Lifted from comments by PGL: The dollar has devalued since Trump became President: https://fred.stlouisfed.org/series/TWEXB Barry Eichengreen has some interesting thoughts here: https://www.project-syndicate.org/commentary/what-explains-dollar-weakness-by-barry-eichengreen-2018-03 “One of the big ones in the circles I frequent is dollar weakness. Between January 2017 and January 2018, the broad effective exchange rate of the dollar fell by 8%,...

Read More »Open thread March 20, 2018

Media release: Alberta needs a provincial sales tax

(March 20, 2018-Edmonton) Today, a coalition of researchers, economists, and members of civil society released an alternative budget to boost Alberta’s economic growth while reducing income inequality. “Alberta is on the road to recovery after a deep recession,” said economist Nick Falvo, “now is not the time to reverse the course.” The document, High Stakes, Clear Choices, sets a progressive vision encouraging public investment to stabilize tough economic times, reduce poverty, support our...

Read More »Scientific realism and inference to the best explanation

from Lars Syll In a time when scientific relativism is expanding, it is important to keep up the claim for not reducing science to a pure discursive level. We have to maintain the Enlightenment tradition of thinking of reality as principally independent of our views of it and of the main task of science as studying the structure of this reality. Perhaps the most important contribution a researcher can make is to reveal what this reality that is the object of science actually looks like....

Read More »Utopia and healthcare—2

from David Ruccio The dystopia of the American healthcare system certainly invites a utopian response—a ruthless criticism as well as a vision of an alternative. As I showed last week, the left-wing response involves a critique of the conditions and consequences of the capitalist organization of U.S. healthcare and the fashioning of a radical alternative. Single-payer, which uses tax revenues to finance the purchase of adequate healthcare services for everyone, is one possibility. On top...

Read More »Syll’s top 20 books compared to RWER’s top 10 and its poll’s top 40 vote receivers

In May of 2016 the Real-World Economics Review conducted a poll titled “Top 10 Economics Books of the Last 100 Years” Voting was open to the journal’s 26,000 subscribers, and over 3,000 of them voted, each having up to ten votes and with 17,270 votes in total cast. The results were published two weeks later and linked on over 2,000 Facebook pages. It is interesting to compare those results to Lars Syll’s personal list of “Top 20 heterodox economics books” published here earlier today....

Read More »Top 20 heterodox economics books

from Lars Syll Karl Marx, Das Kapital (1867) Thorstein Veblen, The Theory of the Leisure Class (1899) Joseph Schumpeter, The Theory of Economic Development (1911) Nikolai Kondratiev, The Major Economic Cycles (1925) Gunnar Myrdal, The Political Element in the Development of Economic Theory (1930) John Maynard Keynes, The General Theory (1936) Karl Polanyi, The Great Transformation (1944) Paul Sweezy, Theory of Capitalist Development (1956) Joan Robinson, Accumulation of Capital (1956)...

Read More »What happens next?

from Peter Radford As we tumble from one degrading political spectacle to another it is worth remembering that things that mattered were actually addressed periodically, even if the result was tumult. For reasons not worth mentioning here I am taking good look at English history between 1909 and 1911. In this case the tumult was triggered by a budget which was resisted by landowners and the House of Lords, and ended with a radical reorientation of power that left the House of Lords...

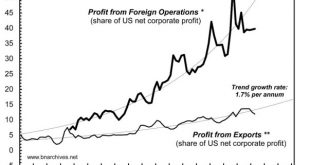

Read More »Trump’s trade wars threaten US foreign investment

from Shimshon Bichler and Jonathan Nitzan There is a lot of buzz about Trump’s recently launched trade wars, but much of this buzz misses the point. The key issue here is not foreign trade, but foreign investment. Foreign trade contributes relatively little to US corporate profit. The disaggregate data here are patchy, but if we can assume that profit rates on exports and domestic sales are roughly the same, we can use the share of exports in GDP as a proxy for the share of export...

Read More » Heterodox

Heterodox