Plus Drugs The following is Mark Cuban’s pitch on supply drugs. If you do not have healthcare insurance which pays for drugs you more than likely going to pay list unless you have a drug store discount such as GoodRx. Mark Cuban talking pharmaceuticals and costs: We started Mark Cuban Cost Plus Drug Company because every American should have access to safe, affordable medicines. If you don’t have insurance or have a...

Read More »Jamie Dimon wants to help poor people by . . .

Jamie Dimon says lower-income people need more help and he’d ‘pay for it by taxing the wealthy a little bit more’ Fortune Taxing the Rich? If he really wants to help the poor? Allow the tax breaks for individuals in the upper 20% sunset. reverse the tax breaks, and tax income from foreign enterprises. A little bit more below. Didn’t we just have a conversation about Jamie’s beliefs on taxes here at Angry Bear? If you forgot, you can find it...

Read More » Heterodox

Heterodox