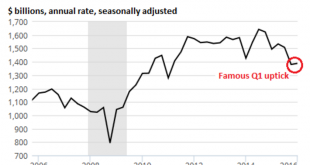

Seems the corporate profits report includes the Fed’s profits, all of which get turned over to the Treasury, of course… How the Fed Stopped the “Corporate Profit Recession” (and the Media Fell for it) By Wolf TichterThe end of the corporate “profit recession” has been declared last week. It was based on data by the Bureau of Economic Analysis, released on May 27. Corporate profits, after declining with some zigs and zags since their peak in the third quarter 2014, suddenly ticked up in the...

Read More »ADP, NY ISM

A forecast for tomorrow’s employment report: ADP Employment ReportHighlightsThe May employment report isn’t expected to be very strong but it may not prove, in contrast to expectations, to be any weaker than April, at least based on ADP’s estimate for private payrolls which comes in at 173,000 vs ADP’s revised 166,000 for April. The Econoday consensus for private payrolls in tomorrow’s government report is noticeably lower, at 150,000 vs May’s 171,000. ADP has been very accurate so far this...

Read More »Capitalism is, overwhelmingly, the main driver of planetary ecological collapse.

From climate change to resource overconsumption to pollution, the engine that has powered three centuries of accelerating economic development revolutionizing technology, science, culture, and human life itself is, today, a roaring out-of-control locomotive mowing down continents of forests, sweeping oceans of life, clawing out mountains of minerals, drilling, pumping out lakes of fuels, devouring the planet’s last accessible resources to turn them all into “product” while destroying...

Read More »Saudi Aramco Seen Increasing July Oil Premium for Asia Customers

The higher prices likely indicate a change in policy from that of putting downward pressure on prices to a more neutral stance. Might have something to due with the last change in oil ministers. We will know more when this latest chart of the history of discounts/premiums is updated: Saudi Aramco Seen Increasing July Oil Premium for Asia CustomersBy Serene Cheong and Sharon Cho(Bloomberg) — Saudi Aramco may widen Arab Light premium by 40c/bbl for July sales to Asia, accord. to median est....

Read More »‘Actual Individual Consumption’ in Europe. A sensible indicator. Three graphs.

Is total German consumption really growing that slowly? In a tweet, Erwan Mahé (@ThalersCorner) expressed his surprise and confusion about the slow increase of private consumer expenditure in Germany, despite robust job growth and relatively low unemployment (and sizeable increases of real wages!). I do share his surprise and confusion, but the world starts to make more sense when we do not just look at household expenditure but at ‘Actual Individual Consumption’ (AIC). This broader...

Read More »May US light vehicle sales

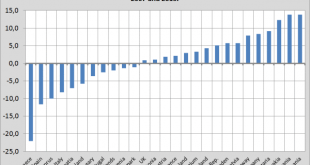

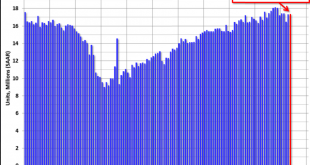

Car sales continue to soften from the highs of last year. And May sales unchanged from April would mean no contribution to growth this month: U.S. Light Vehicle Sales increase to 17.4 million annual rate in May by Bill McBrideBased on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.37 million SAAR in May (Preliminary estimate excluding Jaguar Land Rover and Volvo).That is down about 1.5% from May 2015, and up slightly from the 17.32 million annual sales rate last...

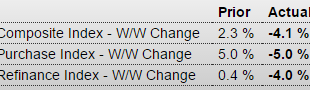

Read More »Mtg purchase apps, Mortgage origination, PMI indexes

Down 5% after last week’s up 5%… ;) MBA Mortgage Applications Note that the total is in decline:This (limited) measure of retail sales is still depressed and weakening as well:Two manufacturing indexes out today. The first was slightly lower than last month and trending down: PMI Manufacturing IndexHighlightsMarkit Economics’ U.S. manufacturing sample continues to report nearly dead flat conditions, at a final May index of 50.7 which compares with 50.5 for the mid-month flash and a final...

Read More »Cecchetti and Kharroubi on the non-neutrality of money

Is money ‘neutral’? Is it just a veil over ‘real’ transactions? Or does it affect the level and composition of ‘real’ expenditure? Stephen Cecchetti and Enisse Kharroubi recently published an article which in a very net way shows that money (and credit) is non-neutral. It’s not a veil. It’s part of the essence of our economy. The abstract: “We examine the negative relationship between the rate of growth of the financial sector and the rate of productivity growth. Using a panel of 20...

Read More »The Trump supporters in econ departments and central banks everywhere

from Dean Baker Eduardo Porter used his NYT column this week to remind us that we have seen people like Donald Trump before and it didn’t turn out well. Porter is of course right, but it is worth carrying the argument a bit further. Hitler came to power following the devastating peace terms that the allies imposed on Germany following World War I. This lead to first the hyper-inflation that we will continue to hear about until the end of time, and then austerity and high unemployment that...

Read More »Home economics

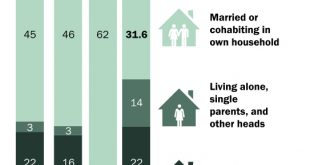

from David Ruccio According to a new report from the Pew Research Center, in 2014, for the first time in more than 130 years, adults aged 18 to 34 were more likely to be living in their parents’ home than they were to be living with a spouse or partner in their own household or in any other living arrangement. Dating back to 1880, the most common living arrangement among young adults has been living with a romantic partner, whether a spouse or a significant other. This type of arrangement...

Read More » Heterodox

Heterodox