I fluffed my lines on a recent BBC Newsnight segment on Uber. As the discussion was wrapping up, I warned that the uberisation of the economy – the ambition to corral the entire cash flow of whole sectors of the global economy into the pockets of a few – is utopian. I said all this in response to Ms Julie Meyer’s assertion that, and I quote (11.23 minutes into the show): The world is being driven by networks…and they’re platforms…That’s the future, we can’t stop that from happening....

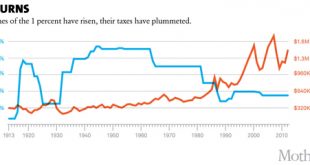

Read More »Top US income tax rate and top 1% average income

from Mother Jones

Read More »IMF economists discover some of the big failures of neoliberalism: about time

from Mark Weisbrot The International Monetary Fund (IMF) has gotten some attention in the past week for the publication of an unusual article in its quarterly magazine, Finance and Development. The article’s title, “Neoliberalism: Oversold?” itself is a shocker, since the institution has been the most influential proponent of neoliberalism in the world for more than four decades. It’s kind of like an op-ed from Donald Trump titled, “Insulting Your Opponents: Oversold?” From the authors...

Read More »The Internet of Things and the Future of Work

from Maria Alejandra Madi Technological change has significantly transformed the labour scenario as the result of the diffusion of innovative practices at the micro-level. The technological impact on the future of work was deeply analysed by Jeremy Rifkin. According to him, we are facing a new phase of history – Third Industrial Revolution – that is characterized by the steady and inevitable decline of jobs in the production and marketing of goods and services. Today, the Third...

Read More »Fed’s labor market index, Saudi price hikes

This went from bad to worse but they don’t seem to pay much attention to it: Labor Market Conditions IndexHighlightsLast week’s employment report was very weak and is reflected in May’s labor market conditions index which came in at minus 4.8 for the fifth straight negative reading and the lowest of the economic cycle, since May 2009. April is revised 2.5 points lower to minus 3.4 which, next to May, is the second lowest of the cycle. These readings point to a fundamental...

Read More »The Keynesian Revolution and the Monetarist Counter-Revolution

from Asad Zaman Before Keynes, Classical Economic Theory (CET) was based on three principles. The First Principle is that Unemployment is automatically eliminated by the free market. The Second Principle is the Quantity Theory of Money, which states that money supply makes no difference to real economic outcomes. The Third Principle is that private investors automatically find the right investment opportunities to create the best economic outcomes for future. The realities of the Great...

Read More »Mohammed Ali: “never give up fighting racism”

Mohammed Ali – ‘The Greatest’ – died today, at the age of 74. With his loss, the world is deprived of the terrific energy of a principled, devout and committed man. A boxer, a philosopher and a poet. But for those of us who worked hard to achieve the cancellation of about $100 billion of debt for thirty five of the poorest countries, Ali occupies a special place in our hearts. This great man, celebrated around the world, took time out to join us in London in 1999, and to give his backing to...

Read More »Employment report, PMI services, ISM non manufacturing, Factory orders

Continuing to decelerate. As previously discussed, I see no chance of a reversal until deficit spending- public or private- picks up to offset the unspent income/savings desires: Employment SituationHighlightsThe assessment of the labor market, not to mention the outlook for consumer spending, just came down as nonfarm payrolls proved much weaker than expected in May, up only 38,000 with the two prior months revised a total of 59,000 lower. The Verizon strike is a negative in the data but...

Read More »Gordon, McCloskey and growing pains

from Peter Radford I try to take my own advice: when you have nothing to say, don’t say anything. Thus, for the best part of a month I have busied myself doing other things and staying away from here. It’s been a nice break, and here I am still convinced that there’s not much to say. The economy is where it was. Economics is where it was. Politics is where it was. The three intermingle, mix, merge, separate and go their different ways in the same manner as before. The same complaints and...

Read More »Credit Unions in Ireland: a viable alternative to the financial crisis banks

Big, listed banks, darlings of the neoliberal establishment, brought Ireland to its knees. Small Irish community banks (credit unions, a volunteer led movement with over 3 million members), while severely affected by the financial crisis, did not only not contribute to the financial crisis but also weathered it, retaining the trust of their members. Mind: ‘members’, not ‘clients’. Via the website of the Irish Central Bank some excerpts of a speech by Registrar Anne Marie McKiernan to Irish...

Read More » Heterodox

Heterodox