from Peter Radford One of the great pleasures of living here in southern Vermont is that we have a terrific local bookshop. I go there simply to absorb that book shop vibe unattainable in the bits and bytes of Amazon. And like all good bookshops this one throws up surprises. About three weeks ago I was browsing the small business and economics section and found a book by Heinz Kurz. It’s his “Economic Thought, A Brief History” I recommend it for all of you who want to understand the...

Read More »Ontario’s Electricity Sector IV: Pre-Election Update

My first, second and third posts on the Ontario electricity sector described how policy and administrative decisions by different Liberal Governments gave rise to excess electricity generation with an inflated cost structure, leading to higher electricity prices. In anticipation of June 2018 elections, the Liberal Government recently implemented a costly and first-in-Canada financial scheme to fund its “Fair Hydro Plan” (FHP) to provide a short-term 17% price reduction. Given that the FHP is...

Read More »Why Krugman and Stiglitz are no real alternatives to mainstream economics

from Lars Syll Little in the discipline has changed in the wake of the crisis. Mirowski thinks that this is at least in part a result of the impotence of the loyal opposition — those economists such as Joseph Stiglitz or Paul Krugman who attempt to oppose the more viciously neoliberal articulations of economic theory from within the camp of neoclassical economics. Though Krugman and Stiglitz have attacked concepts like the efficient markets hypothesis … Mirowski argues that their attempt...

Read More »Open thread Nov. 18, 2017

Industrial production, Household debt, Business sales and inventories, Container counts, Animal trophies

A dip and a recovery due to the hurricane (as per vehicle sales data), chugging along at modest rates of growth, and still down from high a couple of years back, not adjusted for inflation: The NY Fed reports household debt growth decelerated in q1, in line with the deceleration in bank lending: Note the deceleration since January for both of these charts, inline with decelerating bank loan growth: Analyst Opinion of Business Sales and Inventories This was a worse month for...

Read More »Not with a bang but with a (prolonged) whimper

from Jayati Ghosh It is probably obvious to everyone that global capitalism is in dire straits, notwithstanding the brave talking up of output recovery that now characterises almost every meeting of the international governing elite. Even so, discussions of the end of capitalism still typically seem overstated and futile, not least because those hoping and mobilising for bringing in an alternative system are everywhere so scattered, weak and demoralised. In effect, capitalism is the only...

Read More »An Op Ed on Race Relations in the NY Times

The NY Times has an op ed entitled Can My Children Be Friends with White People?. (Dan here …Link corrected) I think this is the most interesting excerpt: …I will teach my boys to have profound doubts that friendship with white people is possible. When they ask, I will teach my sons that their beautiful hue is a fault line. Spare me the platitudes of how we are all the same on the inside. I first have to keep my boys safe, and so I will teach them before...

Read More »Desperately seeking a link between wages and productivity

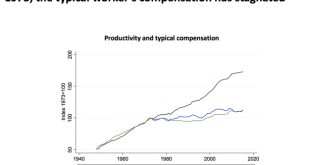

from David Ruccio Everyone, it seems, now agrees that there’s a fundamental problem concerning wages and productivity in the United States: since the 1970s, productivity growth has far outpaced the growth in workers’ wages.* Even Larry Summers—who, along with his coauthor Anna Stansbury, presented an analysis of the relationship between pay and productivity last Thursday at a conference on the “Policy Implications of Sustained Low Productivity Growth” sponsored by the Peterson Institute...

Read More »Completing the Circle: From GD ’29 to GFC ’07

from Asad Zaman Karl Marx said that “The advance of capitalist production develops a working class which by education, tradition and habit looks upon the requirements of that mode of production as self-evident natural laws.” Modern economic theory is a tool of central importance in making the laborers and the poor accept their own exploitation as natural and necessary. As explained in greater detail in the next lecture (AM09), Economic Theory argues that distribution of income is FAIR –...

Read More »Baltimore School Test Scores and Baltimore School Spending

I’ve noted before I have a bit of an interest in Baltimore because my wife originates from there (despite having convinced herself that she’s from the Los Angeles area). So I noticed this story: An alarming discovery coming out of City Schools. Project Baltimore analyzed 2017 state testing data and found one-third of High Schools in Baltimore, last year, had zero students proficient in math. Contrast that with this: The Baltimore City Public School System...

Read More » Heterodox

Heterodox