The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The Eurozone’s Long Depression

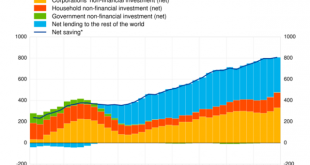

Sectoral balances can tell us so much about what is going on in an economy. Especially when they are expressed as a time series, as in this remarkable chart from the ECB: Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly. What do we mean...

Read More »Keynes and the death of capitalism

In a recent article for the New Statesman, the economics commentator Grace Blakeley makes an extraordinary claim. Writing about the origins of the IMF, she says: Seventy-five years have passed since these international financial institutions were created in Bretton Woods, New Hampshire, in 1944. Back then, delegates sought to tame the power of international finance, the growth of which helped to cause the 1929 Wall Street Crash and the ensuing Great Depression. JM Keynes – who led the...

Read More »Jakob Hanke — EU and China break ultimate trade taboo to hit back at Trump

Brussels and Beijing on Wednesday launched explosive cases at the World Trade Organization, in which they will argue that Trump’s tariffs on steel and aluminum, imposed in May, cannot be justified on grounds of national security, as the White House claims. The EU and China were joined in their protest by Mexico, Norway, Russia and Canada. The six-fold attack on Trump is a landmark departure from the orthodoxy of trade diplomacy as countries have traditionally shied away from challenging...

Read More »Some governments really are like households

In my last post, I said that the fact that a government can buy anything that is for sale in its own currency is not sufficient to confer monetary sovereignty. A country which is dependent on essential imports, such as foodstuffs and oil, for which it must pay in dollars is not monetarily sovereign. Some people disputed this on the grounds that such a country could earn the dollars it needs through exports. So I thought I would write a post discussing how realistic this is in...

Read More »The myth of monetary sovereignty

How many countries can really claim to have full monetary sovereignty? The simplistic answer is "any country which issues its own currency, has free movement of capital and a floating exchange rate." I have seen this trotted out MANY times, particularly by non-economists of the MMT persuasion. It is, unfortunately, wrong. This is a more complex definition from a prominent MMT economist: 1. Issues its own currency exclusively 2. Requires all taxes and related obligations to be...

Read More »Cake and cherries

Sometimes I despair at the naivety of politicians.Theresa May's humiliation in Salzburg was an inevitable consequence of her belief that the EU would be willing to compromise its "four freedoms" to keep her in power. To be fair, press reports since the Chequers plan have suggested that the last thing the EU wants is a change of leadership in the UK. But it was a mistake to interpret this as meaning the EU was willing to become Theresa's poodle. Nothing could be further from the truth. The...

Read More »Brian Romanchuk — Exports And The Cycle

Not all "automatic stabilisers" in the economy are due to government policy; there are patterns of private sector behaviour that tend to act in a counter-cyclical fashion. The role of the external sector is an important stabiliser (at least most of the time). This article is a basic primer on the subject.... Bond Economics Exports And The CycleBrian Romanchuk

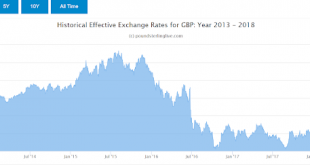

Read More »Patrick Minford’s holidays

Skewering Patrick Minford has become something of an economists' bloodsport. I admit, I have done my fair share of Minford-bashing, though I do try to stay away from trade economics. Others are much better at lampooning Minford's antediluvian approach to trade economics than me.But when Minford starts pontificating on the effect of currency movements on the balance of trade, I can't resist getting out the shotgun. Minford is appallingly bad on anything that involves foreign exchange. He just...

Read More » Heterodox

Heterodox