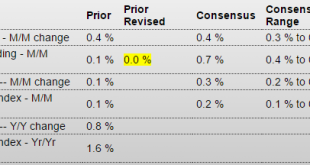

Yet another pretty good April release that I suspect will be reversed in May, as has happened with several other data series. And the increased spending on gasoline due to higher prices coincided with a reduction in the savings rate, as April spending outstripped income. And note that March’s +.1 was revised to 0 with this April number also subject to revision. Personal Income and OutlaysHighlightsApril was definitely the month of the consumer as consumer spending surged 1.0 percent for the...

Read More »The naiveté of science as the history of Ideas

from Robert Locke I am constantly perplexed by the way people on this blog handle the development of science as a history of ideas. I find this view particularly expressed in the exchange of opinions Asad Zaman provokes in his posts and comments to which others respond. I have noted that trying to explain the development of science without going into the political, social, and economic environment in which science exists, will not bear much explanatory fruit. Here are three examples of...

Read More »GDP-growth and the environmental economy

Branko Milanovic gets philosophical about productive and unproductive labour. Is a dentist productive? A soldier? A lobbyist? Seen from the angle of national accounting such questions, important as they are, are beside the point as these accounts aim to gauge total income and all labour which yields an income (wages, profits, whatever) is considered to be productive. As it enables people to gain an income… People work for the money, even when they are protecting the environment. Which...

Read More »Achtung! My Book is Coming Out Soon: Here Is a Brief Overview and Some Media Links

Hi everyone – or, at least, whoever is left out there. As you probably know, this blog has been shut down since October 2014 and I have pretty much fallen off the face of the planet. Actually I’ve been working in investment where I’ve found a job that allows me to pursue non-mainstream economic research. Some of you may recall that I was writing a book during the last days of this blog. I’m happy to say that this book is now fully completed and has been accepted for publication by...

Read More »GDP, Corporate profits, Oil capex, Truck tonnage, Vehicle sales preview

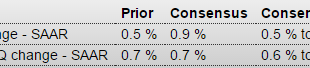

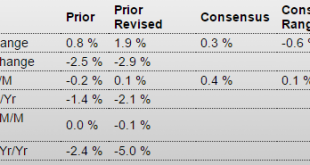

Pretty much as expected, inflation a bit lower. Inventories revised up so Q2 that much more likely to see an inventory reduction along with associated cuts in output: GDPHighlightsFirst-quarter GDP is now revised higher but only slightly, to an annualized growth rate of plus 0.8 percent for a 3 tenths gain from the initial estimate. Upward revisions to residential investment and exports are behind the small gain along with an unwanted upward revision to inventories. Nonresidential...

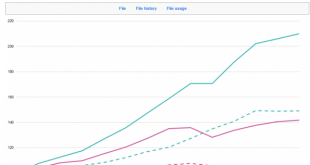

Read More »Involuntary unemployment in the USA

Donald Trump is right and wrong about unemployment. He’s right that 20% unemployment is a f*cking shame and calls for action. A fact not acknowledged by (neoclassical) economists, who for Europe calculate ‘equilibrium’ unemployment (NAIRU, see this post by Lars Syll) in countries like Spain to be higher than 20%.These official (!) estimates are beyond ridiculous! Small wonder that people flock to politicians like Trump. Trump is however wrong to state that USA unemployment is 20%....

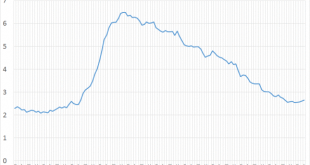

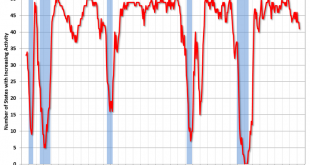

Read More »Philly Fed indicator, Fed discount rate

Not good!The regional Feds are calling for higher discount lending rates even though borrowings are at 0! According to the Fed minutes from the discount rate meeting (different from the FOMC minutes), four of the Fed banks called for a hike in the discount rate. It’s the emergency rate at which banks could borrow directly from the Fed’s discount window – currently at 1%. This disclosure suggests that the Fed is becoming increasingly hawkish.

Read More »Durable goods orders, KC Fed, Pending home sales, Health insurance premiums

Way up and better than expected, but looks like it was all a large aircraft order and some cars. Another good headline April release also likely to reverse in May: Durable Goods OrdersHighlightsIndications on the factory sector have been mixed as is April’s durable goods report. The headline came in at a stronger-than-expected gain of 3.4 percent with March revised higher to a gain of 1.9 percent. Vehicles orders gave an important boost to April, up 2.9 percent as did the always volatile...

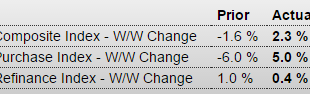

Read More »Mtg prch apps, PMI services

Not a word from the analysts when they were down 6% last week. But when up 5% this week expect lots of mentions… MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages revived in the May 20 week, increasing by 5 percent from the prior week, while refinancing activity managed to post a gain of 0.4 percent despite slightly higher rates. The average 30-year mortgage for conforming loans ($417,000 or less) was up 3 basis points to 3.85 percent. Purchase applications were 17...

Read More »Redbook retail sales, Richmond Fed, New home sales, Chemical activity barometer

From bad to worse:Another May reversal from a hopeful April gain: Richmond Fed Manufacturing IndexHighlightsThe Richmond Fed index fell a sharp 15 points in May to minus 1, adding further evidence of a serious slowdown in manufacturing activity as also indicated in last week’s Empire State and Philly Fed reports for May. Several of the survey’s key measures dropped steeply and went into contraction from previous strength, with shipments down 22 points from April to -8, backlog orders down...

Read More » Heterodox

Heterodox