from Lars Syll Because I was there when the economics department of my university got an IBM 360, I was very much caught up in the excitement of combining powerful computers with economic research. Unfortunately, I lost interest in econometrics almost as soon as I understood how it was done. My thinking went through four stages: 1. Holy shit! Do you see what you can do with a computer’s help. 2. Learning computer modeling puts you in a small class where only other members of the caste...

Read More »Impacts of Temperature

As taken from the comments section. EMichael’s commentary on temperature and its impact. Interesting. “Air conditioning has changed demographics, too. It’s hard to imagine the rise of cities like Dubai or Singapore without it. As residential units spread rapidly across America in the second half of the 20th century, the population in the “sun belt” – the warmer south of the country, from Florida to California – boomed from 28% of Americans to 40%. As...

Read More »Open thread March 9, 2018

Hi folks…I am in a next town over at a friends and am online again. Am also thinking getting a generator due to changes in climate….:)

Read More »Scientist qua scientist, scientist qua citizen: Part I

from Malgorzata Dereniowska That economics is a value-laden science is not a new idea. Most of the prominent economic thinkers were also philosophers, wary of moral and philosophical content of scientific assumptions, models, and theories. That economics needs philosophy, and the separation between these two cannot be maintained any longer, is gaining recognition, and has become a subject of debates in the field of philosophy of economics that brings together (to various extends)...

Read More »WEA Commentaries – new issue

WEA Commentaries Formerly the World Economics Association NewsletterVolume 8, Issue No. 1 Download the issue as a PDF In this issue How to Inspire and Motivate Students Asad Zaman Redefining Governance in Cooperative BanksMitja Stefancic, Silvio Goglio, and Ivana Catturani The Biophysical Basis of Production and the Public Economy June Sekera Tesla, Amazon, Bitcoin, Efficient Markets and FTT Dean Baker Keynes and Econometrics Maria Alejandra Madi Corrupted Economic Research—two...

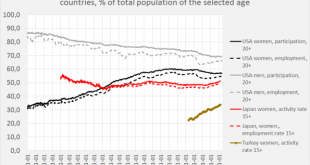

Read More »Female and male participation and employment

According to the accepted narrative after about 1950 female participation rates started to rise thanks to inventions like the washing machine and kept rising forever after. Reality is more confusing. According to a recent book by Julia Sophie Wörsdorfer, washing machines were, contrary to the ideas of Ha-Joon Chang, not that important. Neither cross sectional data nor time series analysis yields a strong correlation between ownership of a washing machine and high female labour force...

Read More »What austerity preachers do not get

from Lars Syll We are not going to get out of the economic doldrums as long as we continue to be obsessed with the unreasoned ideological goal of reducing the so-called deficit. The “deficit” is not an economic sin but an economic necessity … idle all around us. Alexan The administration is trying to bring the Titanic into harbor with a canoe paddle, while Congress is arguing over whether to use an oar or a paddle, and the Perot’s and budget balancers seem eager to lash the helm...

Read More »Open thread March 7, 2018

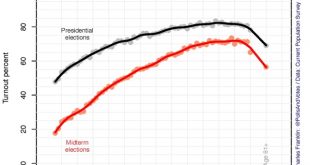

A thought for Sunday: the march of demographics and the 2018 midterms

(Dan here…Better late than never!) A thought for Sunday: the march of demographics and the 2018 midterms Below is a graph showing that the older the demographic (up until age 80), the bigger the turnout during midterm elections. The data behind this graph isn’t just from 2014, but from a series of midterm elections over time — in other words, it has been durable over time. My purpose in this post is show that, even if these percentages hold in this...

Read More »George Osborne, Hubris and Nemesis

This piece appeared in the London Observer on Sunday, 4th March, 2018 By asserting the policy of “monetary radicalism and fiscal conservatism”, Osborne and his colleagues ensured that those responsible for the crisis benefited from the Bank of England’s quantitative easing programme, which inflated asset prices largely owned by the more affluent. Simultaneously, the Conservative government, aided by Orange Book Liberal Democrats like Danny Alexander, used austerity to shift the burden...

Read More » Heterodox

Heterodox