Source: https://ftalphaville.ft.com/2018/01/04/2197227/eight-charts-on-inequality-in-the-us/

Read More »Sometimes we do not know because we cannot know

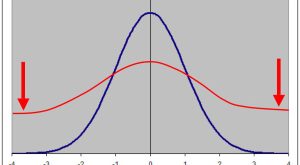

from Lars Syll Some time ago, Bank of England’s Andrew G Haldane and Benjamin Nelson presented a paper with the title Tails of the unexpected. The main message of the paper was that we should not let us be fooled by randomness: The normal distribution provides a beguilingly simple description of the world. Outcomes lie symmetrically around the mean, with a probability that steadily decays. It is well-known that repeated games of chance deliver random outcomes in line with this...

Read More »Open thread April 20, 2018

Changing global income distribution

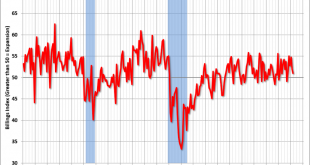

Architectural index, Corporate leverage, Saudi oil pricing

Muddling through at depressed levels: Saudis set price. If they decide to hike as below, it will happen: OPEC’s new price hawk Saudi Arabia seeks oil as high as $100 Apr 18 (Reuters) — Top oil exporter Saudi Arabia would be happy to see crude rise to $80 or even $100 a barrel. OPEC, Russia and several other producers began to reduce supply in January 2017 in an attempt to erase a glut. They have extended the pact until December 2018 and meet in June to review policy. OPEC...

Read More »DSGE models — overconfident macroeconomic story-telling

from Lars Syll A recent paper by Christiano, Eichenbaum and Trabandt (C.E.T.) on Dynamic Stochastic General Equilibrium Models (DSGEs) has generated quite a reaction in the blogosphere … Bradford Delongpoints out that new Keynesian models were constructed to show that old Keynesian and old Monetarist policy conclusions were relatively robust, and not blown out of the water by rational expectations … The DSGE framework was then constructed so that new Keynesians could talk to RBCites. None...

Read More »Inter-generational wealth redistribution in the USA 1989 to 2016

Top 10% national income share across the world 1980 to 2016

Source: http://wir2018.wid.world/executive-summary.html

Read More »Open thread April 18, 2018

China’s “Currency Devaluation Game”

from Dean Baker Donald Trump was apparently angry about the value of the Russian ruble and the Chinese yuan against the dollar. He complained in a tweet that both are playing the “Currency Devaluation game” in a tweet yesterday. Neil Irwin rightly points out that the complaint against Russia is bizarre, both because we don’t have much trade with Russia, but also because the most obvious reason its currency is falling is sanctions pushed by the United States and other western countries....

Read More » Heterodox

Heterodox