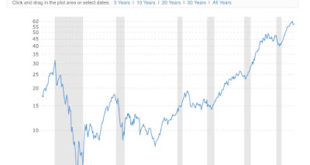

– by New Deal democrat There are some economic and financial indicators that aren’t classic leading or lagging indicators. Rather, they are “over-sensitive” in one direction or another. Two good examples are heavy truck sales and the unemployment rate: they are over-sensitive to the downside: they lead going in to recessions, but lag coming out. The S&P 500 stock market index fits in this category as well. The classic aphorism is “the...

Read More »Overdoses, the Economy, and Politics

September 19, 2024 Letters from an American “Democracy depends on at least two healthy political parties that can compete for voters on a level playing field. Although the men who wrote the Constitution hated the idea of political parties, they quickly figured out the party’s tie voters to the mechanics of Congress and the presidency.” Only one such party exists. Yesterday morning, NPR reported that U.S. public health data are showing a...

Read More »Important mixed messages from jobless claims this week

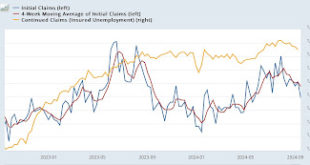

– by New Deal democrat You may recall that last week I wrote that beginning this week and for the next 6+ months, initial claims would be up against some very tough comparisons from 2023 and would be the ultimate true test of whether there has been unresolved post-pandemic seasonality in the numbers. Well, this week’s numbers suggest the unresolved seasonality hypothesis is still with us, but with considerable ambiguity. Initial claims did...

Read More »Important mixed messages from jobless claims this week

– by New Deal democrat You may recall that last week I wrote that beginning this week and for the next 6+ months, initial claims would be up against some very tough comparisons from 2023 and would be the ultimate true test of whether there has been unresolved post-pandemic seasonality in the numbers. Well, this week’s numbers suggest the unresolved seasonality hypothesis is still with us, but with considerable ambiguity. Initial claims did...

Read More »The 0.5% Reduction of the Federal Funds Rate

“The Fed Makes a Large Rate Cut and Forecasts More to Come” Jeanna Smialak Writes “The Federal Reserve cut interest rates on Wednesday by half a percentage point, an unusually large move and a clear signal that central bankers think they are winning their war against inflation and are turning their attention to protecting the job market.” I (and Brad DeLong) wonder why the Fed forecasts more rate cuts to come instead of implementing them...

Read More »The 0.5% Reduction of the Federal Funds Rate

“The Fed Makes a Large Rate Cut and Forecasts More to Come” Jeanna Smialak Writes “The Federal Reserve cut interest rates on Wednesday by half a percentage point, an unusually large move and a clear signal that central bankers think they are winning their war against inflation and are turning their attention to protecting the job market.” I (and Brad DeLong) wonder why the Fed forecasts more rate cuts to come instead of implementing them...

Read More »Housing sector enters yellow flag “recession watch” territory

– by New Deal democrat Residential construction permits and starts bounced back from their July Hurricane-Beryl affected decline, but housing units under construction declined below the threshold for hoisting a yellow “recession watch” flag for this sector. At the same time, I continue to suspect that we are rising from lows in the most leading metrics, and no “recession warning” is warranted. To begin with, the most leading metric, housing...

Read More »Housing sector enters yellow flag “recession watch” territory

– by New Deal democrat Residential construction permits and starts bounced back from their July Hurricane-Beryl affected decline, but housing units under construction declined below the threshold for hoisting a yellow “recession watch” flag for this sector. At the same time, I continue to suspect that we are rising from lows in the most leading metrics, and no “recession warning” is warranted. To begin with, the most leading metric, housing...

Read More »Why are auto insurance rates going up so much?

Kevin Drum has a short piece on the recent surge in auto insurance rates. He doesn’t offer any explanation in his post, but the comment thread has suggestions:• a combination of increase in bad driving and lack of enforcement;• fender benders are much more costly since all the self-driving gear as well as lane alerts, back up and blind spot cameras, etc., are in the bumpers, windshields and side view mirrors;• the increased number of EVs on the...

Read More »Why are auto insurance rates going up so much?

Kevin Drum has a short piece on the recent surge in auto insurance rates. He doesn’t offer any explanation in his post, but the comment thread has suggestions:• a combination of increase in bad driving and lack of enforcement;• fender benders are much more costly since all the self-driving gear as well as lane alerts, back up and blind spot cameras, etc., are in the bumpers, windshields and side view mirrors;• the increased number of EVs on the...

Read More » Heterodox

Heterodox