Following up my initial response to Lane Kenworthy, I decided to approach the question from a different direction and ask “Would we be better off without corporations?”. That is, I’d like to consider a society in which all large enterprises were publicly owned. There would still be room for owner-operated private businesses, worker-controlled co-operatives, partnerships and perhaps some other forms of business I haven’t thought about. I won’t get into disputes about whether this would...

Read More »Open thread July 5, 2022

real-world economics review issue no. 100

real-world economics review issue no. 100 download whole issue Introduction to RWER issue 100 3 Real Science Is Pluralist issue no. 5 – 2001Edward Fullbrook 5 Is There Anything Worth Keeping in Standard Microeconomics? issue no. 12 – 2002Bernard Guerrien 11 How Reality Ate Itself: Orthodoxy, Economy & Trust issue no. 18 – 2003Jamie Morgan 14 What is Neoclassical Economics? issue no. 6 – 2006Christian...

Read More »Inflation: should we take away the soup bowl?

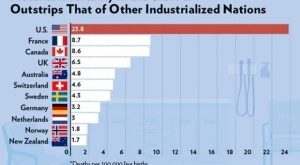

The graph below has been constructed by economists of the European Central Bank. It’s based on national accounts data. It shows that present day inflation is profit driven, not wage driven. Money flows to profits, not wages. What does this mean for monetary, fiscal and income policy, taking some other aspects of inflation into consideration? Quite a lot. High central bank interest rates have a dual purpose. First, they are intended to show that central banks are serious. Let’s...

Read More »Weekly Indicators for June 27 – July 1 at Seeking Alpha

by New Deal democrat Weekly Indicators for June 27 – July 1 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. There was yet more deterioration this week, focused on the long and short leading indicators. But consumer spending still seems to be holding up. As usual, clicking over and reading should bring you up to the virtual moment about the economy, and bring me a little pocket change to buy lunch....

Read More »Economics as ideology

from Lars Syll Although I never believed it when I was young and held scholars in great respect, it does seem to be the case that ideology plays a large role in economics. How else to explain Chicago’s acceptance of not only general equilibrium but a particularly simplified version of it as ‘true’ or as a good enough approximation to the truth? Or how to explain the belief that the only correct models are linear and that the von Neuman prices are those to which actual prices converge...

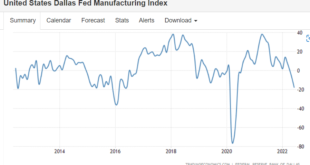

Read More »Dallas Fed, consumer confidence, manufacturing PMI, durable goods orders

Decelerating from post-Covid bounce expansion rates of growth: Decelerating but still at reasonably high levels: Decelerating from the post-Covid war fiscal consolidation but still positive:

Read More »Open thread July 1, 2022

People are not spending down their savings II

from Dean Baker Last month I wrote a piece where I managed to mangle a very simple point. While the reported saving rate had fallen in April, it was actually due to people paying more capital gains taxes, not the result of households spending down savings. The issue here is straightforward. Saving is defined as the portion of disposable income that is not consumed. Savings can fall either because either consumption has increased, or disposable income has fallen. We are not seeing...

Read More » Heterodox

Heterodox