I don’t follow healthcare as much as others at this blog. I started playing around with some graphs at FRED and got a bit confused. I don’t mind being confused, but I like to clear up that confusion eventually. So perhaps someone can tell me what’s going on. First, this graph of healthcare expenditures / GDP which seems to indicate that Obamacare bent the cost curve: (click to embiggenize) But looking at the annual change in healthcare expenditures /...

Read More »Krugman’s misapplication of neoclassical growth models

from Lars Syll The fallacies loanable funds theory commits might be explainable by the misapplication of some ideas and concepts of neoclassical growth models … to the sphere of money and finance … The Ramsey and Solow models are models of real investment only. Financial markets, financial assets and financial saving do not play any role in those models. There is only one good which, for simplicity, will be called “corn”. Corn has three functions: it can be consumed, invested and used...

Read More »Will workers get a pay rise in 2018?

The Financial Times questioned economists for its annual publication of economic forecasts: “With unemployment at a 40-year low, how much of a pay rise will British workers get in 2018?” (See here: https://www.ft.com/content/98ce5e72-ebd9-11e7-bd17-521324c81e23) PRIME economists responded thus: The fall in real wages while employment has fallen and employment has risen is a consequence of sustained hyper-globalisation policy in which much of the labour force is now obliged to compete...

Read More »Happy New Year to Readers and Bears

Figure 1

Read More »Protests in Iran

This is well outside anything I can claim to know much about, so I can’t vouch for it other than that it sounds right to me. From an Al Arabiya article entitled All you need to know about the Iran protests in 20 points: 1 On Tuesday, December 19, the Iranian government announced a new austerity plan. 2 The plan imposed a 50% increase in the price of fuel. 3 The government decided to cancel the monetary support of more than 34 million people. 6 In this...

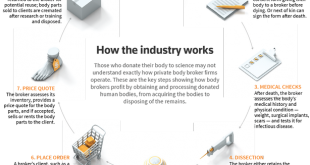

Read More »Body parts—from gifts to exchanges

from David Ruccio Over the course of the last two days, I’ve discussed mean gifts (which promise significant tax relief only to a small group of corporations and wealthy individuals) and mean exchanges (which leave middle-class Americans with a declining share of national income). Now, thanks to recently completed Reuters investigation, we’re forced to confront the reality in the United States of mean exchanges that transform generous donations into desperate, mean gifts. I’m referring to...

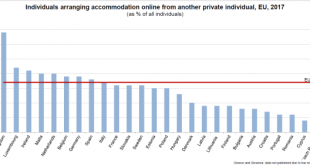

Read More »Thoughts about the sharing economy

Recently, Eurostat published data on the sharing economy. Its huge (graph, source: Eurostat). And this digital enhanced sharing economy should be (and is) included in GDP. But the private, non-monetary use of digital GPS apps which enhance your life as they enable you to find your way when, after attending a wedding, you get lost in rural Kent, 2:00 AM (happens…): not. There is a discussion going on if GDP tracks the changes in our life caused by the use of all kind of digital gadgets. It...

Read More »Please excuse the site problems….

The side bar ‘broke’ and I cannot access the code to fix it. If you click on the title you want it seems to offer the correct format for individual posts. I will work on it but am not a tech person. I have notified MEV tech people, but it is the New Year weekend so am not sure when it will be fixed. Sorry for the inconvenience.

Read More »Is it time to ditch the natural rate hypothesis?

from Lars Syll Fifty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy, and (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation. The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the ideas that unemployment really is independent of monetary policy and that...

Read More »1937

from Peter Radford Hayek says this: “The problem which we pretend [to] solve is how the spontaneous interaction of a number of people, each possessing only bits of knowledge, brings about a state of affairs in which prices correspond to costs, etc., and which could be brought about by deliberate direction only by somebody who possesses the combined knowledge of all those individuals … “ This is from his essay ‘Economics and Knowledge’ which was published in 1937. Hayek’s thrust is, of...

Read More » Heterodox

Heterodox