I am posting this NPR Fresh Air radio article here because it talks about a part of our society that has not been talked about much. When it comes to discussion of taxation, social programs, how our economy works, the basic premise of free market misses an awful lot. From the page: For many poor families in America, eviction is a real and ongoing threat. Sociologist Matthew Desmond estimates that 2.3 million evictions were filed in the U.S. in 2016 — a...

Read More »Open thread April 13, 2018

More evidence of the skills shortage in top management

from Dean Baker We all know about the skills shortage Harvard has to pay investment managers millions to lose the school a fortune on its endowment, Facebook can’t find a CEO who can avoid compromising its customers’ privacy, and restaurant managers apparently don’t understand that the way to get more workers is to offer higher pay. The NYT gives us yet another article complaining about labor shortages. The complaint is that restaurants have small profit margins and therefore can’t afford...

Read More »ET1%: blindfolds created by economics

from Asad Zaman In my paper on “The Empirical Evidence Against Neoclassical Utility Theory: A Survey of the Literature”, I have argued that economic theories act as a blindfold, preventing economists from seeing basic facts about human behavior, obvious to all others. For instance, economists consider cooperation, generosity, integrity (commitments), and socially responsible behavior, as anomalies requiring explanation, while all others consider these as natural aspects of human...

Read More »Keynesian uncertainty

from Lars Syll In “modern” macroeconomics — Dynamic Stochastic General Equilibrium, New Synthesis, New Classical and New ‘Keynesian’ — variables are treated as if drawn from a known “data-generating process” that unfolds over time and on which we therefore have access to heaps of historical time-series. If we do not assume that we know the “data-generating process” – if we do not have the “true” model – the whole edifice collapses. And of course, it has to. Who really honestly believes...

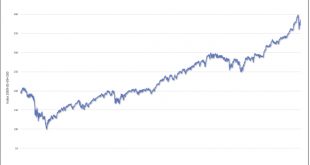

Read More »Ten years after the crash (8 charts)

from David Ruccio “. . . ten years on, U.S. capitalism has created the conditions for renewed instability and another, dramatic crash.” The economic crises that came to a head in 2008 and the massive response—by the U.S. government and corporations themselves—reshaped the world we live in.* Although sectors of the U.S. economy are still in one of their longest expansions, most people recognize that the recovery has been profoundly uneven and the economic gains have not been fairly...

Read More »Open thread April 10, 2018

Modern Money Theory (MMT) vs. Structural Keynesianism

from Thomas Palley A journalist sent me some questions about MMT. My answers are below. 1. What are the major flaws you see within Modern Monetary Theory? (A) I like to say that MMT is a mix of “old” and “new” ideas. The old ideas are well known among Keynesian economists and are correct, but the new ideas are either misleading or wrong. The essential old idea, which everybody knows, is government has the power to issue money. We used to talk of “printing” money. In today’s electronic...

Read More »How to get published in top economics journals

from Lars Syll By the early 1980s it was already common knowledge among people I hung out with that the only way to get non-crazy macro-economics published was to wrap sensible assumptions about output and employment in something else, something that involved rational expectations and intertemporal stuff and made the paper respectable. And yes, that was conscious knowledge, which shaped the kinds of papers we wrote. Paul Krugman More or less says it all, doesn’t it? And for those of us...

Read More »Why should the poor pay high drug prices?

from Dean Baker We have seen a lot of hyperventilating in political circles over Donald Trump’s recently proposed tariffs on steel and aluminum. While these do not seem like well-considered policies, and are likely to do more harm than good even from the narrow standpoint of increasing manufacturing employment, they are not by themselves the horror story being presented. Steel prices often fluctuate by 20 or 30 percent over the course of a year, as they did in 2016. If tariffs raise the...

Read More » Heterodox

Heterodox