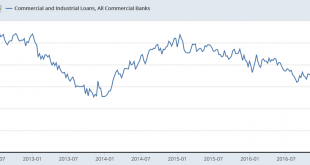

The collapse continues. With total bank credit just over $12.5 trillion, it’s about $500 billion less than it would have been had last year’s loan growth continued. If this lower rate of loan growth continues, and isn’t replaced by some other channel that facilitates agents spending more than their incomes, the implication is that GDP could be a full 2% less than last year, as a substantial portion of bank lending finances purchases of real goods and services:...

Read More »Economics textbooks transmogrifying truth — wages and unemployment

from Lars Syll A couple of weeks ago yours truly was sent a copy of the new edition of Chad Jones intermediate textbook Macroeconomics (4th ed, W W Norton, 2018). There’s much in the book I like, e. g. Jones’ combining of more traditional short-run macroeconomic analysis with an accessible coverage of the Romer model — the foundation of modern growth theory — and DSGE business cycle models. Unfortunately it also contains some utter nonsense! In chapter 7 — on “The Labor Market, Wages, and...

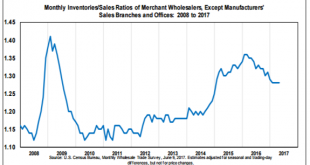

Read More »Business Inventories and Sales, Capex, Consumer Credit

Inventory to sales ratio coming down but remains elevated: Capital expenditures have come back some since the shale bust, but remain depressed: The year over year deceleration continues as also reflected in consumer spending:

Read More »The evidence does not support Macron’s claim that deregulating labor market will boost economy

from Dean Baker In her Washington Post column, Catherine Rampell repeats some ill-founded conventional wisdom in telling readers that French president Emmanuel Macron’s plans to weaken labor unions and reduce restrictions on laying off workers are the path to revitalizing France’s economy. In fact, this claim is not supported by the evidence. There is little evidence that strong unions or labor market protections are associated with high unemployment. The most obvious reason that France...

Read More »Open thread June 9, 2017

‘Cauchy logic’ in economics

from Lars Syll What is 0.999 …, really? Is it 1? Or is it some number infinitesimally less than 1? The right answer is to unmask the question. What is 0.999 …, really? It appears to refer to a kind of sum: .9 + + 0.09 + 0.009 + 0.0009 + … But what does that mean? That pesky ellipsis is the real problem. There can be no controversy about what it means to add up two, or three, or a hundred numbers. But infinitely many? That’s a different story. In the real world, you can never have...

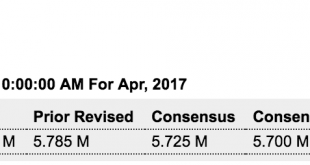

Read More »JOLTS, Q1 Mortgage Report

Maybe the reasoning openings are so much higher than hires is because openings are for jobs that pay less than current employees are earning, in the hopes the company can replace them? ;) Highlights Job openings are nearly 1 million ahead of hirings in a widening spread pointing to skill scarcity in the labor market. Job openings totaled 6.044 million in April which is well outside Econoday’s high estimate for 5.765 million and up from a revised 5.785 million in the prior...

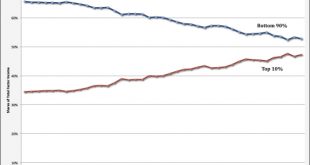

Read More »Pulling away

from David Ruccio Apparently, Richard Reeves is worried that the top echelons of the U.S. middle class—those earning over $120,000—are separating from the rest of the country, and pulling up the drawbridge behind them. “The upper middle class families have become greenhouses for the cultivation of human capital. Children raised in them are on a different track to ordinary Americans, right from the very beginning,” he writes. The upper middle class are “opportunity hoarding” – making it...

Read More »Trump voters need good economic policy, not empathy

from Dean Baker There has been a strange debate among many liberals and progressives since the election as to whether they should have empathy for the people who voted for Donald Trump. After all, Trump is a pretty reprehensible character who has pledged to do some pretty awful things in the White House. Is there a reason that people should have empathy for the voters who put him there? Whatever answer you pick to that question, there is another set of questions that should be simpler for...

Read More » Heterodox

Heterodox