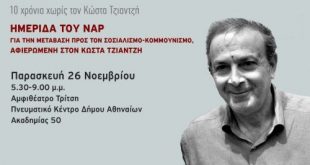

Σύντροφοι και συντρόφισσες, καλησπέρα Για τον Κώστα Δεν θα πω πολλά. Άλλωστε στον Κώστα δεν άρεσαν οι υπερβολές και οι έπαινοι όσο τον αφορούσαν. Διακατεχόταν από αυτή την υποδόρια και ταυτόχρονα ευγενική ειρωνεία που κρύβει πίσω της την ουσιαστική σεμνότητα ενός ανθρώπου αφιερωμένου στο σκοπό της επανάστασης. Είναι σαν να έλεγε «ας αφήσουμε τις περιττές φιοριτούρες και ας επικεντρωθούμε σε αυτό που είναι το βασικό». Σε μιά εποχή που η ήττα πλημμύρισε την Αριστερά και το...

Read More »Rational expectations — the triumph of ideology over science

from Lars Syll For more than 20 years, economists were enthralled by so-called “rational expectations” models which assumed that all participants have the same (if not perfect) information and act perfectly rationally, that markets are perfectly efficient, that unemployment never exists (except when caused by greedy unions or government minimum wages), and where there is never any credit rationing. That such models prevailed, especially in America’s graduate schools, despite evidence to...

Read More »A golden age of macro economic statistics 3. Informal and precarious labor.

In September 2021, a Dutch judge decided, in a case of the FNV Union against Uber, that Uber drivers are employees, not dependent or independent contractors. Meaning, on the micro level, that these employees in one stroke were entitled to more money, more protection and more rights. In the macro-conceptual framework of the International Labour Organization (ILO) this means that they shifted from a somewhat informal status to a formal status (see below). While it shows up, in the...

Read More »How small a target: taxation and expenditure

I was puzzled by Anthony Albanese’s Budget reply speech in May this year, which put forward only one alternative policy, a “$10 billion social housing fund”, which proved on inspection to be an off-budget piece of spurious financial engineering that, if all went well might generate $500 million a year for housing. The government already has four or five similar funds and of course the much larger Future fund. What puzzled me was that Albanese’s response seemed to fall between two...

Read More »The case for being born

The New Yorker is running a profile of the anti-natalist philosopher David Benatar. Reading it, I was unconvinced by the implied response to the obvious objection, “if life is so bad, why not kill yourself”, namely that suicide is painful in itself and causes pain to others. I searched a bit, and discovered that, not only had Harry Brighouse covered the book at Crooked Timber soon after it came out, but I had made the same objection in comments[1], which I’ll reproduce for...

Read More »The fatal flaw of mathematics

from Lars Syll Gödel’s incompleteness theorems raise important questions about the foundations of mathematics. The most important concerns the question of how to select the specific systems of axioms that mathematics are supposed to be founded on. Gödel’s theorems irrevocably show that no matter what system is chosen, there will always have to be other axioms to prove previously unproved truths. This, of course, ought to be of paramount interest for those mainstream economists who still...

Read More »Causality as child’s play

from Asad Zaman 1 THE DILEMMA OF CAUSALITY Study of causality confronts us with a huge dilemma. Intense controversy has raged for centuries over this topic among the philosophers. At the same time, studies of child development show that infants learn about causal concepts almost from birth, and toddlers have a sophisticated approach to causality. How can causality be easily understood by babies, but remain confusing and complicated to the best philosophers for centuries? The...

Read More »Open thread Nov. 26, 2021

The proliferation and efflorescence of indicators

from Ken Zimmerman (originally a comment) In the early 20th century the emergence of the United States as a global force unparalleled and nearly unrivaled in material might catapulted obscure economic indicators into central, abiding elements of national life. No “man on the street” would have given a thought to gross national product or national income in the 1920s or at any point before then, and not simply because that number didn’t exist. People wouldn’t have thought of their nation...

Read More »Is there a “policy”?

from Peter Radford I read this morning that the Federal Reserve had bought, at the peak of the recent crisis, about 40% of all US government bonds being issued. This may, to some of you, be something of no concern. Think again The illusion that there are separate spaces for monetary and fiscal policy is belied by this fact. Which one was it? Was it the Fed flooding the economy with money? Or was it the government issuing debt to finance economic support? I suppose it was both. But it...

Read More » Heterodox

Heterodox