My wife drives a 21 year-old Pontiac Vibe (= Toyota Matrix). It could fail at any time, and the question of what she’ll replace it with is on our minds. EV or hybrid? I personally know some Tesla owners who are happy with their choice, but I remain concerned about range and charging stations. Thanks, Elon, for warning me off EVs!“The day before Elon Musk fired virtually all of Tesla’s electric-vehicle charging division last month, they had high hopes...

Read More »April consumer prices: still an interplay of gas and house prices, with a side helping of motor vehicle insurance

– by New Deal democrat First, a programming note: I’ll post about retail sales later today. Consumer inflation in April continued essentially to be an interplay between shelter and gas prices, with a side helping of auto insurance and repairs. During late 2022 and early 2023, shelter was still accelerating or steady at a high rate of inflation, while gas prices were falling. Beginning in late 2023, the dynamic reversed, as shelter inflation...

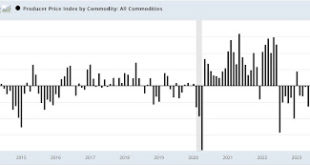

Read More »April producer prices reflect some building pressure from a strong economy with full employment

– by New Deal democrat Tomorrow and Thursday a plethora of data will be released, on consumer inflation and spending, production, housing, and jobless claims. In the meantime today we got a chance to look at upstream pressures on inflation. And those upstream pressures do seem to be building slightly, reflecting a strong economy with full employment. Commodity prices increased 0.9%. These are very volatile, so this was not particularly out...

Read More »Overall and core Consumer Price Index (CPI) both increased by 0.4 percent in March

It appears rent, transportation, and medical care services are the culprits holding up a decrease in inflation. Medicare does not surprise me at all. Harvard School of Health blames the rise of prices on administrative expenses, corporate greed and price gouging, and higher utilization of costly medical technology. What to Look for in the April CPI by Dean Baker CEPR The overall and core Consumer Price Index (CPI) both increased by 0.4...

Read More »The Household Survey isn’t the only data series sending up caution flares

– by New Deal democrat I’ve written two posts earlier this week delving into the big divergence between the Establishment Survey portion of the Employment Report, which shows moderate growth, and the Household Survey, which is most consistent with a recession already having started. At any given time, some data will be positive and some will be negative. That’s why I follow a whole series of reports with longer term proven reliability. Most of...

Read More »Republican U.S. States Sue EPA over Strict Power Plant Emission Rules

US Republican attorneys general sue to stop EPA’s carbon rule, Reuters, Clark Mindock Republican attorneys general from 27 U.S. states and industry trade groups sued the Environmental Protection Agency or EPA on Thursday. They seek to block an EPA landmark rule requiring sweeping reductions in carbon emissions from existing coal-fired power plants and new natural gas plants. The rule, finalized by President Joe Biden’s administration last month...

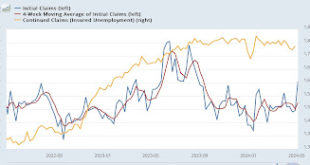

Read More »Initial claims jolted awake from snooze-fest by highest number in almost nine months

– by New Deal democrat After several months of snoozing at almost identical weekly levels, initial jobless claims awoke with a bit of a jolt this week, increasing by 22,000 to 231,000, the highest weekly number since last August. The four week average unsurprisingly also rose, by 4,750, to 215,000. With the usual one week delay, continuing claims rose 17,000 to 1.785 million, still one of the lowest readings since last August: As usual, the...

Read More »An Erroneous Supply Chain Argument

“Silly” Arizona House Representative Republican Justin Wilmeth is making an argument for lower gasoline, etc. prices to Arizona. Justin traveled to California to ask for no cap on fuel prices at a California refinery (Arizona has no refinery). As if he does not have enough to do in AZ? Not sure what makes him think, they will not raise prices anyway and without a cap. Justin’s main beef . . . “If they were to lower production or supply, the...

Read More »Microsoft is investing $3.3 billion dollars to build a new data center in Racine Wisconsin

by Prof. Heather Cox-Richardson Letters from an American Pres. Joe Biden, Dem Governor Tony Evers, and Microsoft are bailing out Wisconsin from trump’s “eighth wonder of the world” lie in Racine WI with Taiwan’s Foxconn. When this was occurring, Repub. Gov. Scott Walker with Repub legislators committed to a $3.3 billion subsidy and tax incentive package in support of the pirates. Racine did get upgraded upgrading roads, sewer system,...

Read More »The Establishment Survey portion of the jobs report continued to be positive

– by New Deal democrat AB: New Deal democrat reviews the Establishment Survey and again it differs from the Household Survey in a positive way. On Monday I wrote that the Household survey portion of the jobs report was recessionary for the second time in three months. But I pointed out that there was a very large divergence in jobs growth in the past 24 months, amounting to 1.7% of the prime age workforce, between that survey and the...

Read More » Heterodox

Heterodox