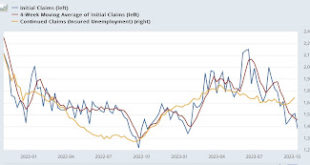

Initial claims on the cusp of turning lower YoY – by New Deal democrat Initial jobless claims dropped below 200,000 last week for the first time since January, and not too far from the 50+ year low of 182,000 set in September one year ago. Specifically, they declined -13,000 to 198,000. The four-week average declined -1,000 to 205,750, the lowest since February. Contrarily, with the usual one-week lag, continuing claims rose 29,000 to 1.734...

Read More »Weekend read – The Great Gatsby curve among America’s über rich

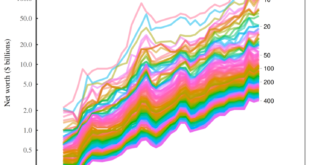

from Blair Fix Economists are not known for their literary imaginations. Flip through any economics textbook and you’ll find a barrage of terms like the ‘Philips curve’ and the ‘Fisher effect’. The jargon is simple enough — empirical relations are usually named after the person who discovered them. But this convention is neither descriptive nor fun. The exception to this vanilla naming practice is a pattern called the ‘Great Gatsby curve’.1 It’s named after F. Scott Fitzgerald’s famous...

Read More »Is peace realistic?

It is easy to think that those of us who favor a two-state solution are utopian dreamers. The mantle of realism seems to rest naturally on those who insist on standing tough against a Palestinian state. But this simple dichotomy has never been accurate, and the realist case for a renewed effort to achieve a stable peace between Israel and the Palestinians is getting stronger every day. Seeking peace may well lead to failure, but the alternative...

Read More »WEA Conference: CAPITALISM, SOCIALISM AND DEMOCRACY 80 YEARS LATER

2024 WEA Online Conference. CAPITALISM, SOCIALISM AND DEMOCRACY 80 YEARS LATER – the relevance of the issues raised by Schumpeter On the WEA Conference website, you can find all the details for submissions and participation: https://schumpeter2024.weaconferences.net/ Starting from Schumpeter’s book, this WEA Online Conference, led by Arturo Hermann and Maria Alejandra Madi, would promote an open debate on how these concepts of Capitalism, Socialism and Democracy characterise our...

Read More »Economics and the way the world works

from Lars Syll With any phenomenon of interest, understanding its nature or essential properties allows us to relate to, or interact with, it in more knowledgeable and competent ways than would otherwise be the case … A surprising number of social theorists, when embarking on substantive analyses, pay almost no attention at all to insights bearing on the nature of these (or any other) factors. Instead, the preferred option is to select the types of methods, procedures or tools to be...

Read More »Some big news

My semi-retirement Share this:Like this:Like Loading...

Read More »The morning after

My latest Substack newsletter Share this:Like this:Like Loading...

Read More »Is the solution to global warming atomic or diatomic

Also, is the solution just dissolved iron sulfate or also dissolved silica ? Sorry for the pun in the title. It is a reference to one of the hives on twitter — the nuclear energy enthusiasts who note the large fraction of zero carbon electricity currently produced by nuclear reactors.* Another approach to dealing with global warming is carbon capture. There is industrial scale carbon capture technology (which makes nuclear energy look cost...

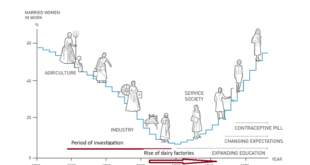

Read More »Claudia Goldin, inspirational

Claudia Goldin won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. I can write about her work. But here, I will be inspired by her work. One of the events she emphasizes is that women’s participation in the ‘GDP’ labor market became less after say 1860, as shown in the figure. Below I will investigate if this model (this is a model) can be used for the interpretation and analysis of my data on long-term agricultural development (yes, it can). The...

Read More »Green education

from Maria Alejandra Madi For instance, the growing quantity of legal proceedings pertaining to passivity on climate change represents a noteworthy advancement in the endeavour to safeguard the natural environment. The high-profile legal case known as the “Case of the Century” in France has garnered significant attention, as non-governmental organisations (NGOs) have levied accusations against the French state for its perceived inadequate efforts in addressing climate change....

Read More » Heterodox

Heterodox