Read More »

Dumb and Dumber — the Chicago economics version

from Lars Syll Some years ago, in a lecture on the US recession, Robert Lucas gave an outline of what the New Classical school of macroeconomics today thinks on the latest downturns in the US economy and its future prospects. Lucas shows that real US GDP has grown at an average yearly rate of 3 per cent since 1870, with one big dip during the Depression of the 1930s and a big — but more minor — dip in the recent recession. After stating his view that the US recession that started in 2008...

Read More »CPI, PPI

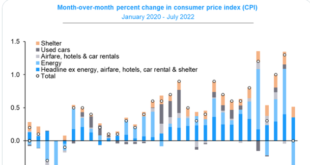

As previously discussed, with oil prices coming down the inflation problem ends. (The month to month change in CPI was 0) And what happens next depends on what oil prices do next. I suspect they go a lot higher as Saudi OSPs remain elevated and speculative long positions taken on when the war in Ukraine started seem to have been sold in anticipation of recession. And while refining margins are down from the highs, they remain elevated, indicating refiners, the only buyers of...

Read More »Who’s holding back electric cars in Australia?

We’ve long known the answer – and it’s time to clear the road My latest piece in The Conversation Share this:Like this:Like Loading...

Read More »A coherent alternative has to be proposed

from Nikolaos Karagiannis and Issue 94 RWER The practical use of the term “neoliberal” exploded in the 1990s, when it became closely associated with two developments. One of these was financial deregulation, which would culminate in the 2008 financial crash and in the still-lingering euro debacle. The second was economic hyper-globalization, which accelerated thanks to free flows of finance and to new, more ambitious types of trade agreements. Financialization and hyper-globalization have...

Read More »Hat trick! My newsletter for August

From my Substack Share this:Like this:Like Loading...

Read More »Open thread August 9, 2022

Yanis Varoufakis on the irrelevance of mainstream economics

from Lars Syll [embedded content] Varoufakis is undoubtedly right — there is indeed something about the way mainstream economists construct their models that obviously doesn’t sit right. One might have hoped that humbled by the manifest failure of its theoretical pretences during the latest economic-financial crises, the one-sided, almost religious, insistence on axiomatic-deductivist modelling as the only scientific activity worthy of pursuing in economics would give way to...

Read More »Machine age musings on algorithmic growth theory

from Peter Radford Don’t mind me. I am just thinking out aloud… That we live in a Machine Age is indisputable. Our lifestyles depend entirely upon the mediation of machines. Without them modernity collapses back to whatever existed in the prior ages and we surrender most of what we currently cherish. And it is important to use the phrase “machine age” because other phrases such as Industrial Age and so on limit us. Some say we are now entering a Digital Age, but this too is a...

Read More »Consumer credit, Supply Chain, China exports

This is about borrowing to spend, indicating positive spending and GDP: Pressures easing here: And this may indicate global spending is holding up: So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However sufficient deficit spending remains (about 5% of GDP) to sustain more modest levels of growth.

Read More » Heterodox

Heterodox