AEI-Brookings recently issued a report on paid medical leave. I found one of the figures in the paper to be especially interesting: Click to embiggen or to show the entire graph. (You should see four columns in the graph.)

Read More »Credit check

More problematic by the week. Note the absolute level of c and I loans has been flat to negative since October: Annual rate of growth remains sub 2%: This is consistent with the weakening housing releases: This is consistent with weakening consumer spending: This is consistent with weakening vehicle sales: Corporate bonds are not picking up the slack- quite the opposite:

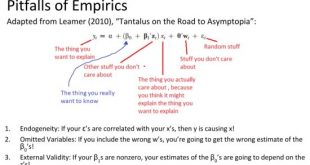

Read More »Ed Leamer and the pitfalls of econometrics

from Lars Syll Ed Leamer’s Tantalus on the Road to Asymptopia is one of my favourite critiques of econometrics, and for the benefit of those who are not versed in the econometric jargong, this handy summary gives the gist of it in plain English: Most work in econometrics and regression analysis is — still — made on the assumption that the researcher has a theoretical model that is ‘true.’ Based on this belief of having a correct specification for an econometric model or running a...

Read More »Intelligence and Education

I’ve noted a few times that the political center needs to come to grips with research on genes and intelligence or we risk ceding the field to people with scary impulses and frightening goals. I think something like what the center-left position should be is reasonably well articulated by Richard J. Haier. Haier is a professor emeritus in the University of California at Irvine medical school, editor in chief of the journal Intelligence, and he was one of the...

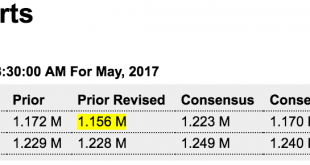

Read More »Housing starts, consumer sentiment, credit growth article

Down and prior month revised down and permits way down as well. All in line with the previously discussed deceleration in bank real estate lending that began just after the elections in November: Highlights The bad economic news keeps building, this time in the housing sector. Housing starts fell an unexpected 5.5 percent in May to a far lower-than-expected annualized rate of 1.092 million with permits likewise very weak, down 4.9 percent to a 1.168 million rate. All...

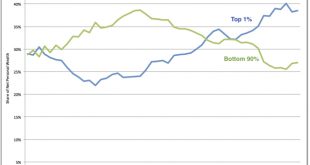

Read More »American myth

from David Ruccio One of the most pernicious myths in the United States is that higher education successfully levels the playing field across students with different backgrounds and therefore reduces wealth inequality. The reality is quite different—for the population as a whole and, especially, for racial and ethnic minorities. As is clear from the chart above, the share of wealth owned by the top 1 percent has risen dramatically since the mid-1970s, rising from 22.9 percent in 1976 to...

Read More »Open thread June 16, 2017

The Annotated 15th June 2017 Eurogroup statement on Greece

Extending (again) the extending-and-pretending Eurogroup policy on Greece’s never-ending crisis Back in August 2015, while sitting gloomily in the Greek Parliament during the sad, long night leading to the voting in of the 3rd MoU, I found solace in annotating the MoU’s text. Last night, I felt the need to repeat that wretched ritual once more, this time with the 15th June 2017 Eurogroup statement on Greece. (In...

Read More »Fed surveys, Industrial production, Housing market index, Fed’s gdp forecasts

These spiked up with the Presidential election and are only slowly coming back down: Muddling through at just over a 2% annual rate, but q2 looking weaker than q1: Highlights Forget about all the strength in the low sample-sized regional reports. Government data are not pointing to strength at all as manufacturing readings in the May industrial production report are a matter of concern. Industrial production could manage no better than an unchanged reading in May while the...

Read More »Trumponomics: Causes and Consequences

paperback now available from the Amazon pages listed below 508 pages Here are links to the book’s pages on the various AmazonsUnited States $28, Brazil, Canada, France, Germany, India, Italy, Japan, Mexico, Spain, United Kingdom

Read More » Heterodox

Heterodox